3.2 — Marginal Productivity Theory

ECON 452 • History of Economic Thought • Fall 2020

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/thoughtF20

thoughtF20.classes.ryansafner.com

Second-Generation Marginalists

Primarily extended and applied Jevons, Menger, & Walras’ marginalist tendencies to more problems in economics

- especially, the problem of pricing the factors of production

In England: Alfred Marshall, Phillip Wicksteed, Francis Edgeworth, A.C. Pigou

In Austria: Friedrich Wieser, Eugen von Böhm-Bawerk

In Switz./Italy: Enrico Barone, Vilfredo Pareto

In United States: John Bates Clark, Irving Fisher, Frank Knight, Frank Fetter

In Sweden: Knut Wicksell

Second-Generation Austrian Marginalists

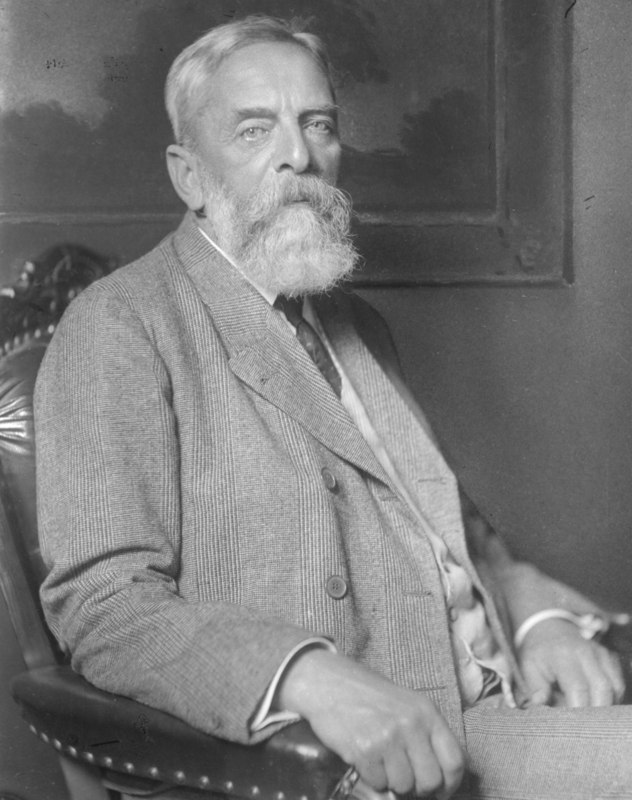

Friedrich von Wieser

Friedrich von Wieser

1851—1926

Student of Menger, ultimately replaced Menger as Professor of Political Economy at University of Vienna

Coined the term “marginal utility” (Grenznutzen)

Teacher to F.A. Hayek

1889, Der natürliche Werth (Natural Value)

1914, Theorie der gesellschaftlichen Wirtschaft (Theory of Social Economy),

Friedrich von Wieser: Alternative Cost Theory

Friedrich von Wieser

1851—1926

What role do costs of production (payments to factors) play in value of final goods?

Costs are the values which are forgone in directing resources to a particular production process rather than other production processes

In this sense, production costs are really a reflection of utilities elsewhere in the economy

Alternative cost theory or opportunity cost

Friedrich von Wieser: Alternative Cost Theory

Friedrich von Wieser

1851—1926

Beginnings of major disagreements:

Jevons always thought costs were “real” in some sense, e.g. the disutility or pain of labor

- utility of consumption vs. disutility of production; utility & disutility curves

Marshall & Edgeworth would later argue you can derive an upward-sloping supply/cost curve for non-land factors by disutility of use

Friedrich von Wieser: Imputation Theory

Friedrich von Wieser

1851—1926

Menger had clear insights about capital and production: goods of higher order, their complementarity and substitutability, etc.

If we all agree that prices of final goods reflect their marginal utility, how do we price factor services (land, labor, capital)?

Wieser, using a legal term, this is a “problem of imputation”

Friedrich von Wieser: Imputation Theory

Friedrich von Wieser

1851—1926

Wieser’s solution was linear programming with simultaneous equations (no calculus)

Example: consider a three-good society, factors in each good’s production are x, y, and z, represented by three simultaneous equations:

x+y=1002x+3z=2904y+5z=590

Solve for x, y, and z (prices of each factor)

Assumes prices for final goods are given, fixed production coefficients, and no substitution of factors

Wieser, Friedrich von, 1893, Natural Value p.88

Eugen von Böhm-Bawerk

Eugen von Böhm-Bawerk

1851—1914

Studied law at University of Vienna; exposed to Menger but never his direct student

Friend & brother-in-law to Friedrich Wieser

Became Minister of Finance of Austria-Hungary; amabassador to Germany

Later became professor of political economy, teacher to Ludwig von Mises

Eugen von Böhm-Bawerk

Eugen von Böhm-Bawerk

1851—1914

Direct critique of Marxism: 1896, Karl Marx and the Close of His System

Famously wrote on capital theory and interest theory

- We will dig into this next week

Capital & Interest 2 volumes:

- 1884, History and Critique of Interest Theories

- 1889, Positive Theory of Capital

Eugen von Böhm-Bawerk

Eugen von Böhm-Bawerk

1851—1914

Took a different approach to the imputation problem (factor pricing) than Wieser:

Followed a phrase in Menger, “the loss principle” — applying to the price of the final good what would be lost if one of the factor services is withdrawn

A good start, but in truth, marginal product operates at infinitesimally small changes (derivative)

Eugen von Böhm-Bawerk: On Opportunity Cost

Eugen von Böhm-Bawerk

1851—1914

“If in any branch of production the price sinks below the cost...men will withdraw from that branch and engage in some better paying branch of production. Conversely, if in one branch of production, the market price of the finished good is considerably higher than the value of the sacrificed or expended means of production, then will men be drawn from less profitable industries. They will press into the better paying branch of production, until through the increased supply, the price is again forced down to cost.

Böhm-Bawerk, Eugen von, 1884, Capital and Interest

Eugen von Böhm-Bawerk: On Opportunity Cost

Eugen von Böhm-Bawerk

1851—1914

“What determine the amount of this cost? The amount of the cost is identical with the value of the productive power, and, as a rule, is determined by the money marginal utility of this productive power...The price of a definite specie of freely reproducible goods fixes itself in the long run at that point where the money marginal utility, for those who desire to purchase these products, intersects the money marginal utility of all those who desire to purchase in the other communicating branches of production. The figure of the two blade of a pair of shears still holds good. One of the two blade, whose coming together determine the height of the price of any species of product, is in truth the marginal utility of this particular product. The other, which we are wont to call "cost," is the marginal utility of the products of other communicating branches of production. Or, according to Wieser, the marginal utility of "production related goods." It is, therefore, utility and not disutility which, as well on the side of supply as of demand, determine the height of the price. This, too, even where the so-called law of cost plays its role in giving value to goods. Jevons, therefore, did not exaggerate the importance of the one side, but came very near the truth when he said "value depends entirely upon utility.” (45)

Price is Determined at the Margin: B-B’s Example

Böhm-Bawerk has a great demonstration of how markets work to set the price at the margin

- Story of the three “marginal pairs”

Imagine a small public horse market:

3 people, A, B, and C each own 1 horse

3 people, D, E, and F each are potentially interested in buying a horse

Based on Eugen von Böhm-Bawerk’s example in Capital and Interest (1884)

Price is Determined at the Margin: B-B’s Example

| Person | Reservation Price |

|---|---|

| Seller A | Minimum WTA: $400 |

| Seller B | Minimum WTA: $500 |

| Seller C | Minimum WTA: $600 |

| Buyer D | Maximum WTP: $600 |

| Buyer E | Maximum WTP: $500 |

| Buyer F | Maximum WTP: $400 |

Price is Determined at the Margin: B-B’s Example

| Person | Reservation Price |

|---|---|

| Seller A | Minimum WTA: $400 |

| Seller B | Minimum WTA: $500 |

| Seller C | Minimum WTA: $600 |

| Buyer D | Maximum WTP: $600 |

| Buyer E | Maximum WTP: $500 |

| Buyer F | Maximum WTP: $400 |

Suppose Buyer F announces she will pay $400 for a horse

Only Seller A is willing to sell at $400

Buyers D, E, and F are willing to buy at $400

- D and E are willing to pay more than F to obtain the 1 horse

- They raise their bids above $400 to attract sellers

Price is Determined at the Margin: B-B’s Example

| Person | Reservation Price |

|---|---|

| Seller A | Minimum WTA: $400 |

| Seller B | Minimum WTA: $500 |

| Seller C | Minimum WTA: $600 |

| Buyer D | Maximum WTP: $600 |

| Buyer E | Maximum WTP: $500 |

| Buyer F | Maximum WTP: $400 |

Suppose Seller C announces he will sell his horse for $600

Only Buyer D is willing to buy at $600

Sellers A, B, and C are willing to sell at $600

- A and B are willing to accept less than C to sell their horses

- They lower their asks below $600 to attract buyers

Price is Determined at the Margin: B-B’s Example

| Person | Reservation Price |

|---|---|

| Seller A | Minimum WTA: $400 |

| Seller B | Minimum WTA: $500 |

| Seller C | Minimum WTA: $600 |

| Buyer D | Maximum WTP: $600 |

| Buyer E | Maximum WTP: $500 |

| Buyer F | Maximum WTP: $400 |

Market Price: $500

If the market price reaches $500 (through bids and asks changing)

Sellers A and B sell their horses for $500 each

- Buyers D and E buy them at $500 each

Price is Determined at the Margin: B-B’s Example

| Person | Reservation Price |

|---|---|

| Seller A | Minimum WTA: $400 |

| Seller B | Minimum WTA: $500 |

| Seller C | Minimum WTA: $600 |

| Buyer D | Maximum WTP: $600 |

| Buyer E | Maximum WTP: $500 |

| Buyer F | Maximum WTP: $400 |

Market Price: $500

At $500, B and E are the "marginal" buyer and seller, the "last" ones that just got off the fence to exchange in the market

- B has WTA just low enough to sell

- E has WTP just high enough to buy

The marginal pair actually are the ones that "set" the market price!

Price is Determined at the Margin: B-B’s Example

| Person | Reservation Price |

|---|---|

| Seller A | Minimum WTA: $400 |

| Seller B | Minimum WTA: $500 |

| Seller C | Minimum WTA: $600 |

| Buyer D | Maximum WTP: $600 |

| Buyer E | Maximum WTP: $500 |

| Buyer F | Maximum WTP: $400 |

Market Price: $500

Notice the most possible exchanges take place at a market price of $500

- 2 horses get exchanged

Any price above or below $500, only 1 horse would get exchanged

- Also, at least one other buyer or seller would raise/lower their bid/ask

Price is Determined at the Margin: B-B’s Example

| Person | Reservation Price |

|---|---|

| Seller A | Minimum WTA: $400 |

| Seller B | Minimum WTA: $500 |

| Seller C | Minimum WTA: $600 |

| Buyer D | Maximum WTP: $600 |

| Buyer E | Maximum WTP: $500 |

| Buyer F | Maximum WTP: $400 |

Market Price: $500

- At $500, C and F are the "excluded" buyers and sellers

- C has WTA too high to sell

- F has WTP too low to buy

Price is Determined at the Margin: B-B’s Example

| Person | Reservation Price |

|---|---|

| Seller A | Minimum WTA: $400 |

| Seller B | Minimum WTA: $500 |

| Seller C | Minimum WTA: $600 |

| Buyer D | Maximum WTP: $600 |

| Buyer E | Maximum WTP: $500 |

| Buyer F | Maximum WTP: $400 |

Market Price: $500

At $500, A and D are the "inframarginal" buyers and sellers

- A has WTA lower than market price, earns extra $100 surplus from exchange

- D has WTP higher than market price, earns extra $100 surplus from exchange

These buyers and sellers benefit the most from exchange

Marginal Productivity Theory

The Ricardian Roots of Marginal Productivity Theory

David Ricardo

1772-1823

Ricardo’s theory of rent applied marginal analysis (“doses” of L+K) to a fixed factor (land), concluding the fixed factor earns a residual surplus (gap between AP>MP) of variable factor (L+K)

Marginal productivity theory takes the other side of the coin: any variable factor must earn a payment equal to its marginal product (holding all other factors fixed)

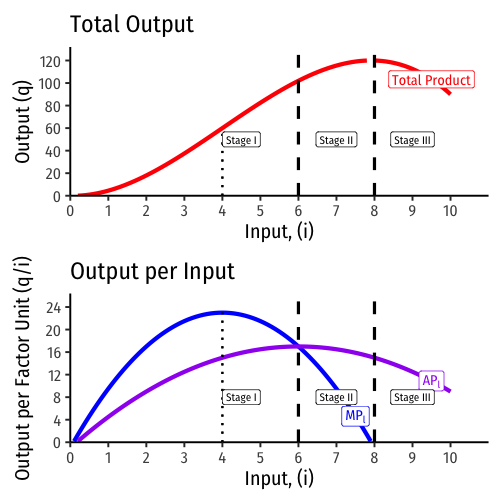

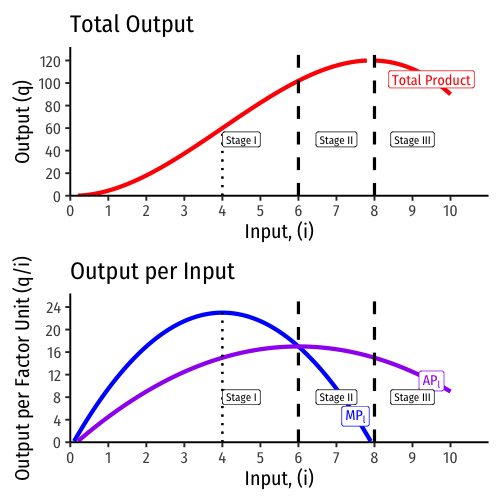

Marginal Productivity Theory

Applying Ricardian logic beyond agriculture, we arrive at the modern law of diminishing returns

- “Law of variable proportions” or “variation of returns”

For any one variable factor (holding all others constant), increasing use will eventually yield a diminishing marginal product

- nothing special about land!

Diminishing Returns

Marginal product of factor i, (MPi): additional output produced by adding one more unit of factor i (holding all others constant) MPi=ΔqΔi

- MPi is slope of TP at each value of i

Average product of factor i (APi): additional output produced by adding one more unit of factor i (holding all others constant) APi=qi

- APi is slope of a ray from the origin to the production function at any quantity of i

Derived Demand in Factor Markets

Demand for factors (e.g. labor) is a “derived demand”:

- Firm only demands inputs to the extent they contribute to producing sellable output

Firm faces a tradeoff when hiring more labor, as more labor ΔL creates:

- Marginal Benefit: Increases output and thus revenue

- Marginal Cost: Increases costs

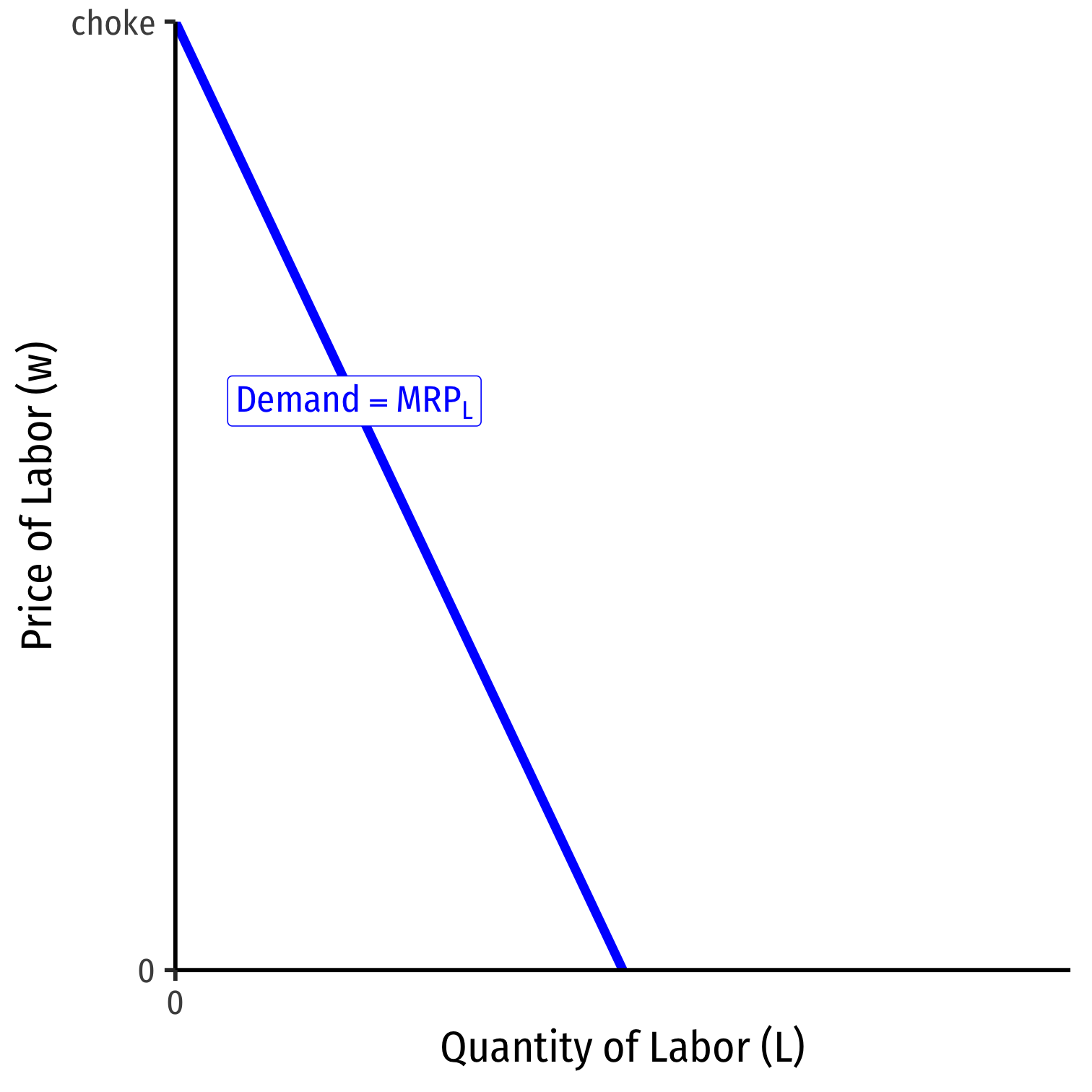

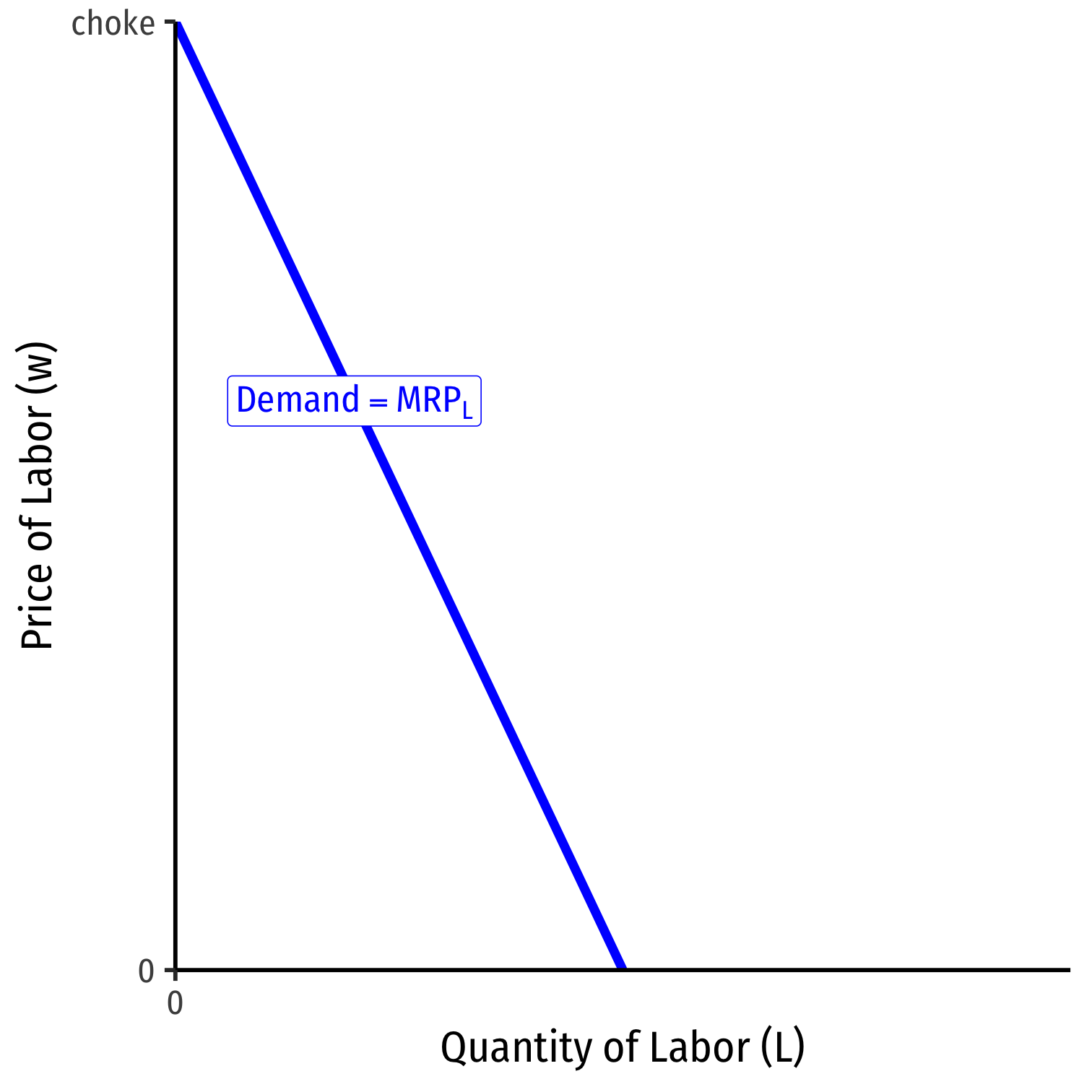

Marginal Revenue Product (of Labor)

- Hiring more labor increases output (i.e. labor's MPL)

- Recall: MPL=ΔqΔL, where q is units of output

Marginal Revenue Product (of Labor)

Hiring more labor increases output (i.e. labor's MPL)

- Recall: MPL=ΔqΔL, where q is units of output

Additional output generates (i.e. labor's MR(q))

- Recall: MR(q)=ΔR(q)Δq, where R(q) is total revenue

Marginal Revenue Product (of Labor)

Hiring more labor increases output (i.e. labor's MPL)

- Recall: MPL=ΔqΔL, where q is units of output

Additional output generates (i.e. labor's MR(q))

- Recall: MR(q)=ΔR(q)Δq, where R(q) is total revenue

- Hiring more labor, on the margin, generates a benefit, called the marginal revenue product of labor, MRPL:

MRPL=MPL∗MR(q)

- i.e. the number of new products a new worker makes times the revenue earned by selling the new products

Marginal Revenue Product for Competitive Firms

- This is the Firm's Demand for Labor:

MRPL=MPL∗MR(q)

- For a firm in a competitive (output) market, firm's MR(q)=p, hence:

MRPL=MPL∗p

Marginal Revenue Product for Competitive Firms

MRPL=MPL∗p

Marginal benefit of hiring labor, MRPL falls with more labor used

- production exhibits diminishing marginal returns to labor!

Choke price for labor demand: price too high for firm to purchase any labor

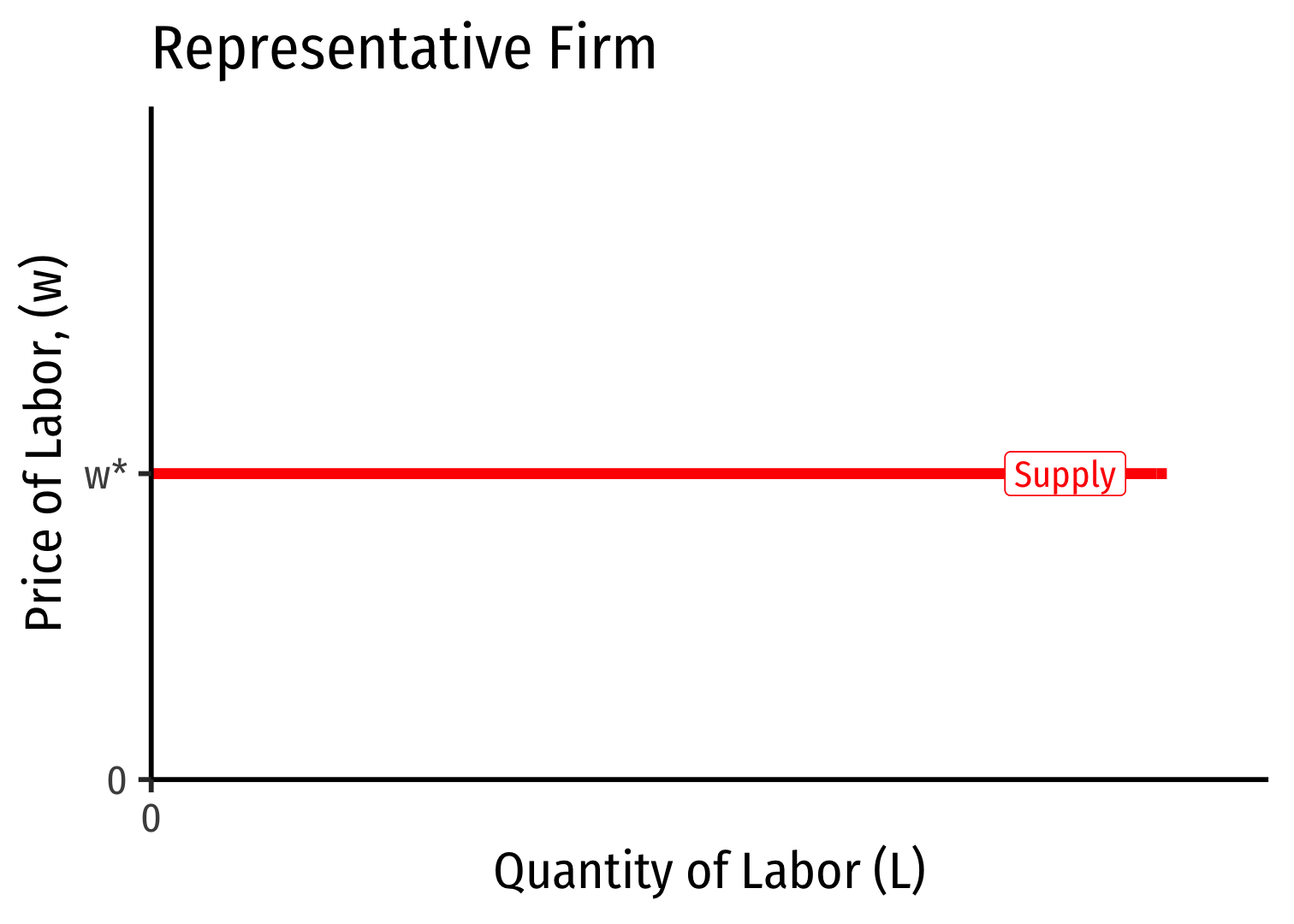

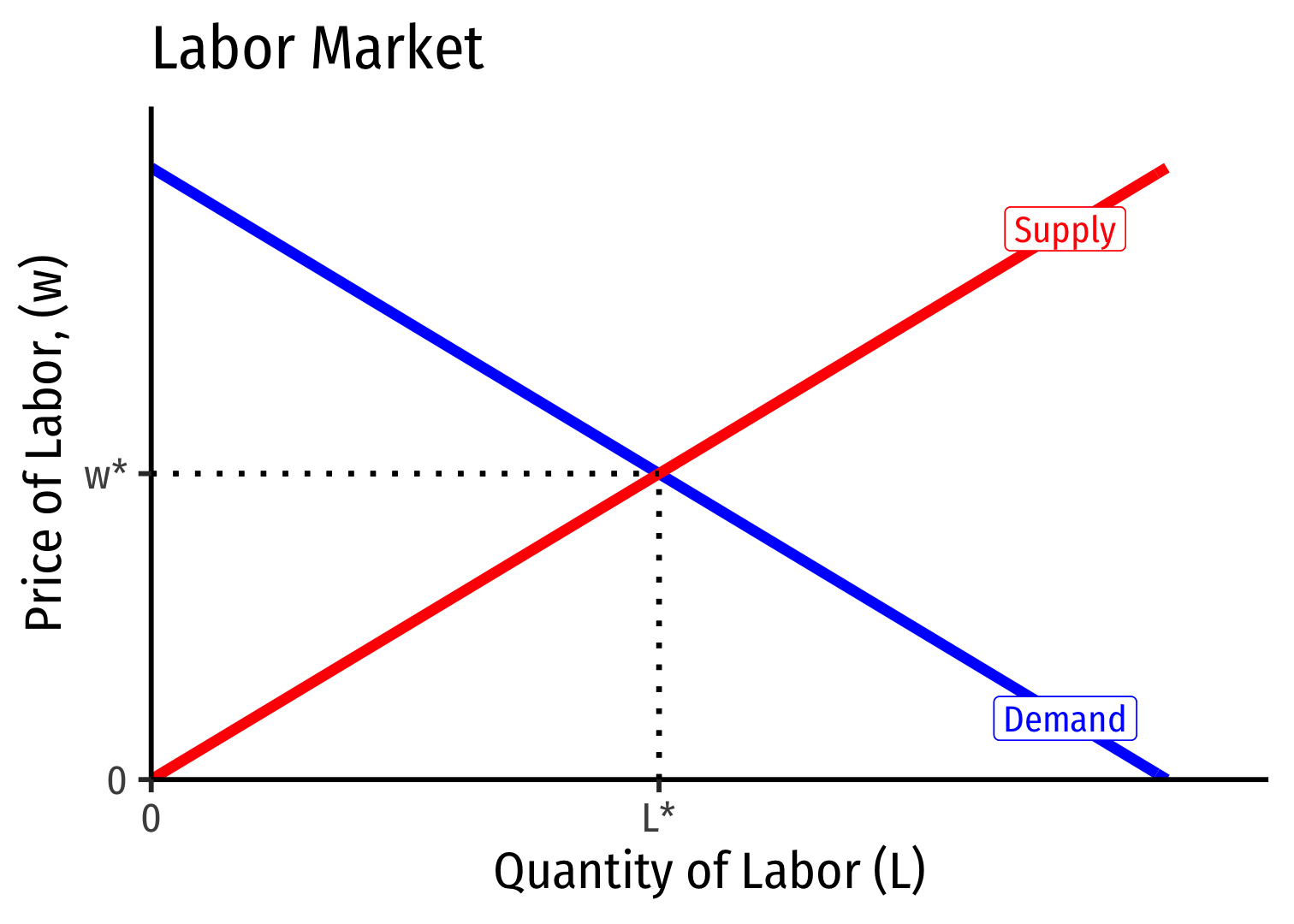

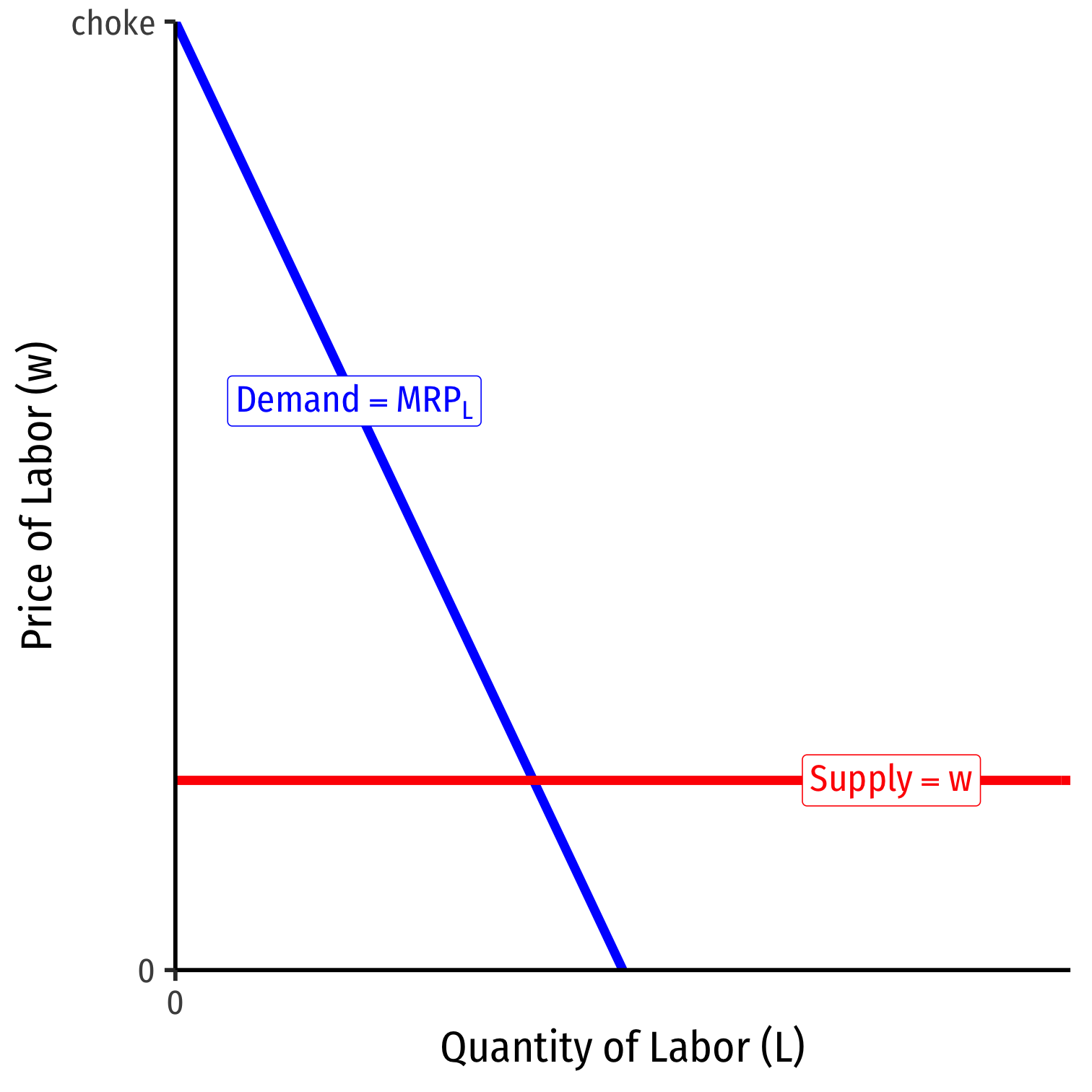

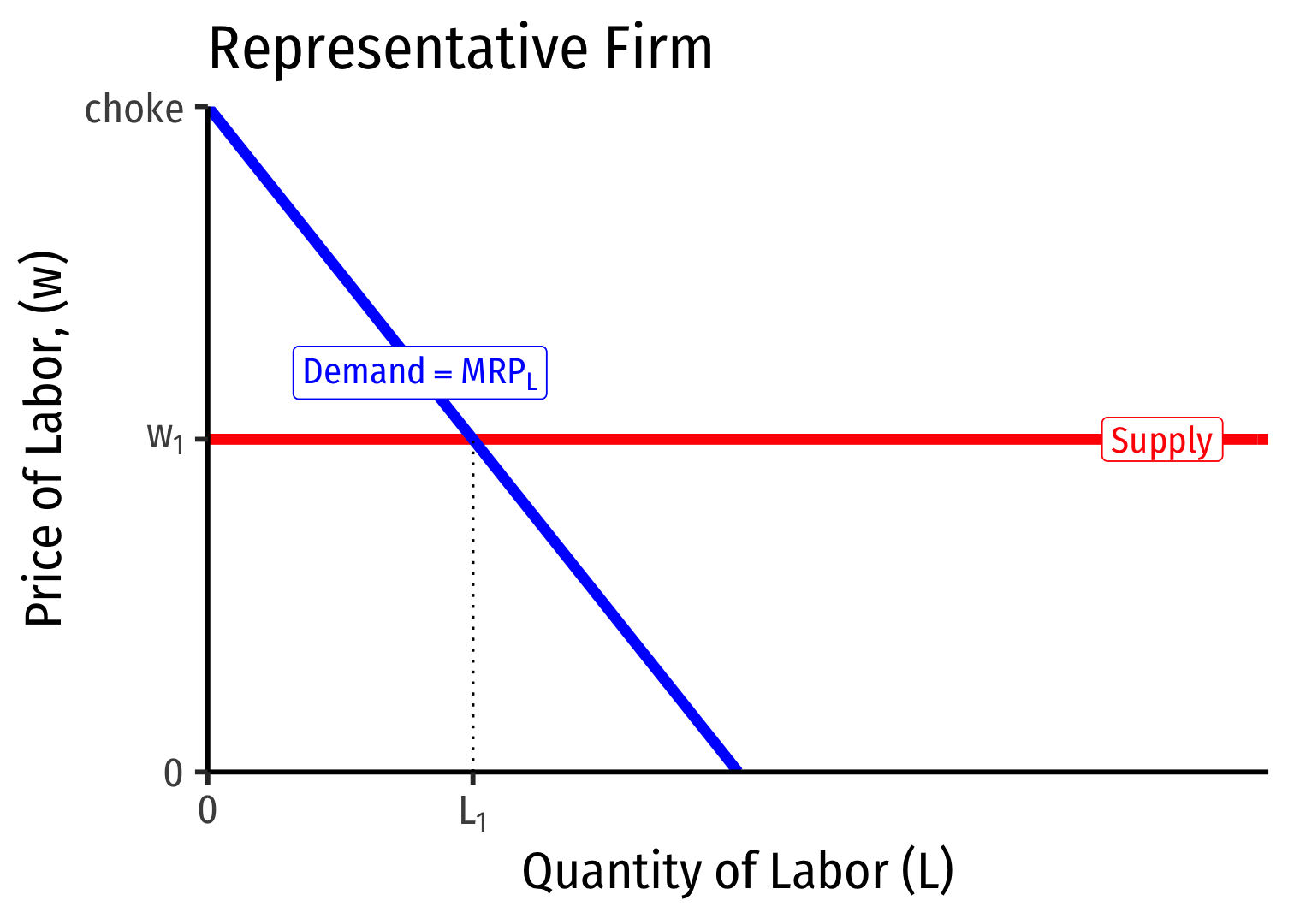

A Competitive Factor Market

- If the factor market is competitive, labor supply for an individual firm is perfectly elastic at the market price of labor (w∗)

Labor Supply and Firm's Demand for Labor

We've seen a falling MRPL, the marginal benefit of hiring labor

Marginal cost of hiring labor, w, remains constant

- so long as firm is not a big purchaser (has no market power) in the labor market

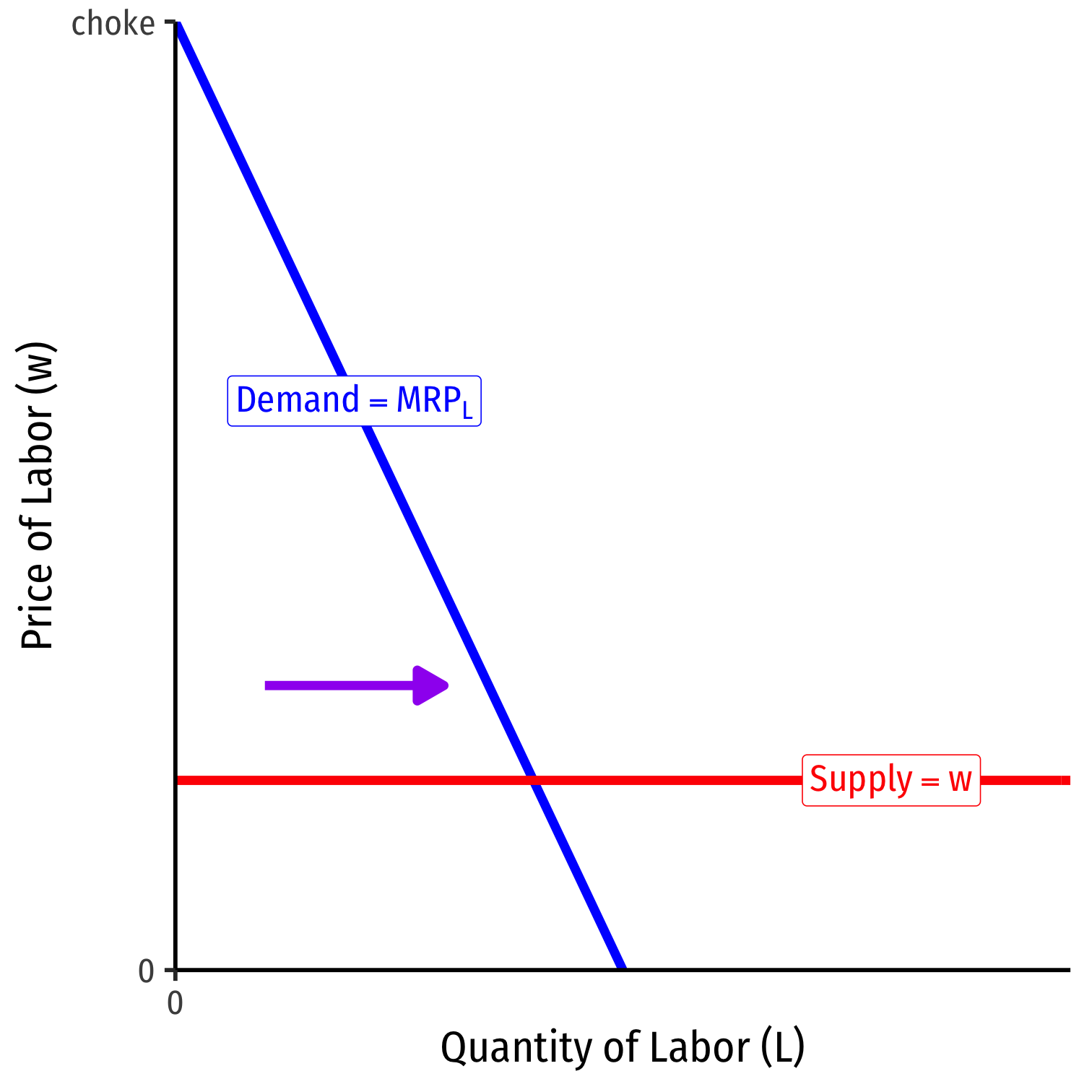

Labor Supply and Firm's Demand for Labor

At low amounts of labor, marginal benefit (MRPL)>w marginal cost

Firm will hire more labor

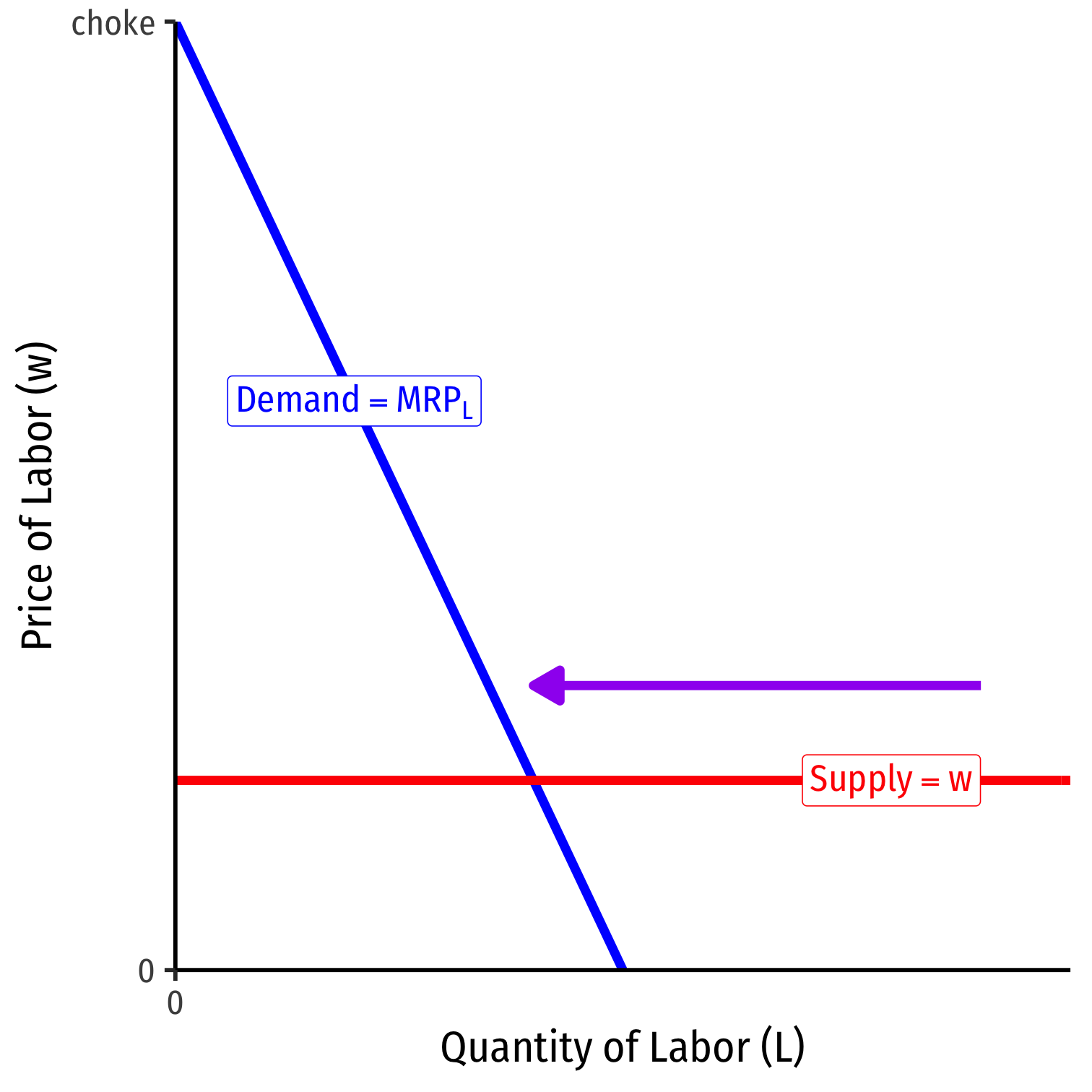

Labor Supply and Firm's Demand for Labor

At high amounts of labor, marginal benefit (MRPL)<w marginal cost

Firm will hire less labor

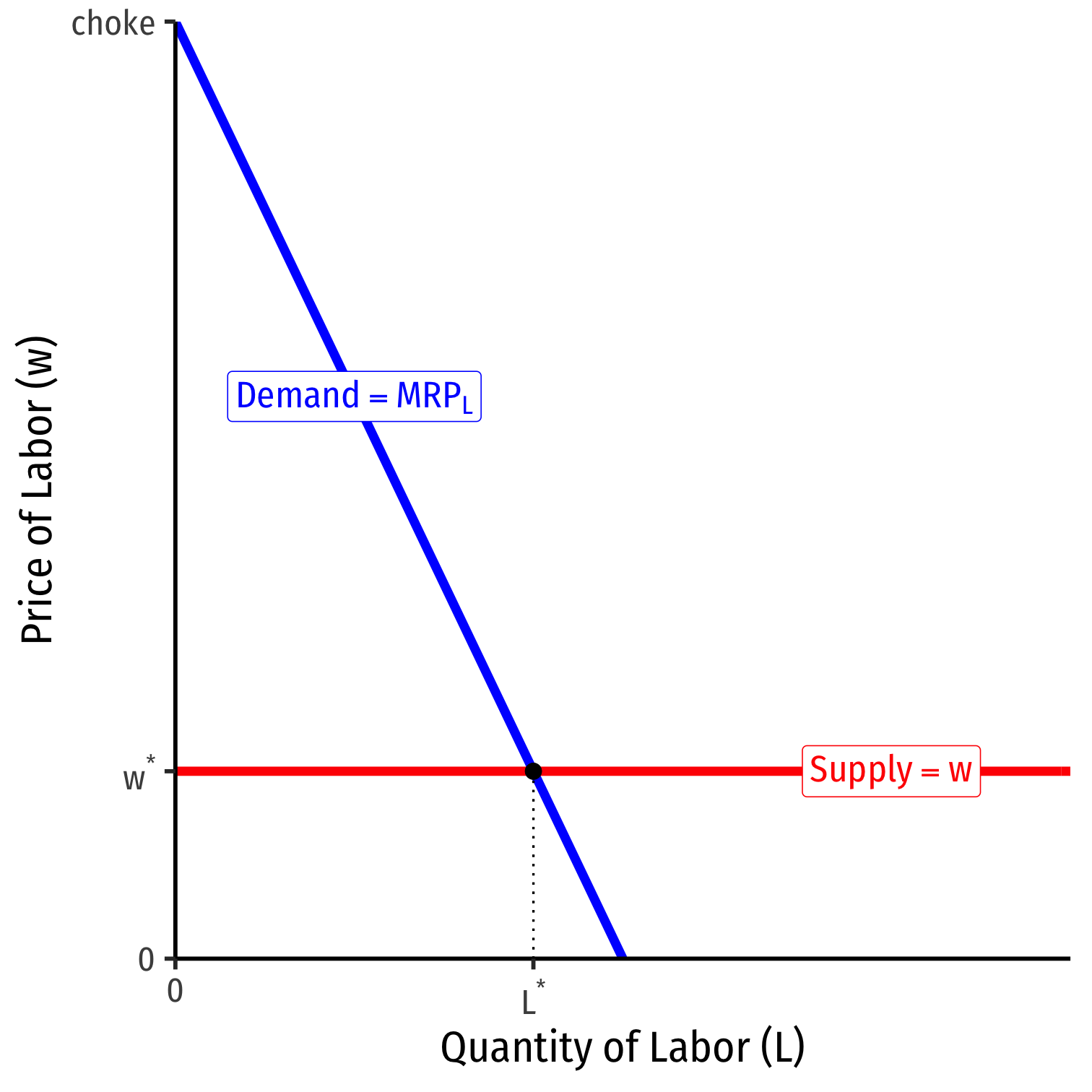

Labor Supply and Firm's Demand for Labor

Firm hires L∗ optimal amount of labor where w=MRPL

i.e. marginal cost of labor = marginal benefit of labor

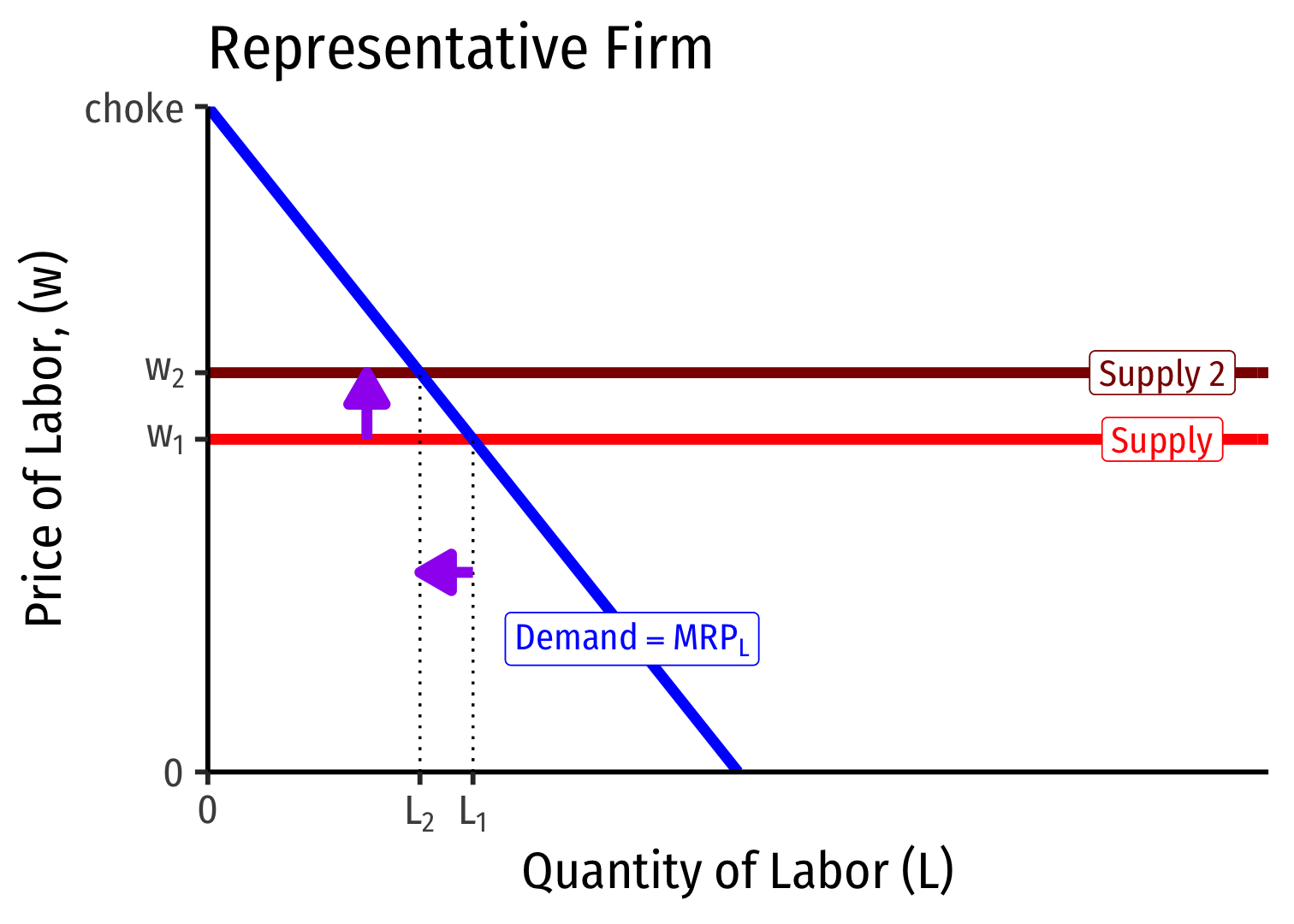

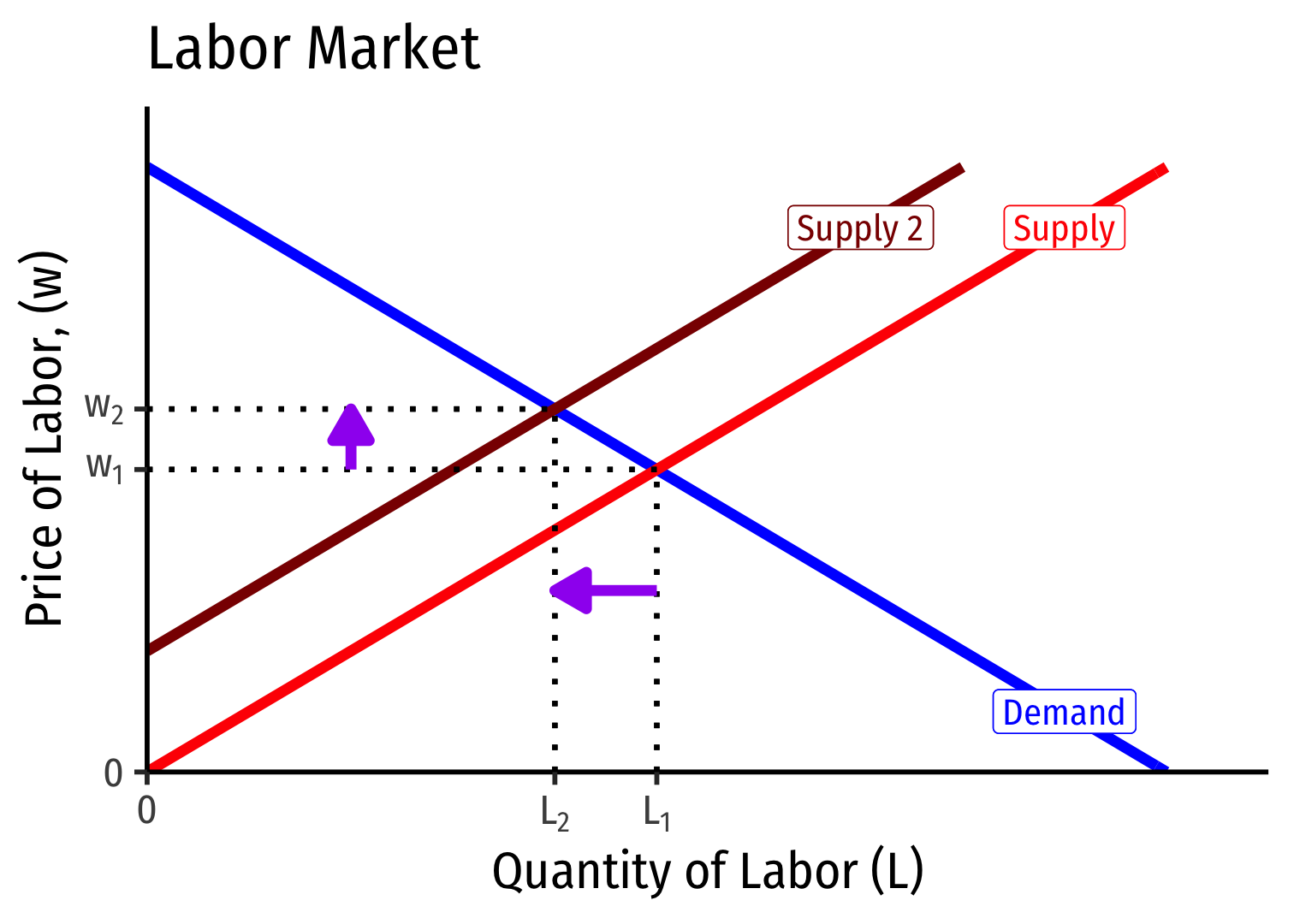

Labor Supply and Firm's Demand for Labor

Labor Supply and Firm's Demand for Labor

- If market supply of labor decreases, firms hire fewer workers, at higher wages (and vice versa)

Multiple Inputs and Cost Minimization

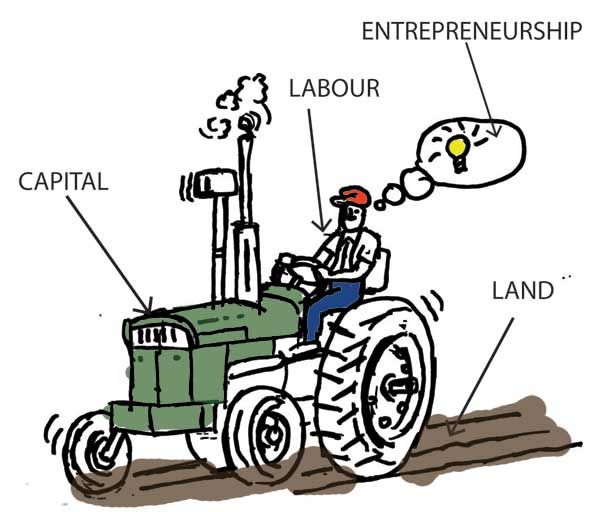

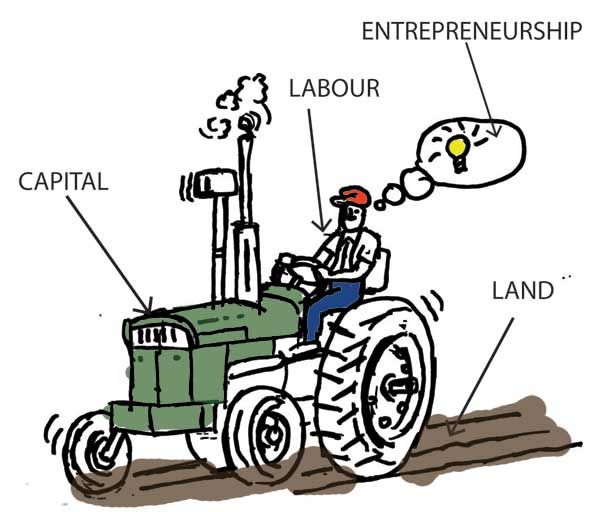

But firms produce with many factors, what is the more general rule for hiring the optimal combination of factors?

Assume three factors: land, labor, capital

Optimal hiring condition is the equimarginal rule (Gossen’s Second Law} again:

MPlpl=MPkpk=MPtpt=⋯=MPnpn

- Cost of production is minimized where the marginal product per dollar spent is equalized across all n possible inputs

- the “last dollar spent” on each input provides the same marginal product

Product Exhaustion & The Morality of Marginal Productivity

John Bates Clark

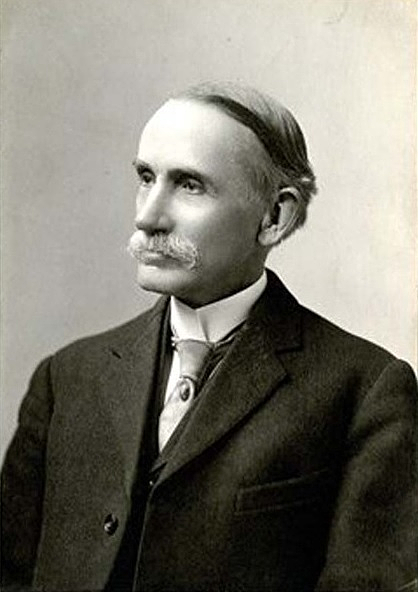

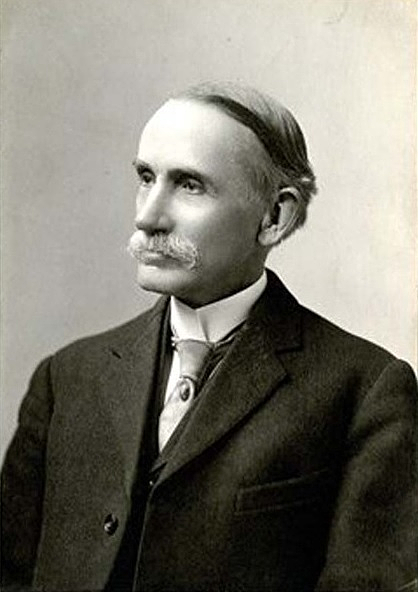

John Bates Clark

1847—1938

Initially a German Historicist (studied under Karl Knies) in Germany; a Christian socialist

Became professor at Columbia, independently derived his own version of marginal utility theory

Main popularizer of marginal productivity theory, virtues of market competition; opponent to American Institutionalists (see later)

1886, The Philosophy of Wealth

1889, “Possibility of a Scientific Law of Wages” paper at AEA; generalized in 1899 The Distribution of Wealth

Product Exhaustion

Ricardian rent theory defined rent as a residual, will always adjust to fill the gap between output price and wages & profits

- output price = wages & profits + rent

Thus, the payments to all factors of production (land, labor, capital) “fully exhaust the product”

- i.e. the sum of factor payments (costs to firm) equals the price

Product Exhaustion

On a competitive market, each product is paid its marginal (revenue) product

Does the sum of these marginal products exactly equal the market price of the output?

- “Product Exhaustion” debate:

Q=?MPL×L+MPK×K+MPT×T

John Bates Clark

John Bates Clark

1847—1938

Clark famously argued that on a competitive market, each factor is paid its marginal product, and that this exactly exhausts the product

Viewed this as a moral virtue of markets: each factor is paid for its contribution to society

- factor prices are not only efficient, they are just

Offered no proof that this is true

John Bates Clark: The Morality of Marginal Productivity

John Bates Clark

1847—1938

Meant this as a critique of both Karl Marx and Henry George

Georgists believed rent was undeserved, unearned income of landowners: should go to government

Marxists believed profit was exploitatibe and undeserved (surplus value): belonged to workers

Clark’s Distribution of Wealth argues that marginal productivity theory shows that under competitive markets, each factor is paid its just due

- Labor and land and capital are all necessary for production, and are paid for their productive contributions

John Bates Clark: The Morality of Marginal Productivity

John Bates Clark

1847—1938

Furthermore, argues that the distribution of income (under competitive markets) is just and deserved!

Heavily criticized for this normative theory

- Problems: not perfectly competitive, monopolies, labor unions, etc.

- His student, Thorstein Veblen reached the opposite conclusion!

Hume’s is-ought gap

Phillip Wicksteed

Phillip Wicksteed

1844—1927

A British economist and unitarian minister

Learned economics from Jevons, and got inspired to write about political economy after reading Henry George

1894, An Essay on the Co-Ordination of the Laws of Distribution

- tries to solve the product exhaustion problem of marginal productivity theory

1910, The Common Sense of Political Economy: Including a Study of the Human Basis of Economic Law

- one of the greatest books popularizing marginalism

Phillip Wicksteed

Phillip Wicksteed

1844—1927

Uses Euler’s Theorem of homogeneous functions to prove product exhaustion under specific conditions:

- production functions must be linearly homogenous (of degree 1)

- cnY=f(cnL,cnK,cnT) only for n=1

- we would say: “constant returns to scale”

Criticized for this by many (Edgeworth, Pareto, Wicksell, etc.)

- John Hicks: “Where Wicksteed went wrong was his assumption that he could argue from the shape of the curve at one particular point to the general shape of the curve.”

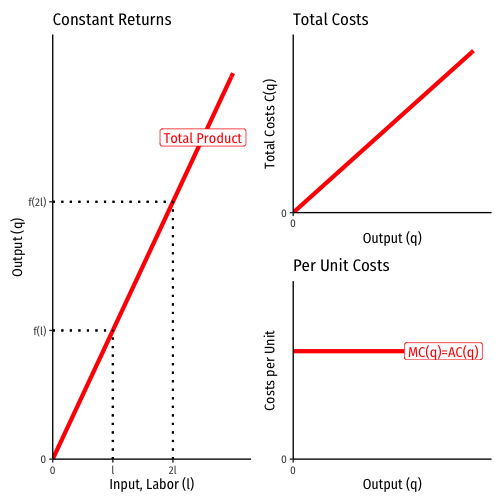

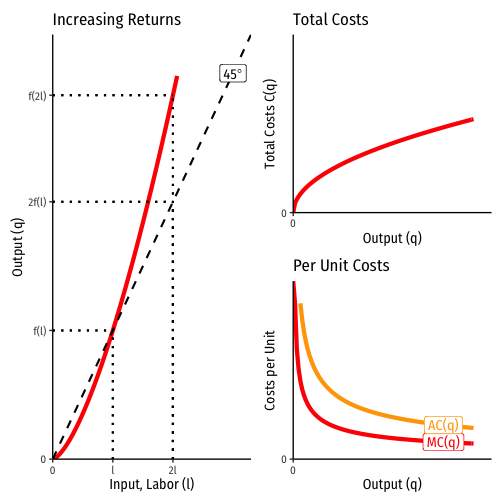

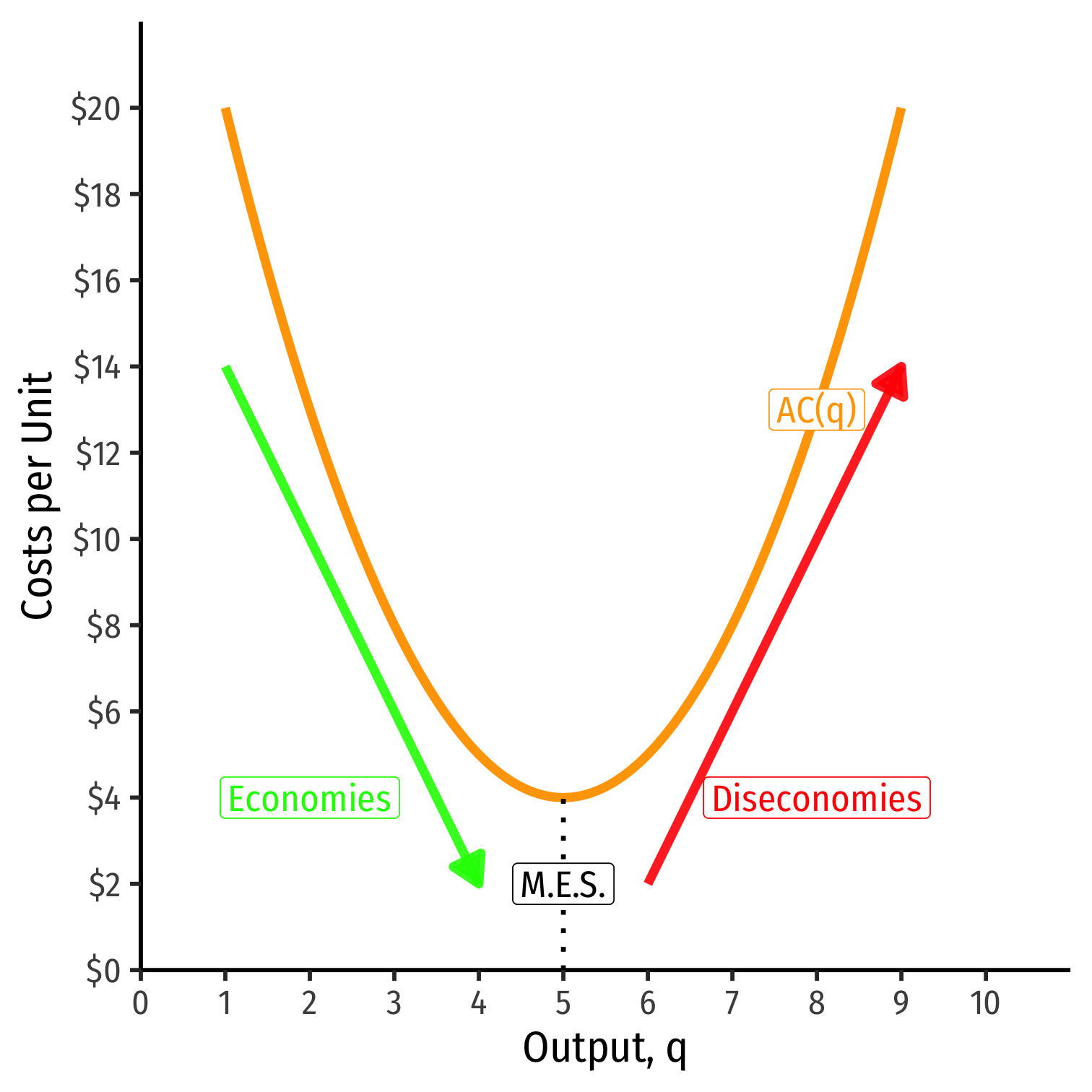

Returns to Scale

- The returns to scale of production refers to the change in output when all inputs are increased at the same rate

Returns to Scale

The returns to scale of production refers to the change in output when all inputs are increased at the same rate

Constant returns to scale: output increases at same proportionate rate as inputs increase

- e.g. if you double all inputs, output doubles

Returns to Scale

The returns to scale of production refers to the change in output when all inputs are increased at the same rate

Constant returns to scale: output increases at same proportionate rate as inputs increase

- e.g. if you double all inputs, output doubles

- Increasing returns to scale: output increases more than proportionately to the change in inputs

- e.g. if you double all inputs, output more than doubles

Returns to Scale

The returns to scale of production refers to the change in output when all inputs are increased at the same rate

Constant returns to scale: output increases at same proportionate rate as inputs increase

- e.g. if you double all inputs, output doubles

- Increasing returns to scale: output increases more than proportionately to the change in inputs

- e.g. if you double all inputs, output more than doubles

- Decreasing returns to scale: output increases less than proportionately to the change in inputs

- e.g. if you double all inputs, output less than doubles

Constant Returns to Scale

Constant returns to scale: doubling all inputs ⟹ double output f(cl,ck,ct)=cf(l,k,t)∀c>1

Constant economies of scale: average and marginal costs (are equal and) do not vary with output

Total revenues are completely exhausted by the payments to factors (costs to firm)

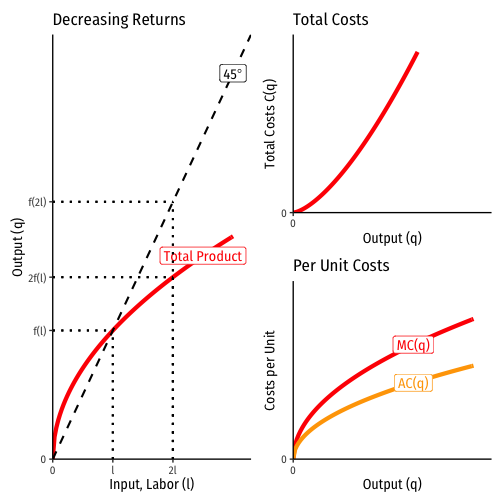

Decreasing Returns to Scale

Decreasing returns to scale: doubling all inputs ⟹ less than double output f(cl,ck,ct)<cf(l,k,t)∀c>1

Diseconomies of scale: average and marginal costs are increasing with output

- AC < MC ⟹ marginal cost pricing is always profitable

- Total Costs < Total Revenues ⟹π>0

Total revenues are not exhausted by the payments to factors (costs to firm); residual leftover!

Increasing Returns to Scale

Increasing returns to scale: doubling all inputs ⟹ more than double output f(cl,ck,ct)>cf(l,k,t)∀c>1

Economies of scale: average and marginal costs are decreasing with output

- AC > MC ⟹ marginal cost pricing is always loss-inducing

- Total Costs > Total Revenues ⟹π<0

Total revenues are insufficient to cover the payments to factors (costs to firm); losses!

Knut Wicksell

Knut Wicksell

1851—1926

Swedish economist at University of Stockholm

Another supposed independent discoverer of marginal productivity theory

Made key contributions to capital and interest theory, influence Austrian & Keynesian schools of macroeconomics

- we'll explore more next week

1898, Interest and Prices

Wicksell and Product Exhaustion

Knut Wicksell

1851—1926

Most economists believed that an industry would always be either constant, increasing, or decreasing returns

Wicksell showed that most firms actually go through all three phases of returns to scale

- developing a long-run U-shaped average cost curve for a firm

- would take a few decades for neoclassical economists to derive and understand shape of AC curve

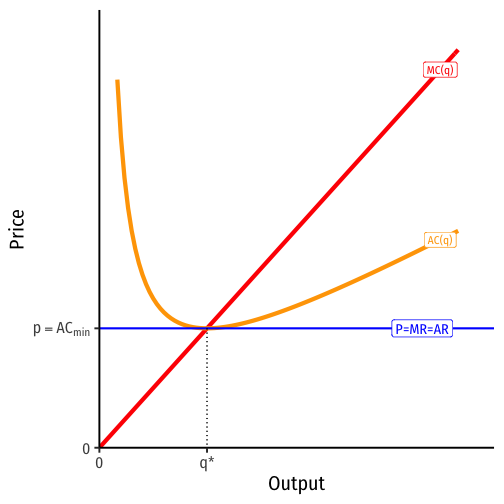

Wicksell and Product Exhaustion

Knut Wicksell

1851—1926

Thus, it is not necessary (as Wicksteed did) to assume constant returns to prove product exhaustion

Competition would ensure that in the long run, firms are producing at their least-cost combination

- p=MC=ACmin

- π=0

- “product exhaustion”

Wicksell and Product Exhaustion

Minimum Efficient Scale: q with the lowest AC(q)

- constant returns to scale

Economies of Scale: ↑q, ↓AC(q)

- increasing returns to scale

Diseconomies of Scale: ↑q, ↑AC(q)

- decreasing returns to scale

Wicksell and Product Exhaustion

Think about what you learn in microeconomics

In perfect competition, in the long run, as profits attract entrants and losses force exits, price settles on the break-even point, where profit is 0

- p=MC=ACmin

- factors are paid their opportunity costs (marginal products); nothing leftover

We still haven’t gotten to the famous model of perfect competition, but this is where everything is heading

Implications & Criticisms of Marginal Productivity Theory

Implications of Marginal Productivity Theory

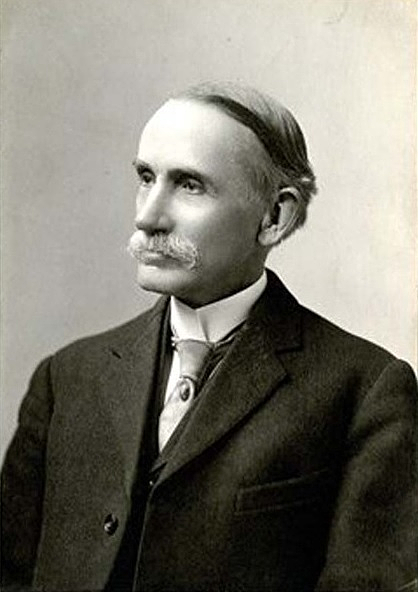

John Bates Clark

1847—1938

Several flaws with marginal productivity theory as a theory of distribution

MPT is primarily a theory of factor pricing, not about distribution of relative shares

It’s even an incomplete theory of factor pricing!

- Considers only demand side of factor market (firms), not the supply side!

Assumes competitive output and input markets

- Labor unions, monopsony power, bargaining, etc.

Implications of Marginal Productivity Theory

- A big problem: it’s impossible to observe and measure an individual factor’s marginal product!

“there is no separate product of the tool on the one hand and of the labor using the tool on the other...We can disengage no concretely separable product of labor and capital” — Frank Taussig

The Firm as Nexus of Contracts

L: Armen Alchian (1914-2013)

R: Harold Demsetz (1930-2019)

"[A firm] is a team use of inputs and a centralized position of some party in the contractual arrangements of all other inputs. It is the centralized contractual agent in a team productive process," (p.778).

The Firm as Nexus of Contracts

L: Armen Alchian (1914-2013)

R: Harold Demsetz (1930-2019)

"Two men jointly lift heavy cargo into trucks. Solely by observing the total marginal productivity and making pay-weight loaded per day, it is impossible to determine each person's marginal productivity...In team production, marginal products of cooperative team members are not so directly and separably (i.e., cheaply) observable. What a team offers to the market can be taken as the marginal product of the team but not of the team members. The costs of metering or ascertaining the marginal products of the team's members is what calls forth new organizations and procedures," (pp.778).

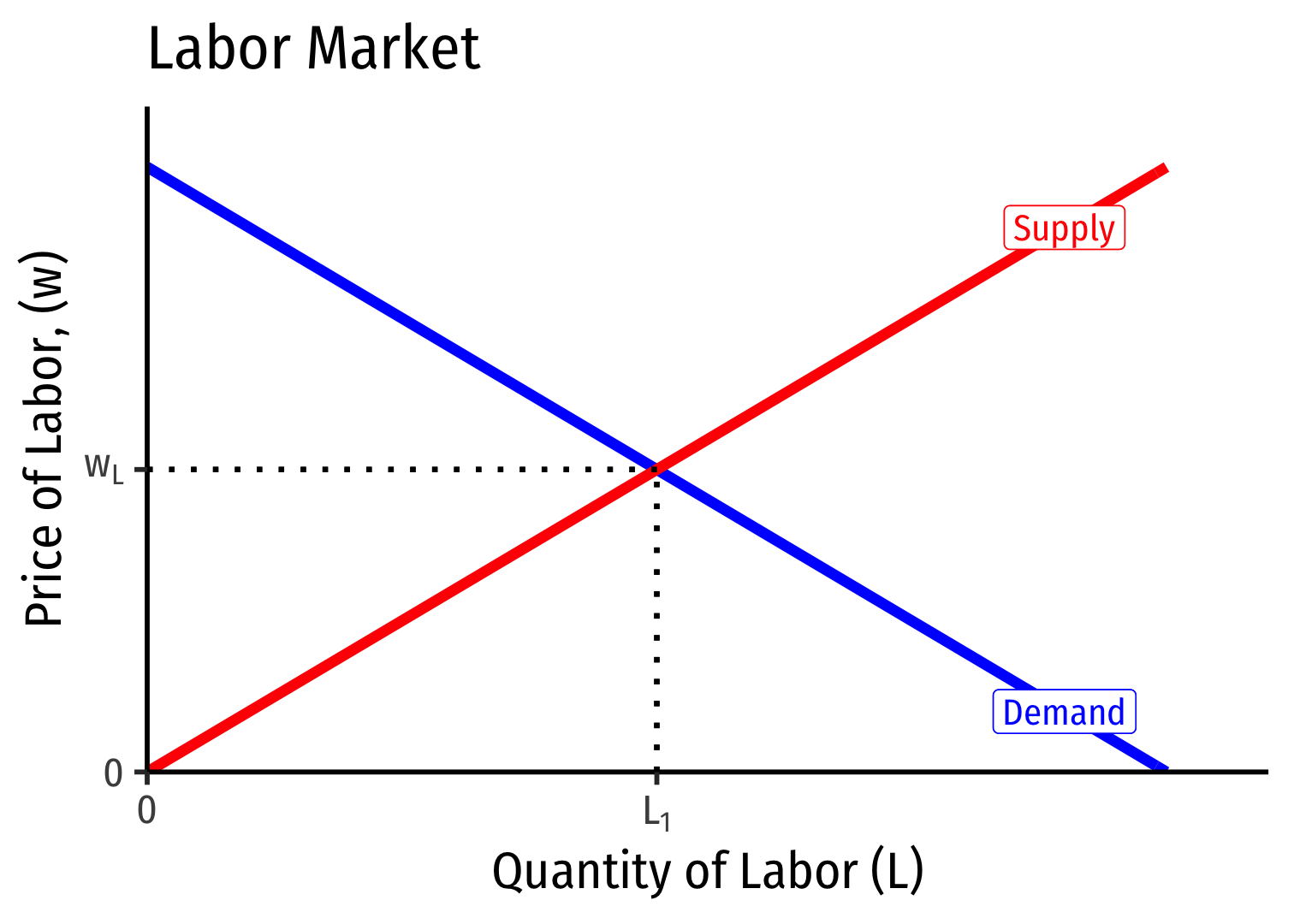

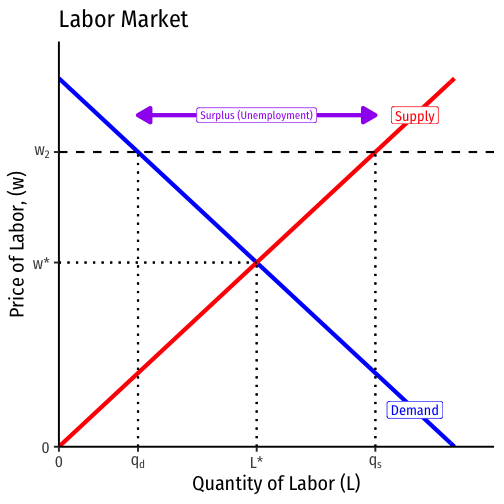

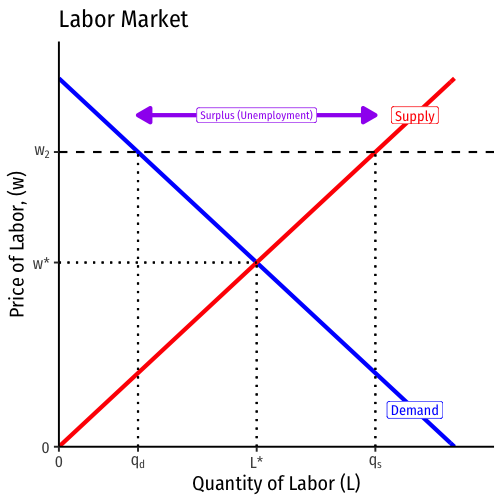

Implications of Marginal Productivity Theory

Factor employment is determined by supply & demand of factor, where demand is driven by the factor’s marginal revenue product

- if market price is above equilibrium (e.g. w2), a surplus (unemployment) of that factor

Prices will adjust downwards to equilibrium

Implications of Marginal Productivity Theory

What implications does this have for macroeconomic policy?

Applied to the entire economy, implies that (non-frictional) unemployment is due to above-equilibrium factor prices

- markets will correct this by adjusting prices downwards

Anticipating Keynes:

- but is it that easy to lower wages??

- if workers have less income, will that affect aggregate demand?

Implications of Marginal Productivity Theory

John Bates Clark

1847—1938

MPT describes the outcome to which we are always approaching (i.e. perfect competition), it is an equilibrium state of rest

- actual prices in real world are not equilibrium prices, we are not in perfect competition

In long run equilibrium in perfect competition, factor prices are paid their marginal products

- p=MC, all factors are paid opportunity costs, firms break even and “exhaust the product” AR(q)=AC(q)

A scarce factor (talent, etc) will command higher prices (and reap economic rents), might be efficient, but is that moral?