3.7 — Welfare Economics

ECON 452 • History of Economic Thought • Fall 2020

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/thoughtF20

thoughtF20.classes.ryansafner.com

Welfare Economics: A Summary

Today we will zig-zag between the Marshallian/British and the Paretian/Lausanne approaches to welfare economics

- Focus on applying economic theory to measuring the costs/benefits of policy

- Edgeworth & Pigou: Marshallian/Cambridge

- Pareto & Barone: Walrasian/Lausanne

From 1930s to today, development of the “New” Welfare Economics

- ordinal utility, general equilibrium

- mathematical proofs of the “two fundamental welfare theorems,” and existence of general equilibrium

- John Hicks, Abram Bergson, Abba Lerner, Paul Samuleson, Ken Arrow, Gerard Debreu

Francis Ysidro Edgeworth & The Mathematical Tools

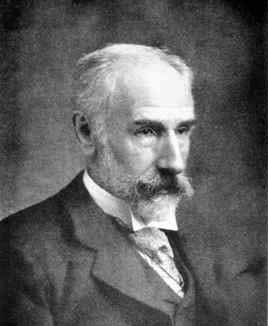

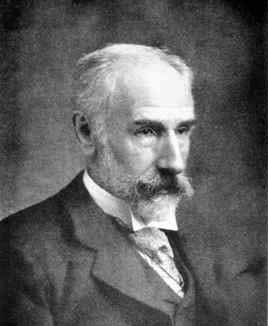

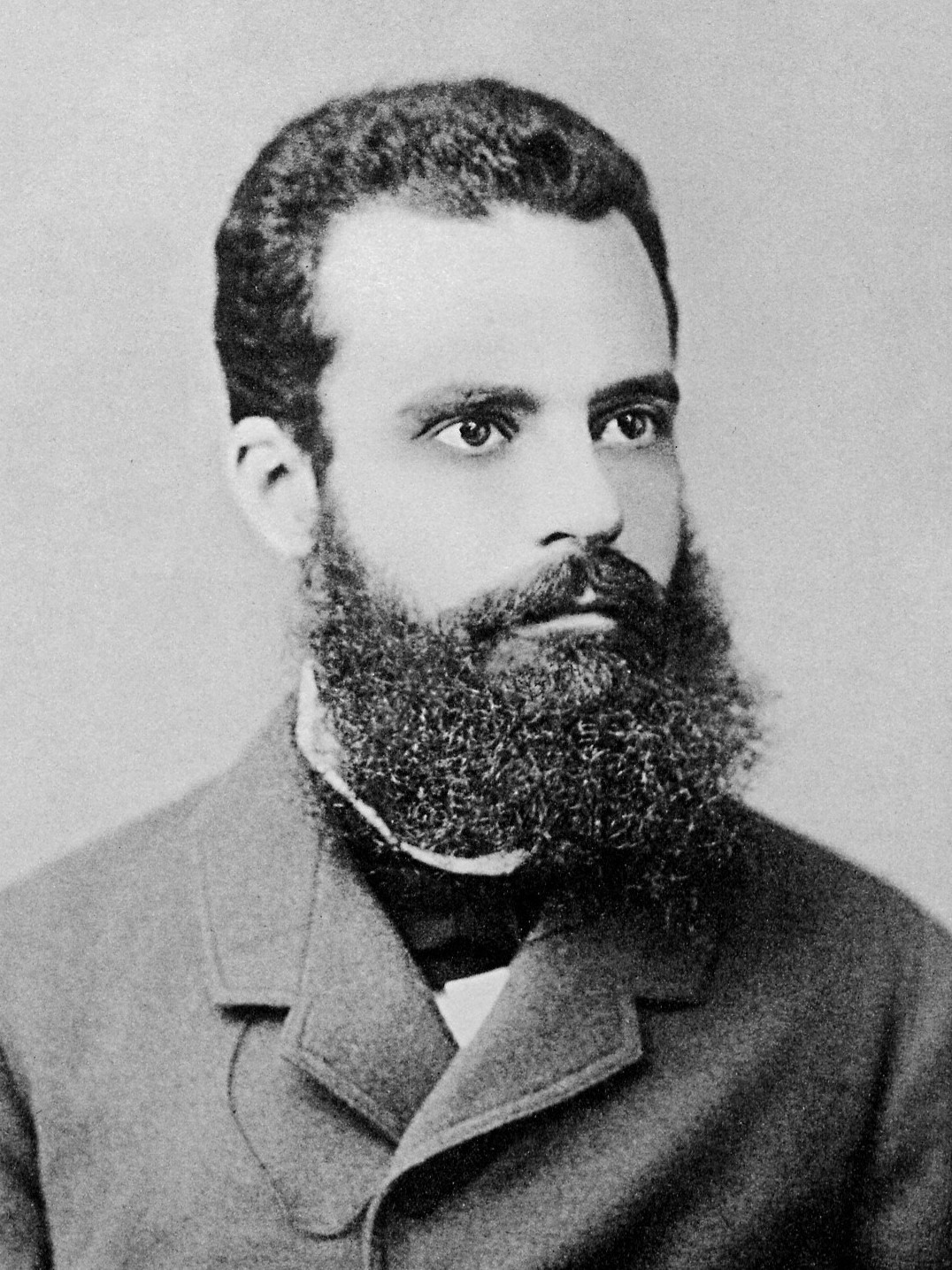

Francis Ysidro Edgeworth

Francis Ysidro Edgeworth

1845-1926

Professor at Oxford, friends with Jevons & Marshall

Founding & long-time editor of The Economic Journal

Restated utilitarian ethical & economic analysis in mathematical form

Polite but famously prickly in debates

“Francis is all right to get on with, but beware of Ysidro” — Marshall

Francis Ysidro Edgeworth

Francis Ysidro Edgeworth

1845-1926

- 1881 Mathematical Psychics: An Essay on the Application of Mathematics to the Moral Sciences

- Famously unintelligible

“This book shows clear signs of genius, and is a promise of great things to come...His readers may sometimes wish that he had kept his work by him a little longer till he had worked it out a little more fully, and obtained that simplicity which comes only through long labour. But taking it as what it claims to be, ‘a tentative study’, we can only admire its brilliancy, force, and originality.” — Marshall

“Whatever else readers of this book may think about it, they would probably all agree that it is a very remarkable one...There can be no doubt that in the style of his composition Mr. Edgeworth does not do justice to his matter. His style, if not obscure, is implicit, so that the reader is left to puzzle out every important sentence like an enigma” — Jevons

Francis Ysidro Edgeworth

Francis Ysidro Edgeworth

1845-1926

A major advocate of mathematical economics

Major innovations:

- indifference curves†

- more realistic utility functions†

- “Edgeworth box” (see below, with Pareto)

Focused on limits to determinant answers (in Jevons & Walras)

- led to debates for next few decades

- would be rediscovered later in more formalist economics

† Irving Fisher in the U.S. also used and developed his own version of these!

Edgeworth: Mathematical Economics

Francis Ysidro Edgeworth

1845-1926

- Economics as a series of maximization problems:

“Now, it is remarkable that the principle inquiries in Social Science may be viewed as maximium-problems. For Economics investigates the arrangements between agents each tending to his own maximium utility...Since, then, Social Science, as compared with the Calculus of Variations, starts from similar data...and travels to a similar conclusion — determinations of maximum — why should it not pursue the same method, Mathematics?” (p.481 in Reader)

Edgeworth, Francis Y, 1881, Mathematical Psychics

Edgeworth: Mathematical Economics

Francis Ysidro Edgeworth

1845-1926

Economic analysis is repeated application of maximization problems

Why go through the redundancy of different institutional contexts? Merely abstract to the essence: mathematical model

Accused Marshallian economists of being seduced by the “zigzag windings of the flowery path of literature.”

Edgeworth, Francis Y, 1881, Mathematical Psychics

Edgeworth: Mathematical Economics & Physics

Francis Ysidro Edgeworth

1845-1926

- Very clearly tried to apply tools of physics to Economics

“The Economical Calculus investigates the equilibrium of a system of hedonic forces each tending to maximum individual utility; the Utilitarian Calculus, the equilibrium of a system in which each and all tend to maximum universal utility,” (p. 484 in Reader)

- Thought utility was measurable, in cardinal units, similar to energy in physics (“pleasure-energy”)

- Future developments in “physio-psychology” could one day create a “hedonimeter” to measure utility

Edgeworth, Francis Y, 1881, Mathematical Psychics

Edgeworth Contra Jevons & Walras on Exchange

Francis Ysidro Edgeworth

1845-1926

- Jevons thought prices would be definite & determinate, based on utility functions:

“The ratio of exchange of any two commodities will be the reciprocal of the ratio of the final degrees of utility of the quantities of commodity available for consumption after the exchange is completed” (Jevons)

- Walras’ tâtonnement conceptualized people shouting their bids and asks, changing them, and trading only at market-clearing prices

Edgeworth: Recontracting and Market Process

Francis Ysidro Edgeworth

1845-1926

Edgeworth points out the “indeterminacy of contract”, and focuses on “recontracting”

Edgeworth’s idea of market process: people in the market go around to each other and make trial bargains which they can later change or revoke

- When they have better information about other participants (and their bids/asks), parties try to recontract

- Contracts are finally settled, and a determinate outcome (among many possible outcomes) is reached

Edgeworth: Recontracting and Market Process

Francis Ysidro Edgeworth

1845-1926

“Is [economic competition] peace or war? ... It is both, pax or pact between contractors during contract, war, when some of the contractors without the consent of others recontract. Thus, an auctioneer having been in contact with the last bidder (to sell at such a price if no higher bid) recontracts with a higher bidder. So a landlord on expiry of lease recontracts, it may be, with a new tenant. The field of competition with reference to a contract, or contracts, under consideration consists of all the individuals who are willing and able to recontract about the articles under consideration. Thus, in an auction the field consists of the auctioneer and all who are effectively willing to give a higher price than the last bid. In this case, as the transaction reaches determination, the field continually diminishes and ultimately vanishes. But this is not the case in general.” (p.485 in Reader).

“A settlement is a contract which cannot be varied with the consent of all the parties to it. A final settlement is a settlement which cannot be varied by recontract, within the field of competition. Contract is indeterminate when there are an indefinite number of final settlements,” (p.485 in Reader)

Edgeworth, Francis Y, 1881, Mathematical Psychics

Edgeworth on Exchange

Francis Ysidro Edgeworth

1845-1926

- In the process, invents 2 key tools:

- Indifference curves describing bundles of goods that provide equal utility

- “The Edgeworth Box” (what we call it today) and the “Contract curve”

Edgeworth on Exchange

Francis Ysidro Edgeworth

1845-1926

- Reaches several conclusions & implications that still are valid today:

- Exchanges between individuals (final settlements) must be on the contract curve

- Competitive market equilibrium must be on the contract curve

- Indeterminacy of equilibrium in two-party bargaining (bilateral monopoly problem)

- “Edgeworth conjecture” (“recontracting theorem”): as # of traders increases, contract curve shrinks to single point: competitive equilibrium

Edgeworth on Exchange

Francis Ysidro Edgeworth

1845-1926

“If we then enquire in what directions [persons] X and Y will consent to move together, the answer is, in any direction between their respective lines of indiffernce, in a direction positive as it may be called for both. At what point then will they refuse to move at all? When their lines of indifference are coincident (and lines of preference not only coincident, but in opposite directions)...” (p.487 in Reader).

“The locus [of all such points] it is here proposed to call the contract-curve” (p.486 in Reader)

“Then...it appears that the total utility of the system is a relative maximum at any point on the pure contract-curve,” (p.488 in Reader).

Edgeworth, Francis Y, 1881, Mathematical Psychics

Edgeworth on Exchange

Francis Ysidro Edgeworth

1845-1926

Edgeworth, Francis Y, 1881, Mathematical Psychics

Edgeworth on Exchange

Francis Ysidro Edgeworth

1845-1926

“[From any point on the contract curve] in whatever direction we take an infinitely small step, [the utilities of both parties] do not increase together, but that, while one increases, the other decreases.”

“It seems to follow on general dynamical principles applied to this special case that equilibrium is attained when the total pleasure-energy of the contractors is a maximum relative, or subject, to conditions...”

Edgeworth, Francis Y, 1881, Mathematical Psychics

Vilfredo Pareto & Paretian Welfare Economics

Vilfredo Pareto

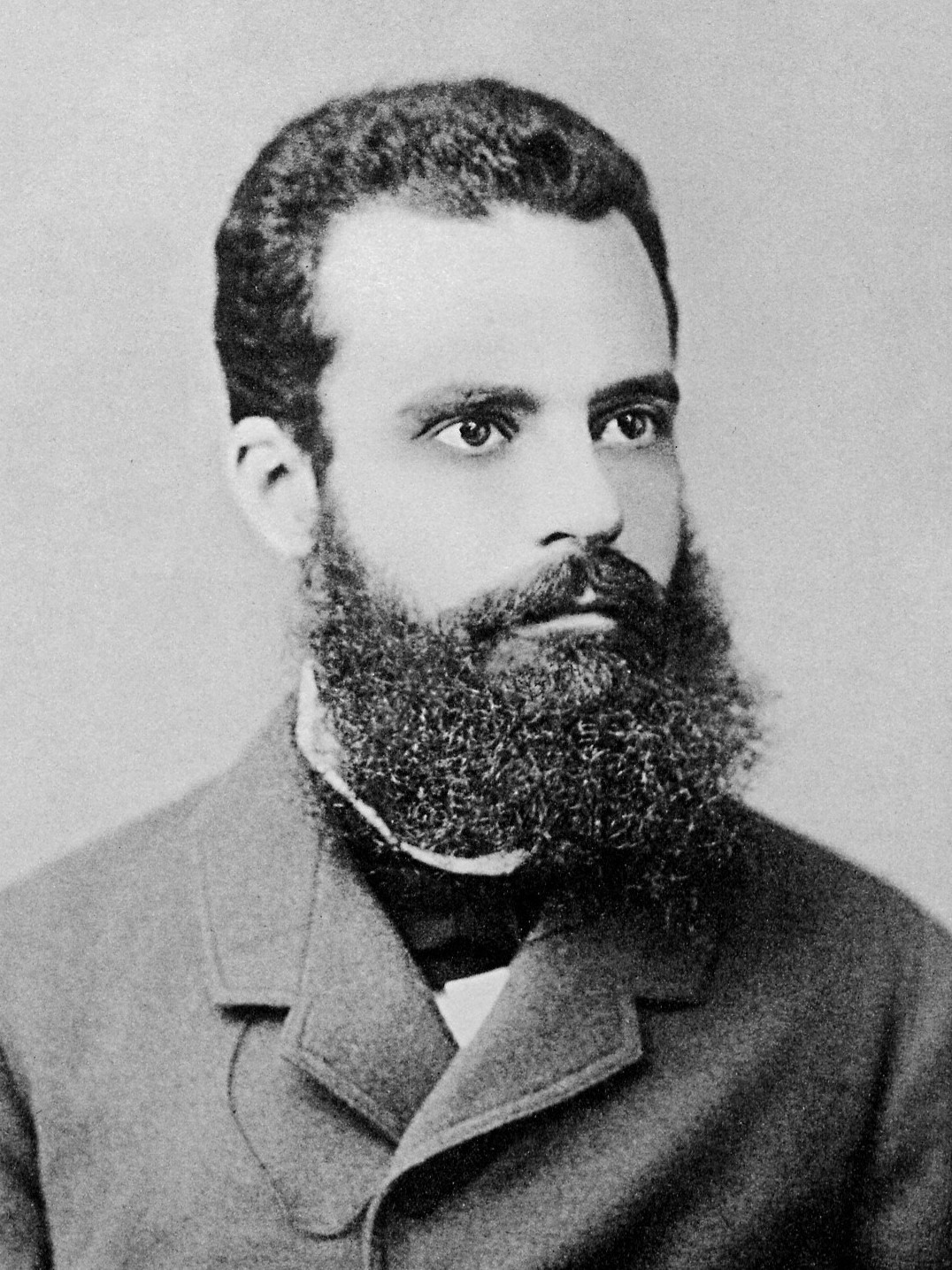

Vilfredo Pareto

1848-1923

A civil engineer turned economist

Student of Walras, and then succeeded him as Chair of Political Economy at U. of Lausanne

Extends general equilibrium theory to policy questions

Vilfredo Pareto: The Sociologist

Vilfredo Pareto

1848-1923

A founding father of sociology

- Supposedly turned to sociology when the abstract mathematical theories of economics did not seem to explain everything

1916, Trattato di Sociologia Generale (The Mind and Society)

- Most of human social activities are “non-logical” (we are driven by “residues”) we merely come up with “rationalizations” (“derivations”) to disguise our actions (to ourselves & others) as being rational - Coins the term “elite” for dominant social class - Circulation of elies: Social change & revolutions are merely one elite overthrowing and replacing an existing elite

“History is a graveyard of aristocracies”

Vilfredo Pareto: The Sociologist

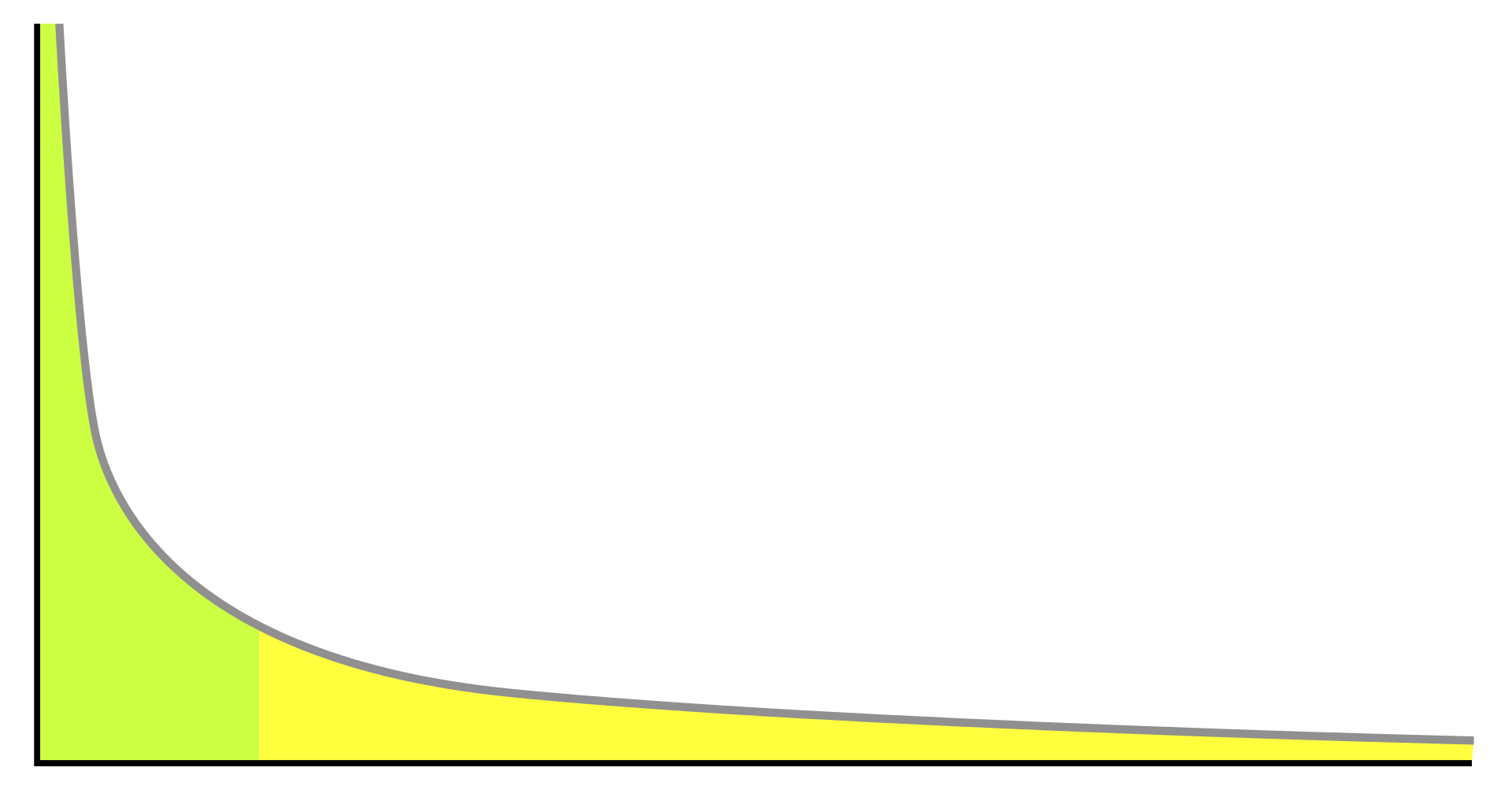

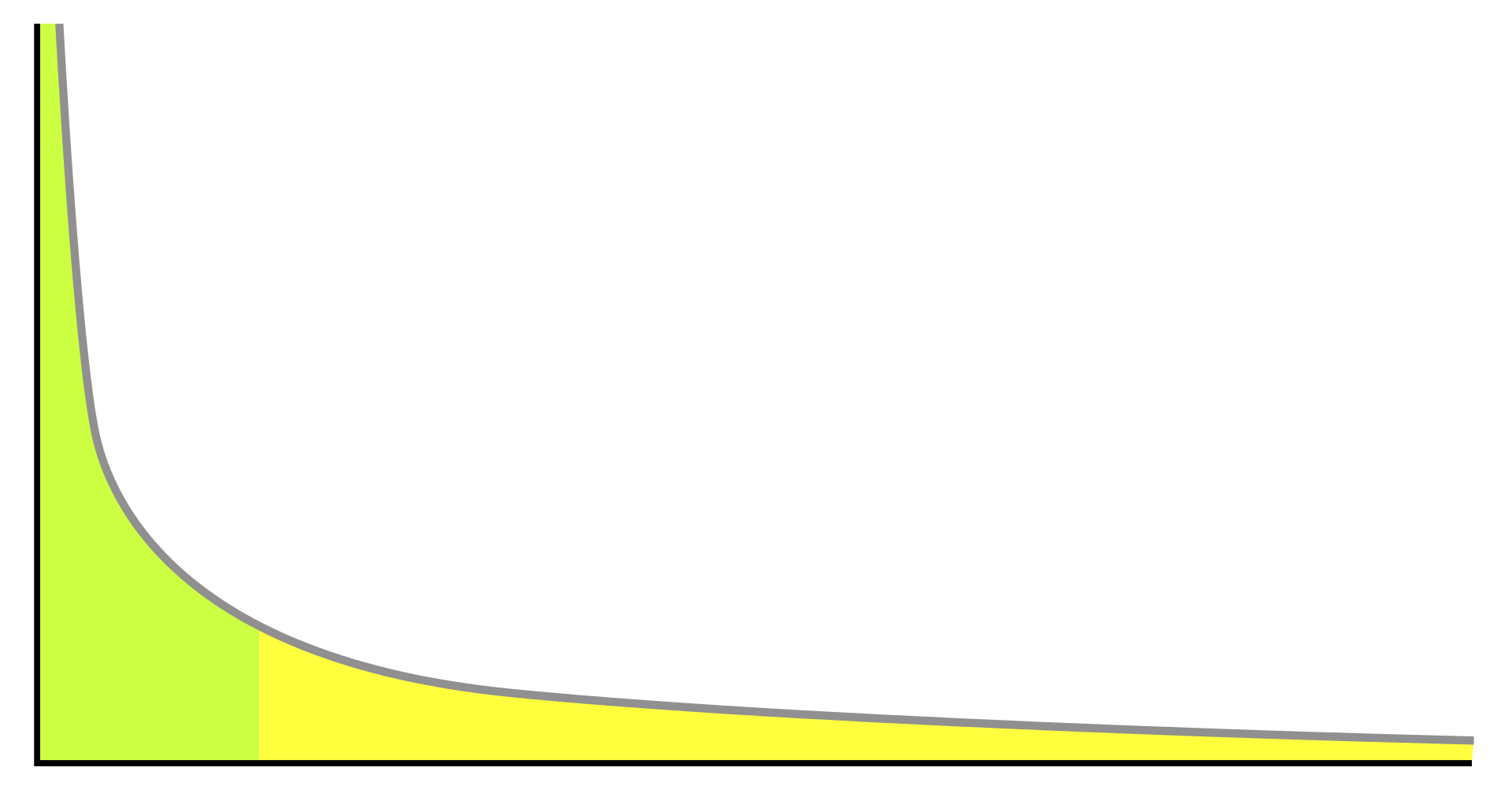

Famous “80-20 rule”, or the “Pareto principle”

- 80% of outcome comes from 20% of the causes (“the vital few”)

- e.g. 80% of the property in Italy is owned by 20% of the population

- e.g. 80% of sales come from 20% of customers

Thought he had discovered a universal empirical law

- it turns out this keeps coming up with such regularity that it might as well be universal law!

Vilfredo Pareto: The Sociologist

- “Pareto distribution” (a kind of power law distribution) $$f(x) = ax^{-k}$$

Taking logs: $$\ln f(x) = a - k \ln x$$

“A power law, also called a scaling law, is a relation of the type \(Y =aX^β\), where \(Y\) and \(X\) are variables of interest, \(β\) is called the power law exponent, and \(a\) is typically an unremarkable constant. For instance, if \(X\) is multiplied by a factor of 10, then \(Y\) is multiplied by \(10β\)—one says that \(Y\) “scales” as \(X\) to the power \(β\).” (Gabaix, 2016: 186)

Vilfredo Pareto’s Politics

Vilfredo Pareto

1848-1923

Big advocate of classical liberalism and fierce opponent to socialism & Marxism

Near the end of his life, after his sociological study and 80-20 rule, became sympathetic towards (then rising 1920s Italian) fascism

- had always thought democracy was a facade, an elite always emerges and enriches itself

- hurt his reputation, though his economic analysis is enormously influential

Influence and Controversy

“One of Pareto’s equations achieved special prominence, and controversy. He was fascinated by problems of power and wealth. How do people get it? How is it distributed around society? How do those who have it use it? The gulf between rich and poor has always been part of the human condition, but Pareto resolved to measure it. He gathered reams of data on wealth and income through different centuries, through different countries: the tax records of Basel, Switzerland, from 1454 and from Augsburg, Germany, in 1471, 1498 and 1512; contemporary rental income from Paris; personal income from Britain, Prussia, Saxony, Ireland, Italy, Peru. What he found – or thought he found – was striking. When he plotted the data on graph paper, with income on one axis, and number of people with that income on the other, he saw the same picture nearly everywhere in every era. Society was not a ‘social pyramid’ with the proportion of rich to poor sloping gently from one class to the next. Instead it was more of a ‘social arrow’ – very fat on the bottom where the mass of men live, and very thin at the top where sit the wealthy elite. Nor was this effect by chance; the data did not remotely fit a bell curve, as one would expect if wealth were distributed randomly. ‘It is a social law’, he wrote: something ‘in the nature of man.’ At the bottom of the Wealth curve, he wrote, Men and Women starve and children die young. In the broad middle of the curve all is turmoil and motion: people rising and falling, climbing by talent or luck and falling by alcoholism, tuberculosis and other kinds of unfitness. At the very top sit the elite of the elite, who control wealth and power for a time – until they are unseated through revolution or upheaval by a new aristocratic class. There is no progress in human history. Democracy is a fraud. Human nature is primitive, emotional, unyielding. The smarter, abler, stronger, and shrewder take the lion's share. The weak starve, lest society become degenerate: One can, Pareto wrote, ‘compare the social body to the human body, which will promptly perish if prevented from eliminating toxins.’ Inflammatory stuff – and it burned Pareto's reputation.”

Vilfredo Pareto’s Economics

Vilfredo Pareto

1848-1923

Pareto is enormously influential for establishing subjective welfare economics

- Later economists would create “new” welfare economics on Paretian foundations

Previous (English) writers (Mill, Jevons, Edgeworth) treated “welfare” as the sum of cardinally-measurable utilities of individuals - Benthamite utilitarianism: “the greatest good for the greatest number”

Vilfredo Pareto’s Economics

Vilfredo Pareto

1848-1923

Pareto decisively breaks away from cardinal utility and additive utility functions; ruthlessly commits himself to making no interpersonal comparisons ever

Optimum conditions of exchange depend only on intrapersonal, never interpersonal comparisons of utility

Pareto even disliked the word “utility” for its connotation of Benthamite utilitarianism, the cardinal use of “utils,” etc.

- Instead preferred the word “ophelimity” 🤷

Vilfredo Pareto’s Economics

Vilfredo Pareto

1848-1923

1906/1909 Manual of Political Economy

Key innovations:

- Focus on normative policy analysis using economic tools: efficiency (Pareto efficiency) defined in normative way

- Fully subjective approach to utility

- First draws indifference curves (Edgeworth only described the math)

- Draws the modern version of the “Edgeworth box”

- Uses this to derive (in essence) the Two Fundamental Laws of Welfare Economics

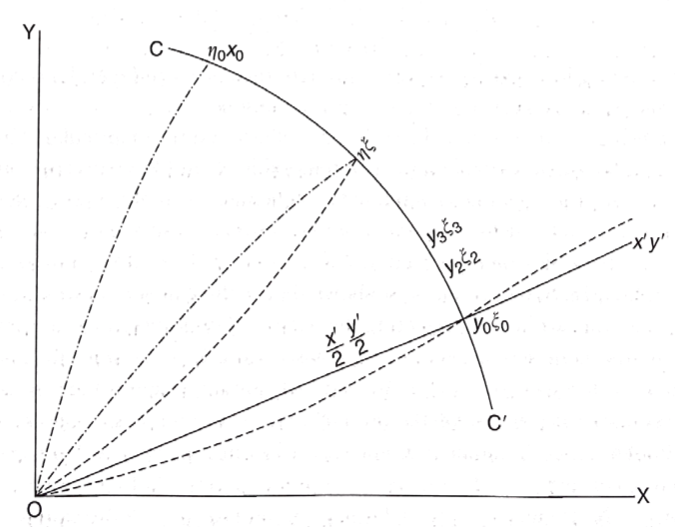

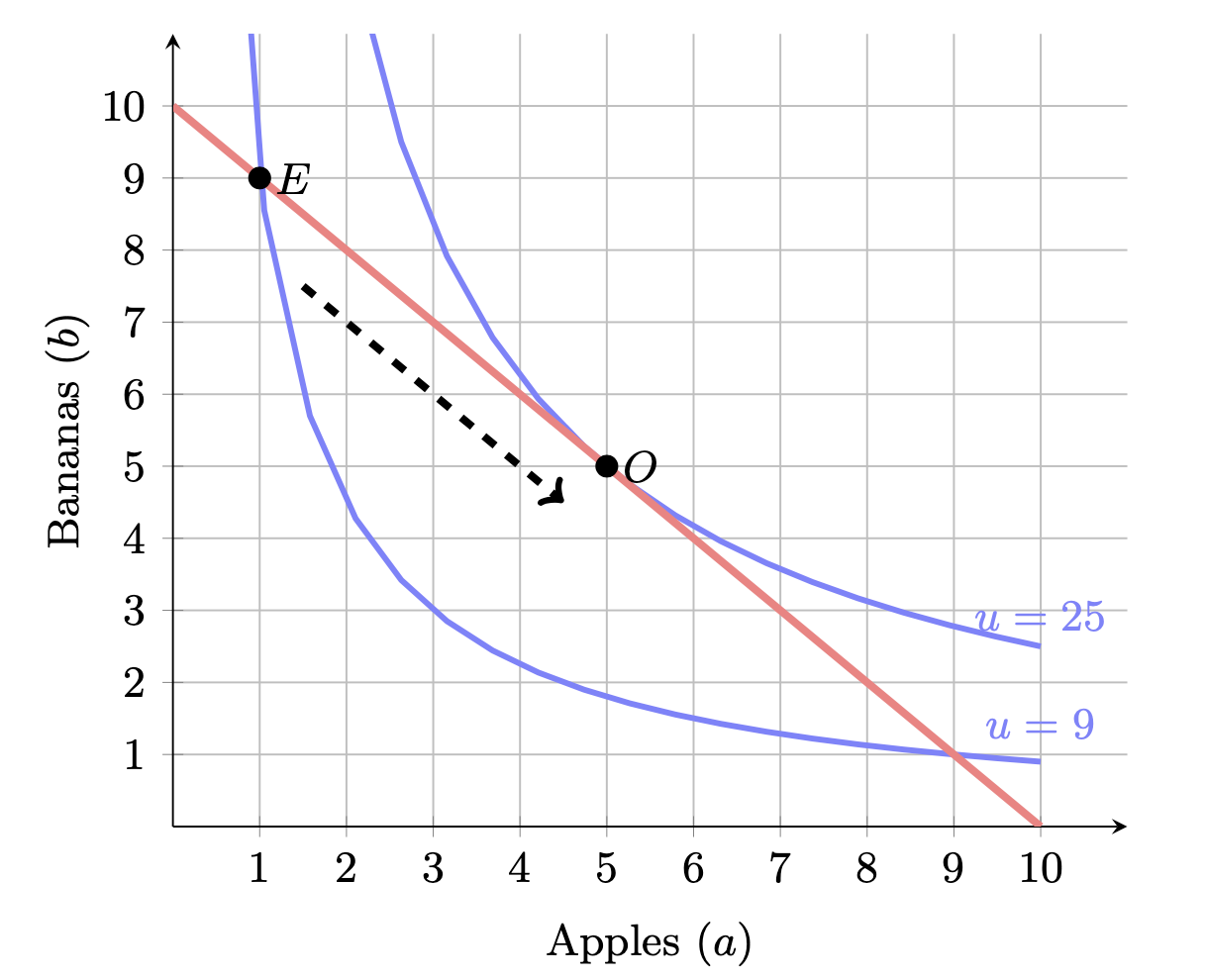

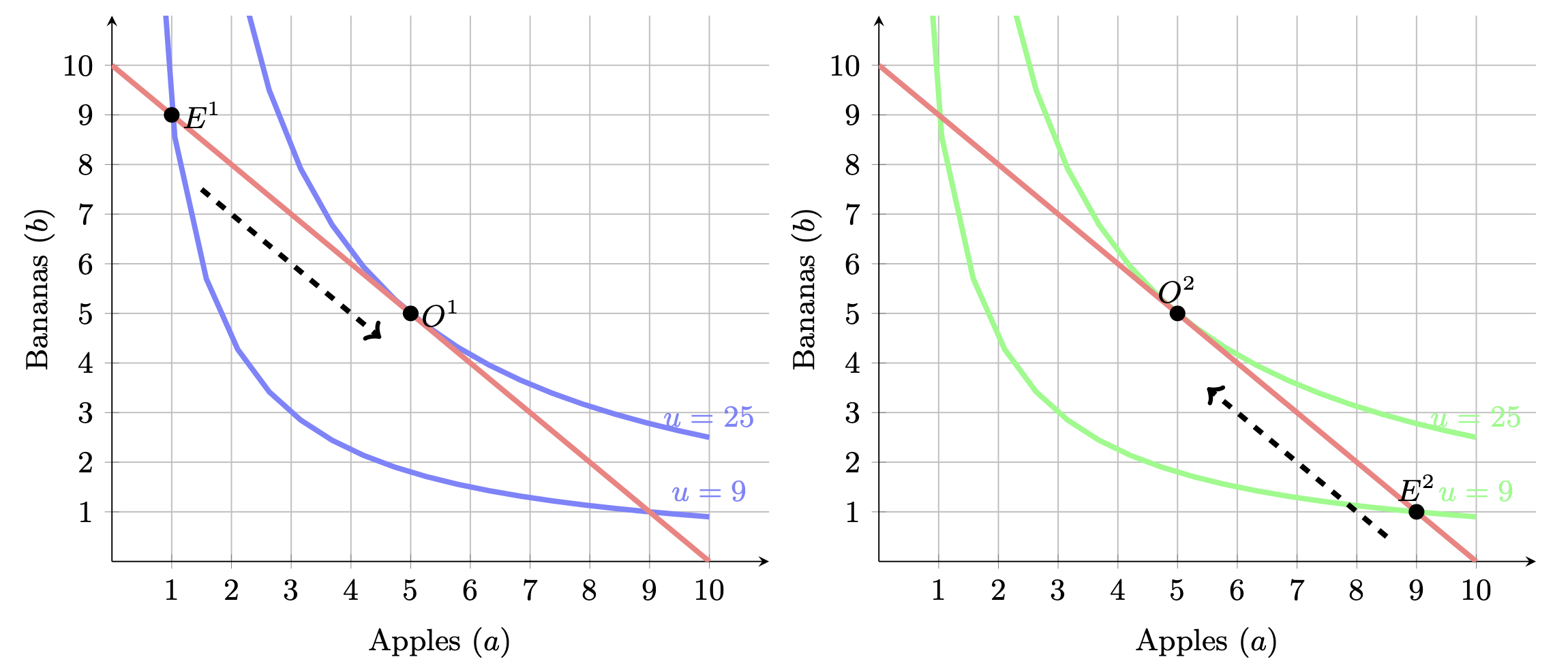

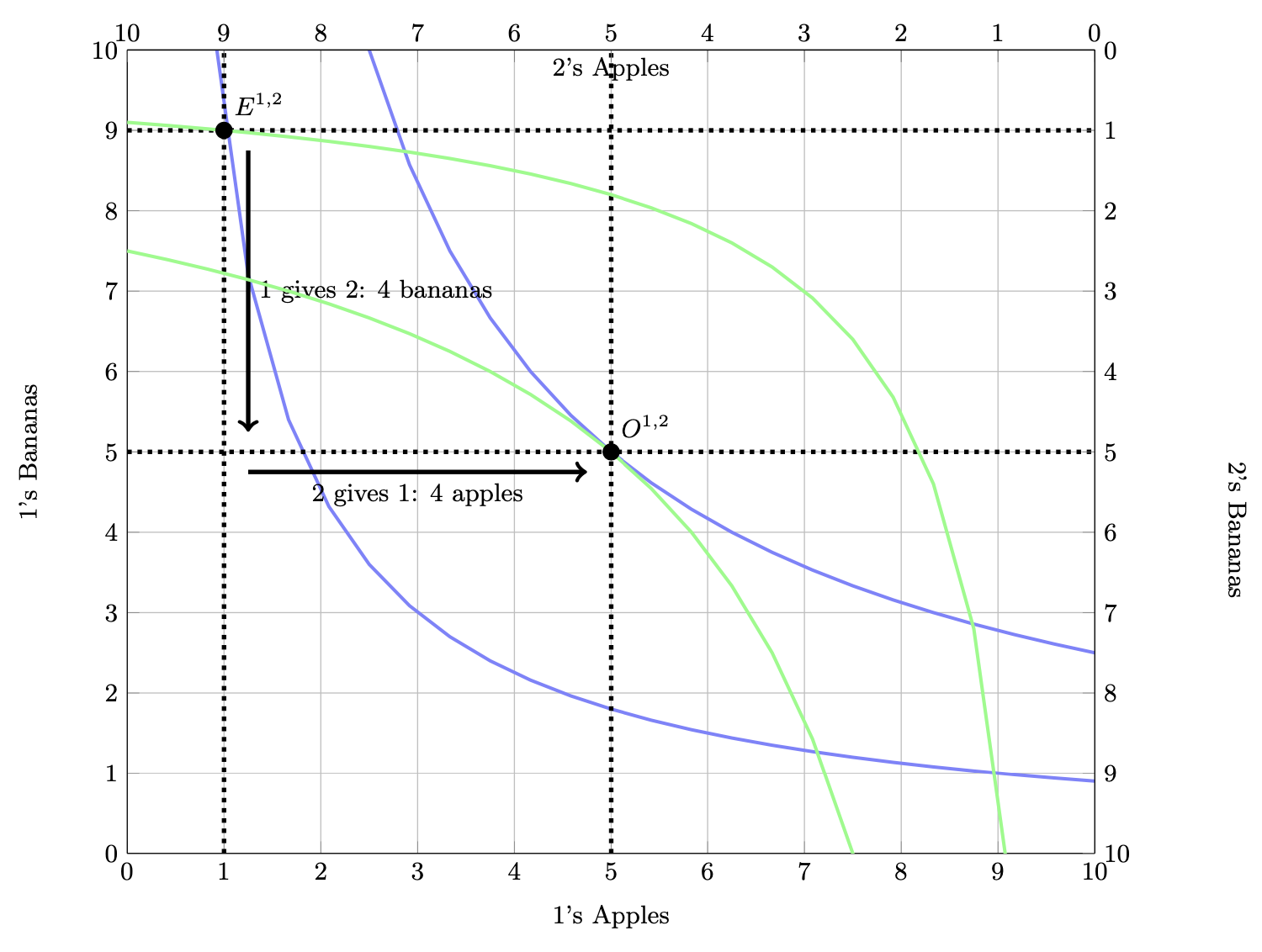

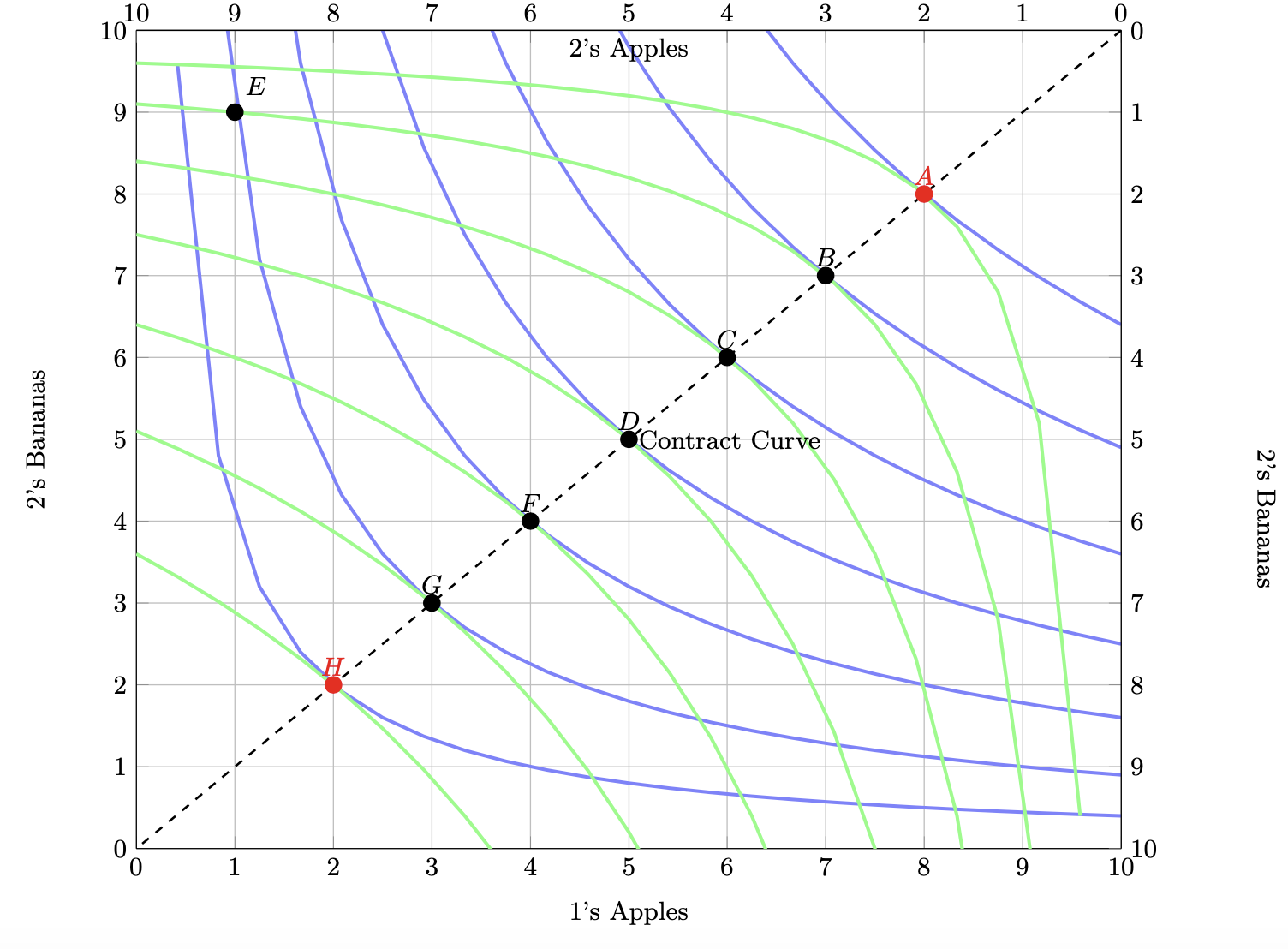

Indifference Curves

Person 1 starts with an endowment of 1 apple, 9 bananas, at \(E\)

Has subjective preferences, represented by indifference curve

We can conceive of a budget constraint based on market prices

Can trade in marketplace to reach higher indifference curve

- Reach \(O\)

Indifference Curves

But what is “the marketplace?” Other people with their own endowments!

Start with simple case of two people

Person 2’s endowment at \(E^2\) and indifference curves

Can trade in marketplace at market prices to reach higher indifference curve

- Reach \(O^2\)

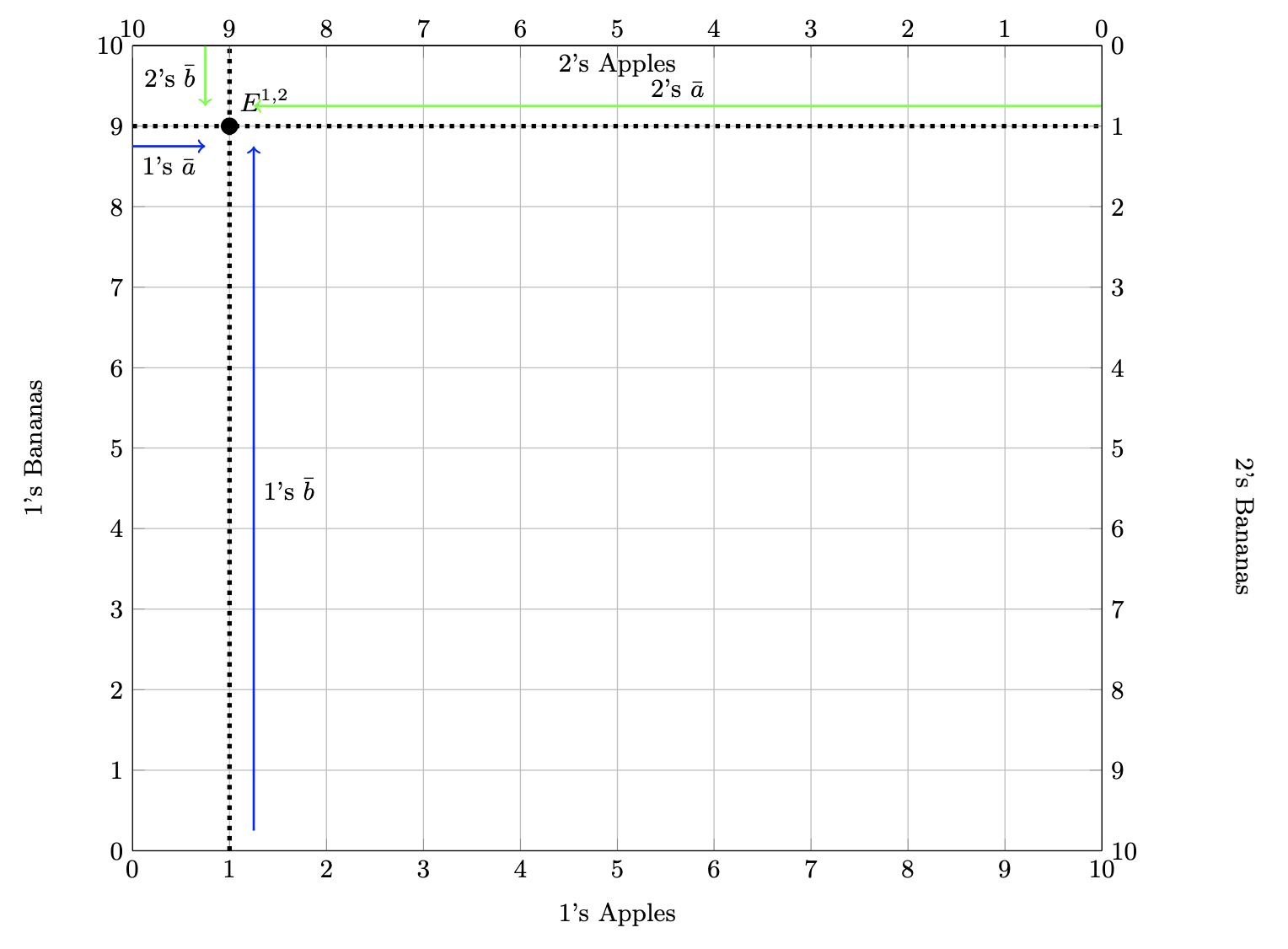

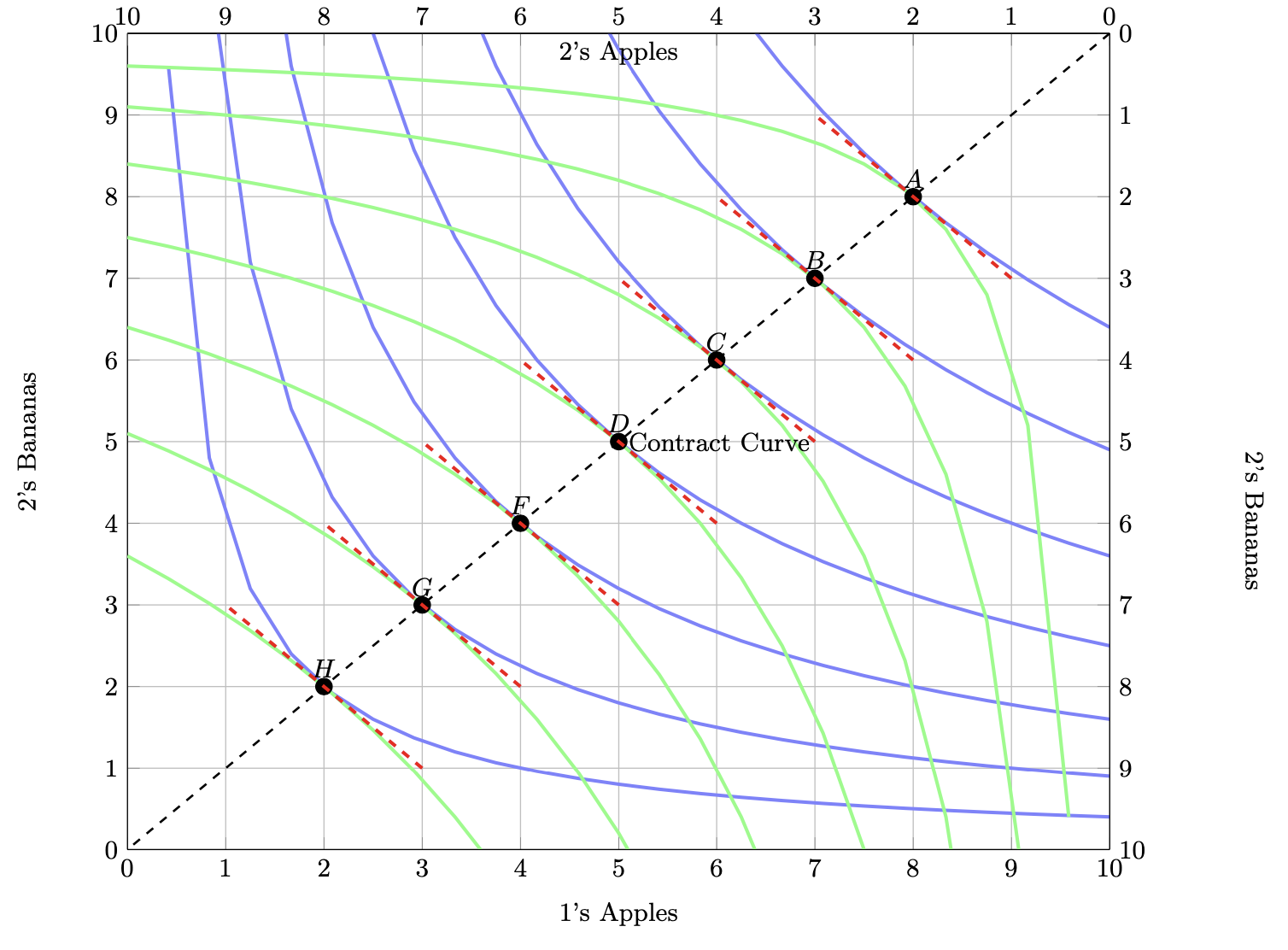

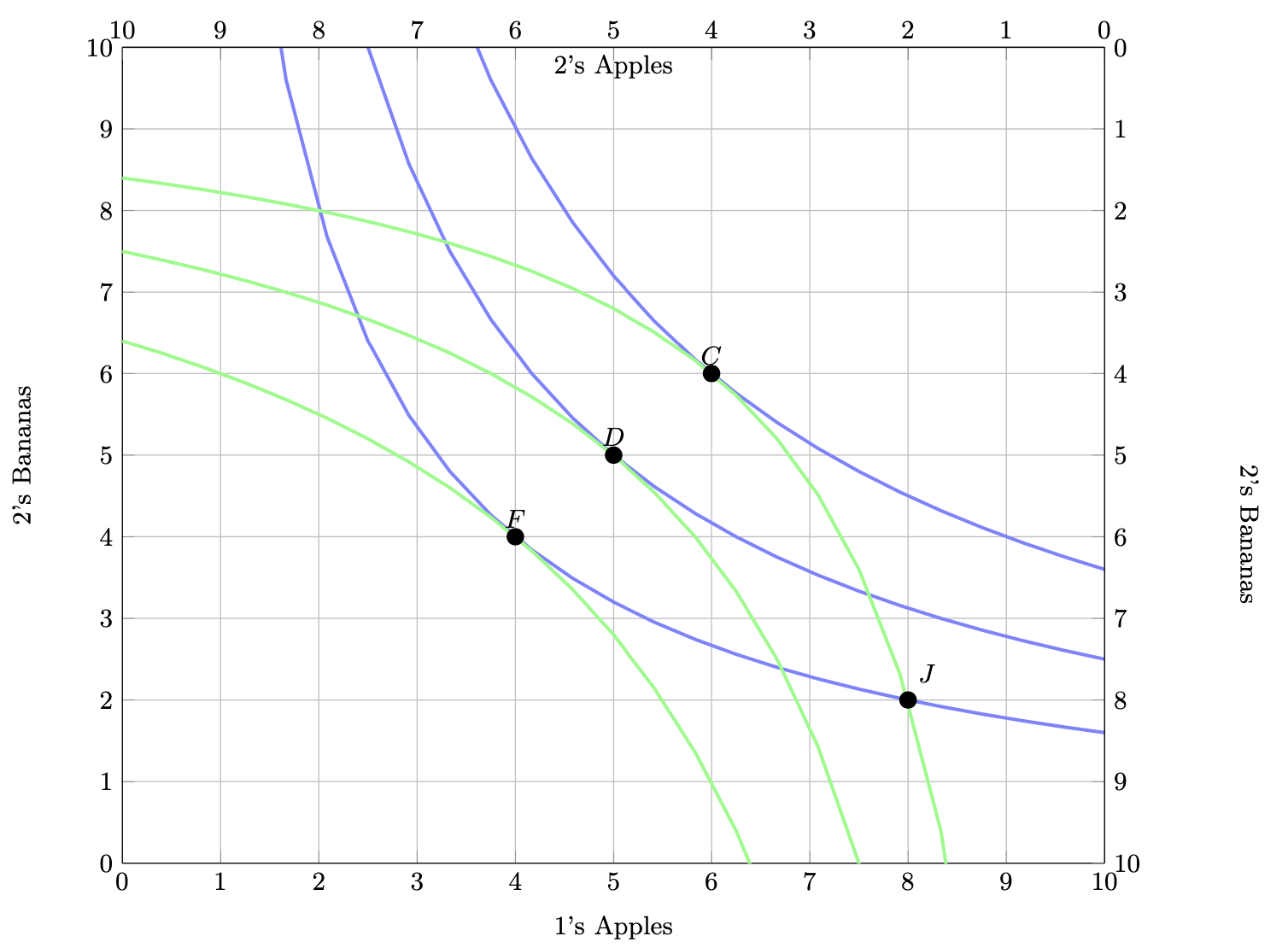

The Edgeworth Box

Now merely take Person 2’s indifference curves, rotate them, and superimpose them in the same graph as Person 1

What we now call the “Edgeworth Box”

- Again, Edgeworth described this and had some rudimentary drawing

- But it’s Pareto who actually draws this!

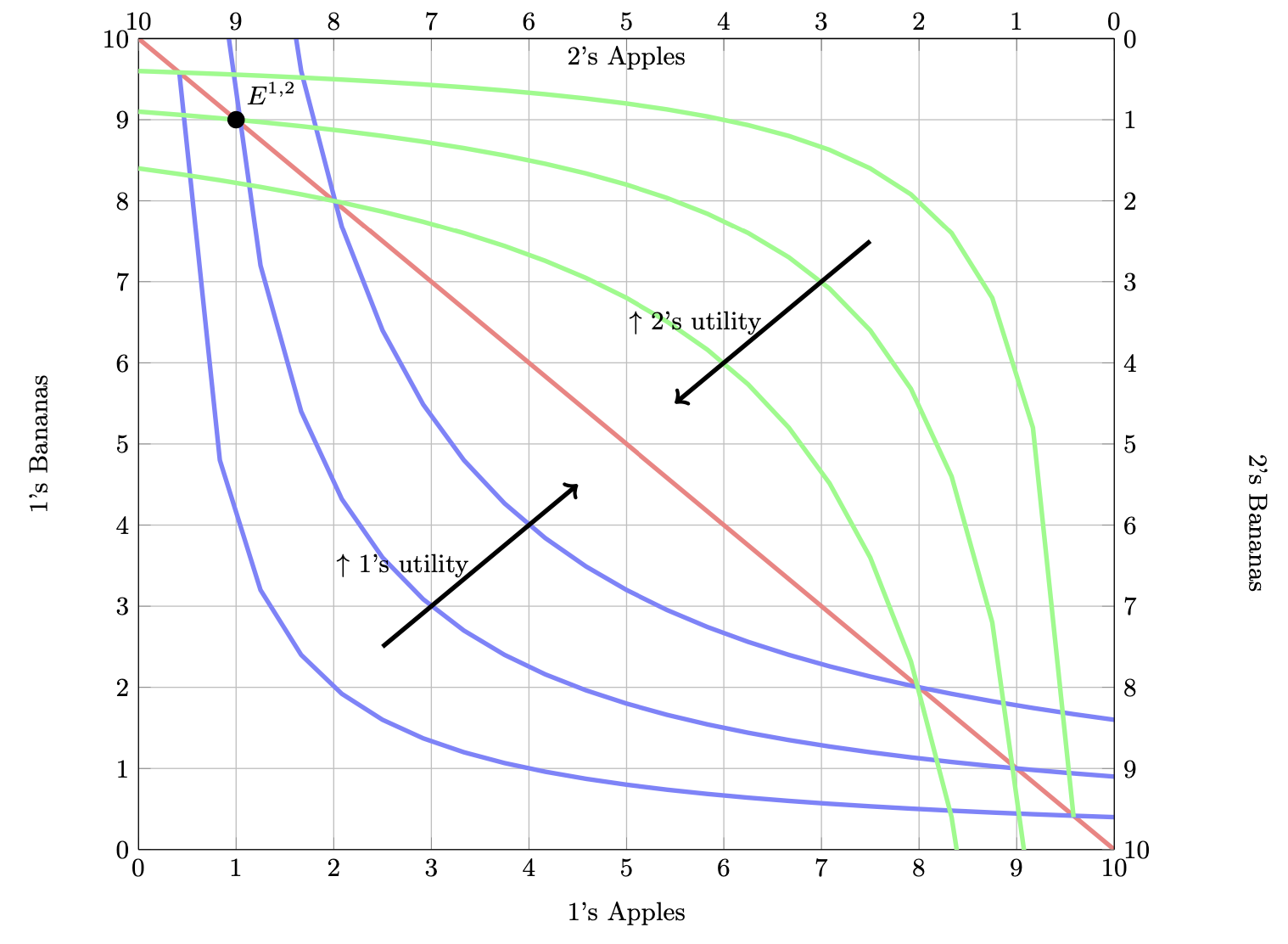

The Edgeworth Box

Movement to NE: improvements in person 1’s utility (more \(a\) and \(b)\)

Movement to SW: improvements in person 2’s utility (more \(a\) and \(b)\)

Both parties start with endowment at \(E^{1,2}\)

- Person 1: 1 apple, 9 bananas

- Person 2: 9 apples, 1 banana

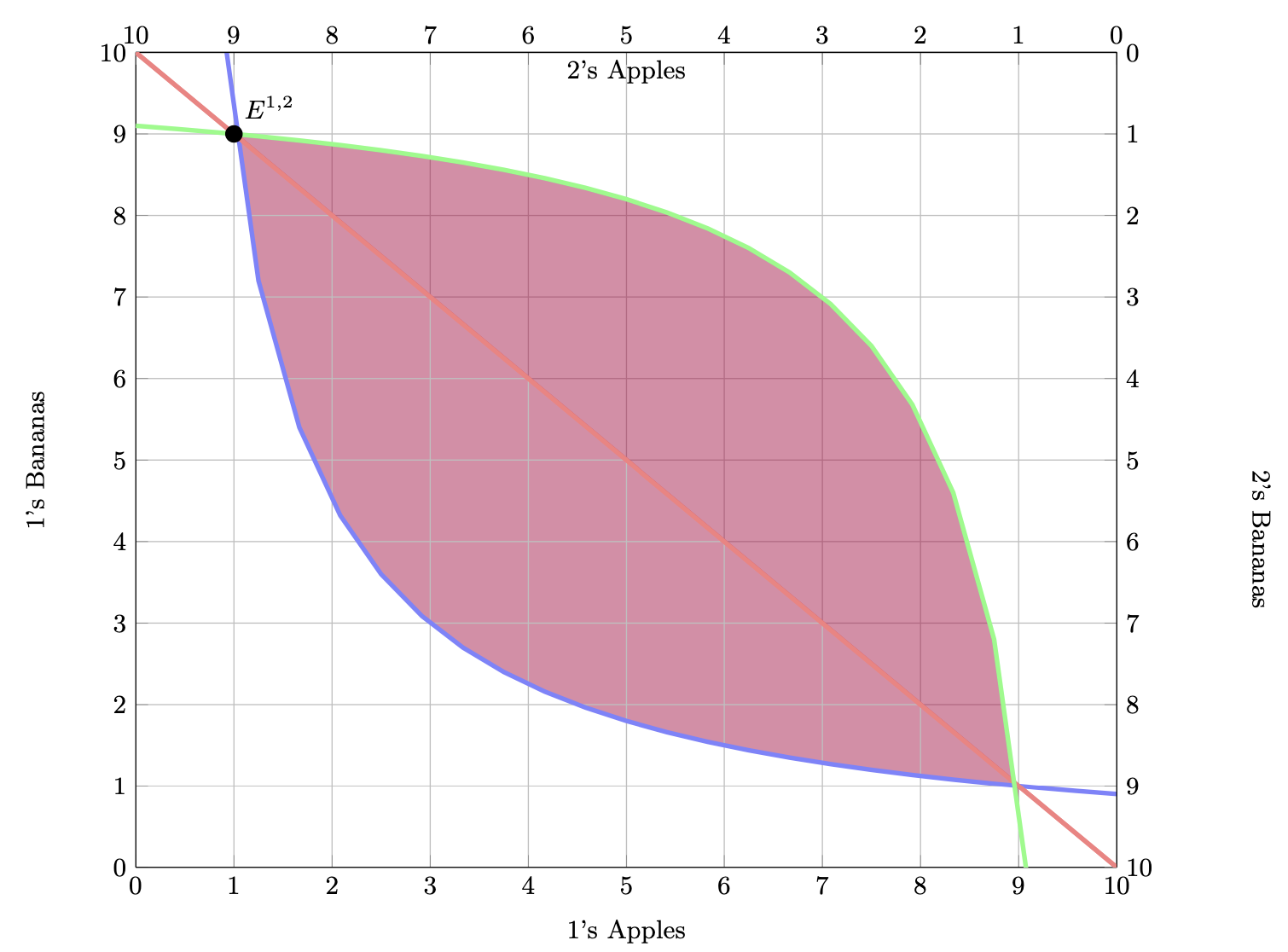

The Edgeworth Box

Both parties start with endowment at \(E^{1,2}\) on original indifference curves

- Person 1: 1 apple, 9 bananas

- Person 2: 9 apples, 1 banana

Gains from trade shown as the shaded area between initial indifference curves

- Person 1 and Person 2 can both be made better off (get on higher indifference curve) in this shaded area

The Edgeworth Box

Suppose both parties exchange at exchange rate of 1 apple for 1 banana

- Person 1 gives 4 apples

- Person 2 gives 4 bananas

Both people reach higher indifference curves at \(O^{1,2}\), from endowments \(E^{1,2}\)

- Person 1 now has 5 apples, 5 bananas

- Person 2 now has 5 apples, 5 bananas

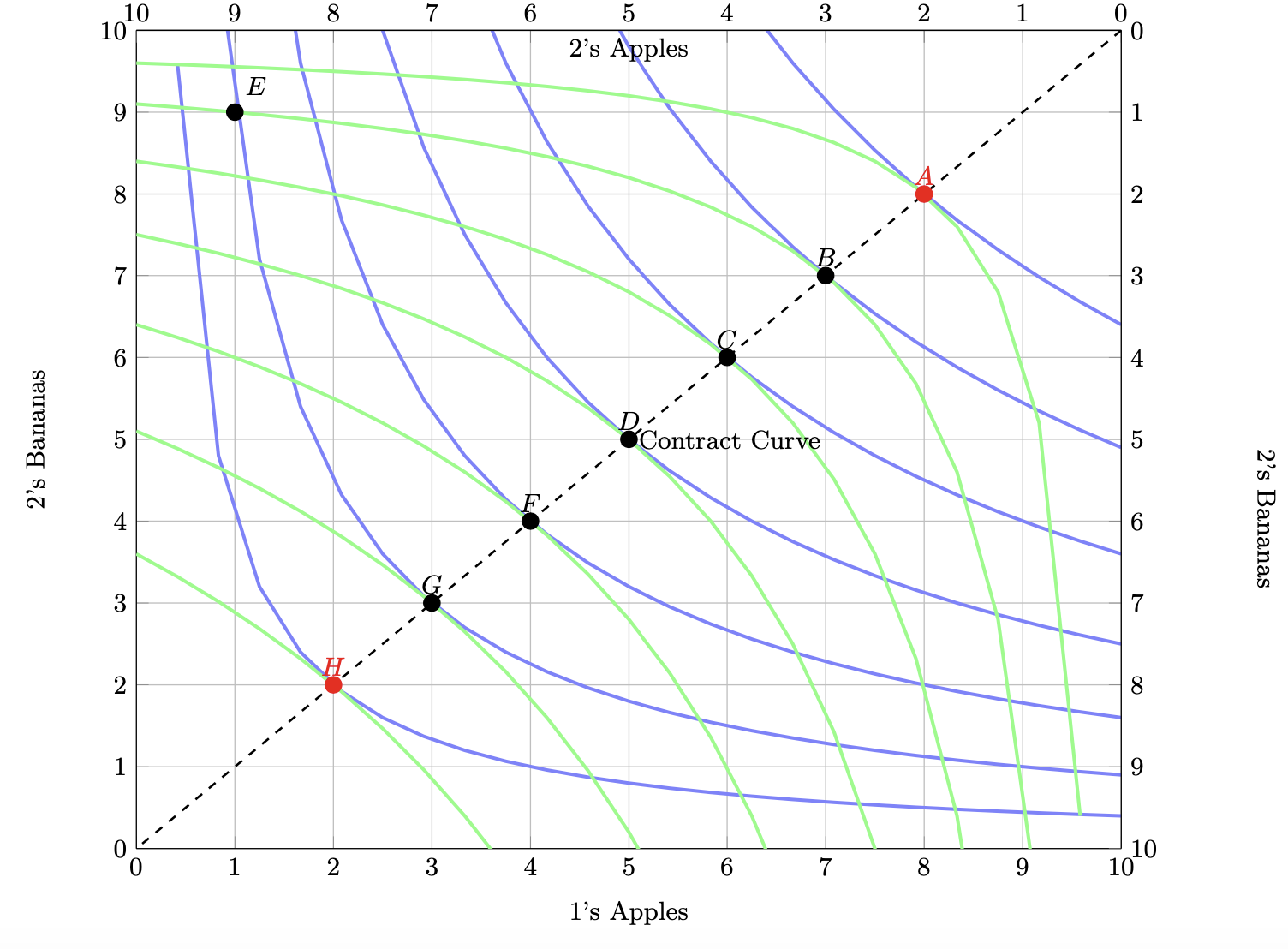

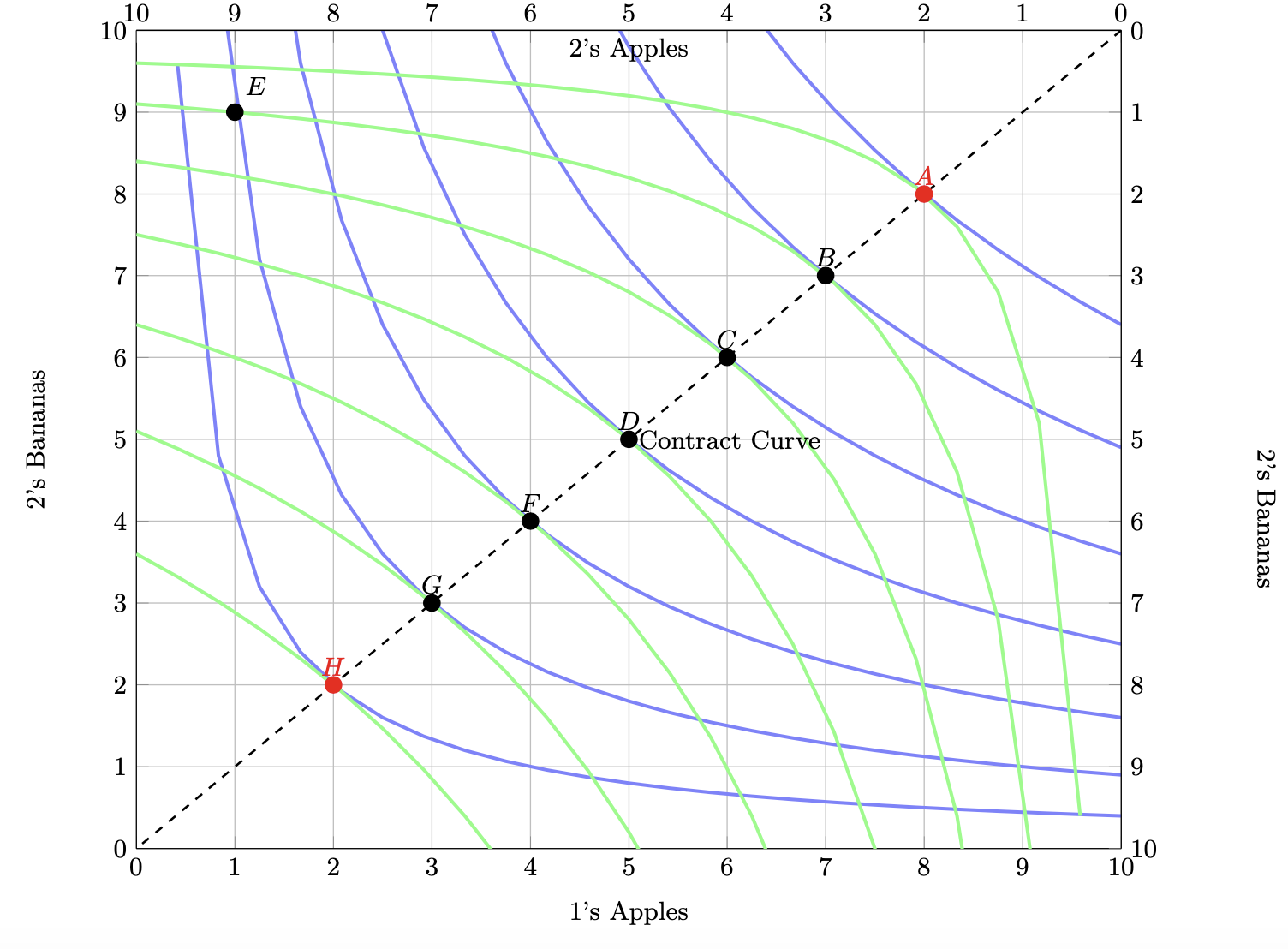

The Edgeworth Box

- But it turns out there are actually many possible exchanges from their endowment point \(E\) that could take place that make both parties better off!

- Points B, C, D, F, G

- This set of points is called (using Edgeworth’s term), the contract curve

The Edgeworth Box and Welfare Comparisons

Vilfredo Pareto

1848-1923

Pareto fiercely was against making interpersonal utility comparisons

To evaluate economic welfare of an individual from economic changes, Pareto only allowed comparisons where individuals are unambiguously better or worse off

To evaluate welfare for a society from economic changes, limit to the case where nobody is clearly worse off

The Edgeworth Box

- Pareto superior change (or a Pareto improvement) makes at least one party better off (reach higher indifference curve), and no party worse off (does not fall to lower indifference curve)

- From point E: points B, C, D, F, G

The Edgeworth Box

- Note, from point E, points A and H are Pareto inferior! Someone is made worse off

- Person 1 falls to lower indifference curve at H

- Person 2 falls to lower indifference curve at A

The Edgeworth Box

- Points on the contract curve are Pareto efficient (or Pareto optimal): there are no possible Pareto improvements!

- no reallocation of resources (exchange) that could be made that would make at least one party better off and no party worse off

The Edgeworth Box

- What is unique about points on the contract curve? All parties indifference curves are tangent to each other

- All parties’ indifference curves have the same slope

- All parties’ marginal rate of substitution are equalized (to the market-price ratio)!

- Market prices are determined by individual exchanges, and exchange equalizes everyone’s MRS!

The First Fundamental Welfare Theorem

Vilfredo Pareto

1848-1923

- Individual optimization \(\implies\) social optimization (the Invisible Hand!)

For any persons \(1\) and \(2\):

$$\underbrace{\frac{MU_x^1}{MU_y^1}}_{MRS_{x,y}^1}=\frac{p_x}{p_y}=\underbrace{\frac{MU_x^2}{MU_y^2}}_{MRS_{x,y}^2}$$

Thus, any Pareto efficient allocation is a market equilibrium (nobody would want to change)

The First Fundamental Welfare Theorem: all competitive market allocations are Pareto efficient

The First Fundamental Welfare Theorem

Vilfredo Pareto

1848-1923

- Pareto defines an increase in “opelimity” as a move onto a higher indifference curve

“We will say that the members of a collectivity enjoy a maximum of ophelimity at a certain position when it is impossible to move a small step away such that the ophelimity enjoyed by each individual in the collectivity increases, or such that it diminishes. That is to say that any small step is bound to increase the ophelimity of some individuals while diminishing that of others.”

“For phenomena of type I [perfect competition], when equilibrium takes place at a point of tangency of indifference curves, the members of the collectivity enjoy a maximum of ophelimity.”

The Second Fundamental Welfare Theorem

Recall that the set of possible Pareto efficient outcomes (the contract curve) depends on the endowments individuals start with

If instead of point \(E\), we start with endowment at point \(J\):

- Person 1 has 8 apples, 2 bananas

- Person 2 has 2 apples, 8 bananas

Then there is a different range of outcomes that are Pareto efficient

The Second Fundamental Welfare Theorem

Vilfredo Pareto

1848-1923

The Second Fundamental Welfare Theorem: any particular Pareto efficient allocation can be achieved by starting from a particular endowment, and then allowing competitive markets

- if, for example, you care about (in)equality of outcomes

Implies an initial, targetted, redistribution of resources can lead to an efficient outcome by then leaving markets alone to operate afterward

- Economists are against interventions that distort prices

- Economists are for initial reallocations (tax & transfer of resources) that then leave markets alone

Enrico Barone

Enrico Barone

1859-1924

Suggested that all changes in individual welfare could be expressed as the amount of real income an individual is willing to pay or willing to recieve to return them to their original endowment

- The willingness to pay criterion

Also showed that the marginal conditions work for production, and introduced idea of production possibilities frontier, and showed Pareto’s approach works as well

See today’s reading page for a great summary by Blaug on the marginal conditions for equilibrium

So Can Socialist Central Planning Do This Instead?

Vilfredo Pareto

1848-1923

“Consider a collectivist society which seeks to maximise the ophelimity of its members. The problem divides into two parts. Firstly we have a problem of distribution: how should the goods within a society be shared between its members? And secondly, how should production be organised so that, when goods are so distributed, the members of society obtain the maximum ophelimity?”

His answer is an informal precursor of the second welfare theorem:

“Having distributed goods according to the answer to the first problem, the state should allow the members of the collectivity to operate a second distribution, or operate it itself, in either case making sure that it is performed in conformity with the workings of free competition.”

Pareto, Vilfredo, 1906/1909 Manual of Political Economy

A.C. Pigou, Externalities, & Marshallian Welfare Economics

A.C. Pigou

A.C. Pigou

1877-1959

Student of Marshall, took over his Chair of Political Economy at Cambridge

1920, The Economics of Welfare

Principle of "payment in accordance with product"

People should pay average externality of their actions

- Markets generally do this automatically

- If markets fail, policy can force the market to work again

Problem with externality is that there is a missing price!

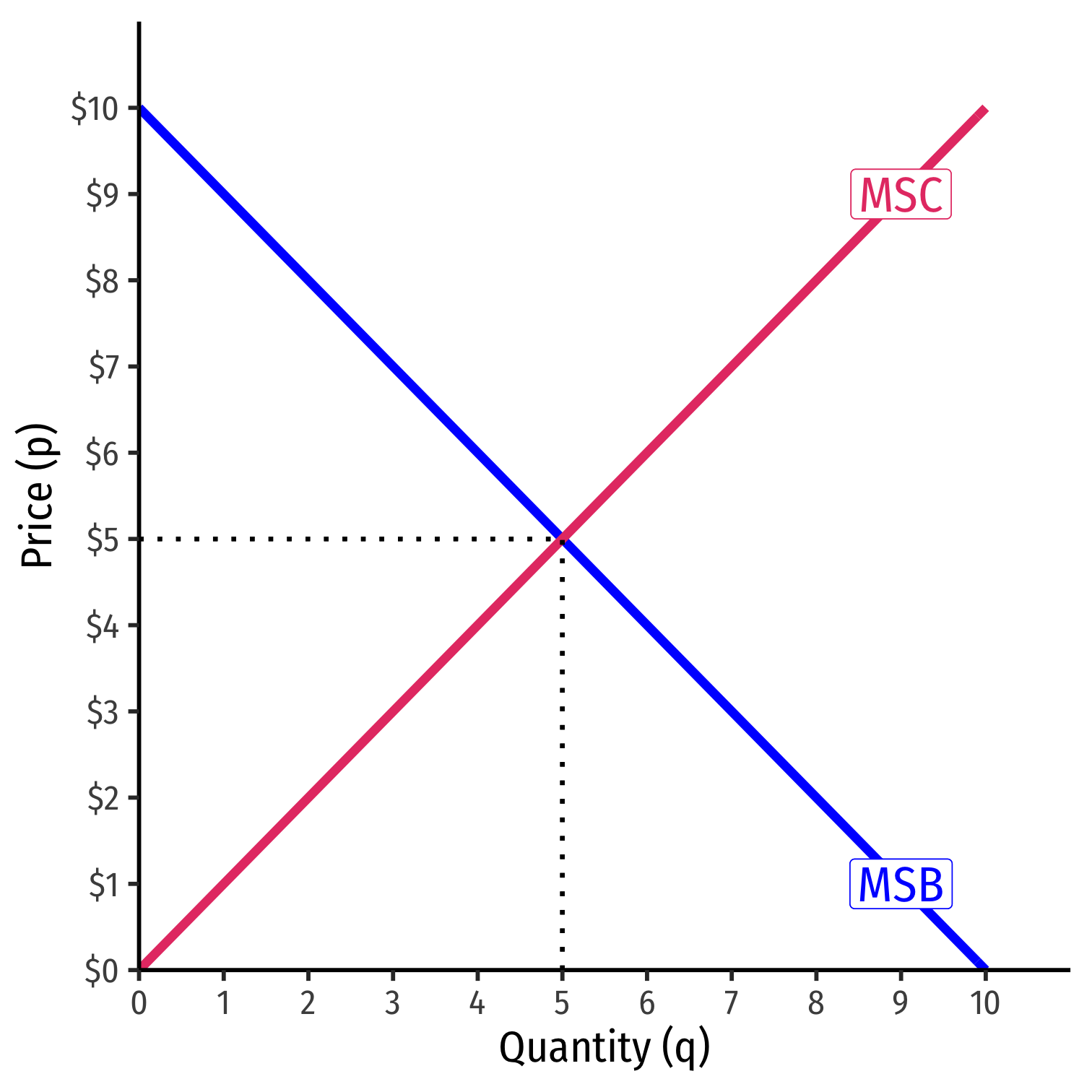

Supply and Demand: Social Costs & Benefits

Demand: marginal social benefit (MSB)

- value to consumers of consuming output

Supply: marginal social cost (MSC)

- opportunity cost of pulling resources out of other uses

Equilibrium: \(MSB=MSC\)

- using resources efficiently, no better alternative uses

Supply and Demand: Social Costs & Benefits

Price system mitigates costs and benefits of people's actions

People using scarce resources must account for consequences:

- Pay to pull scarce resources out of other uses in society

- Compensated for producing something valuable for others

Externality

Externality: an action that incurs a cost or a benefit not compensated via prices

Often interpretted as an action that affects (benefits or harms) a third party not privy to the action

Externality

The real problem is that it is external to the price system!

People base decisions off of their preferences and opportunity costs of resources for society (captured in prices)

Prices properly negotiate the opportunity costs and provide information to people

But without price, decisions do not internalize those effects!

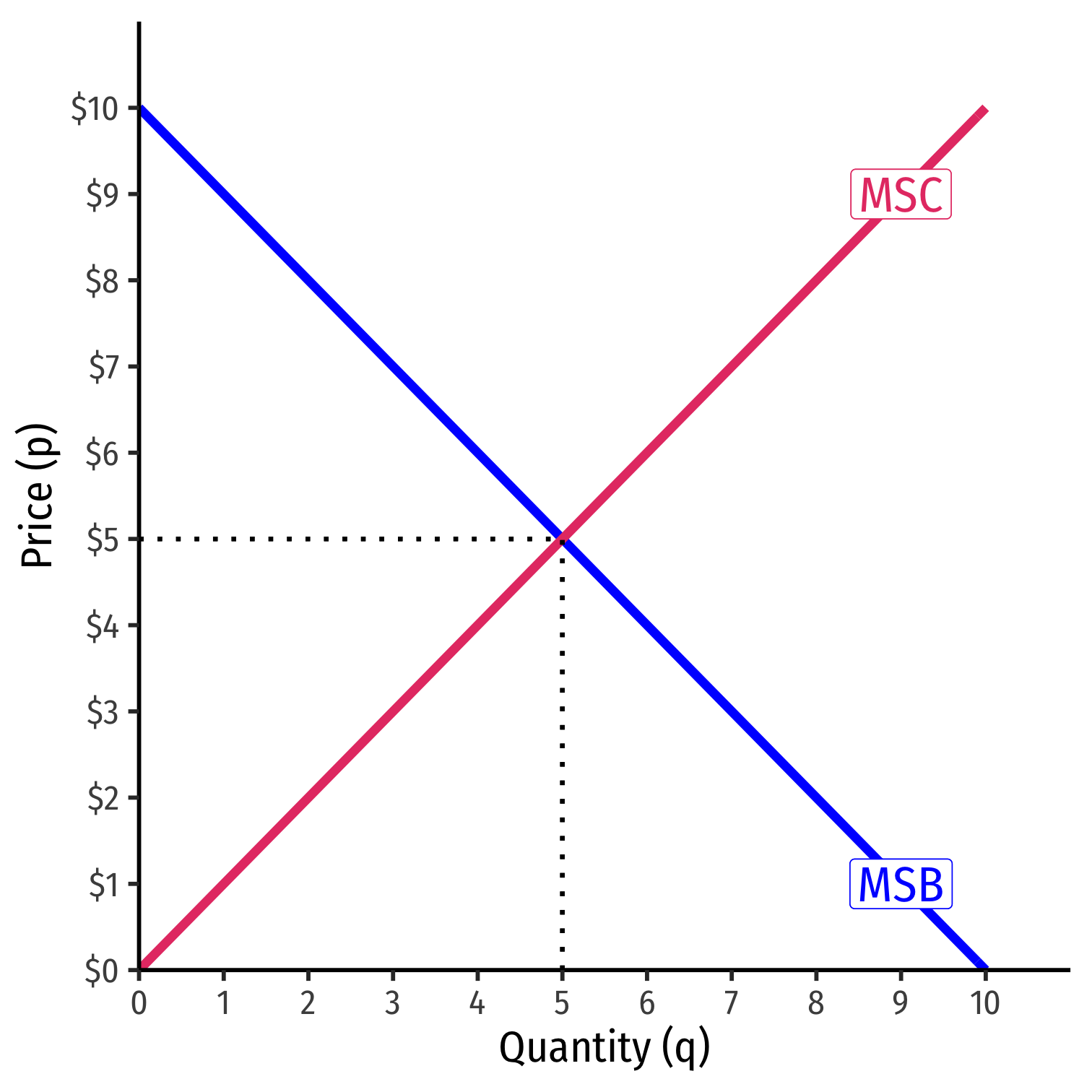

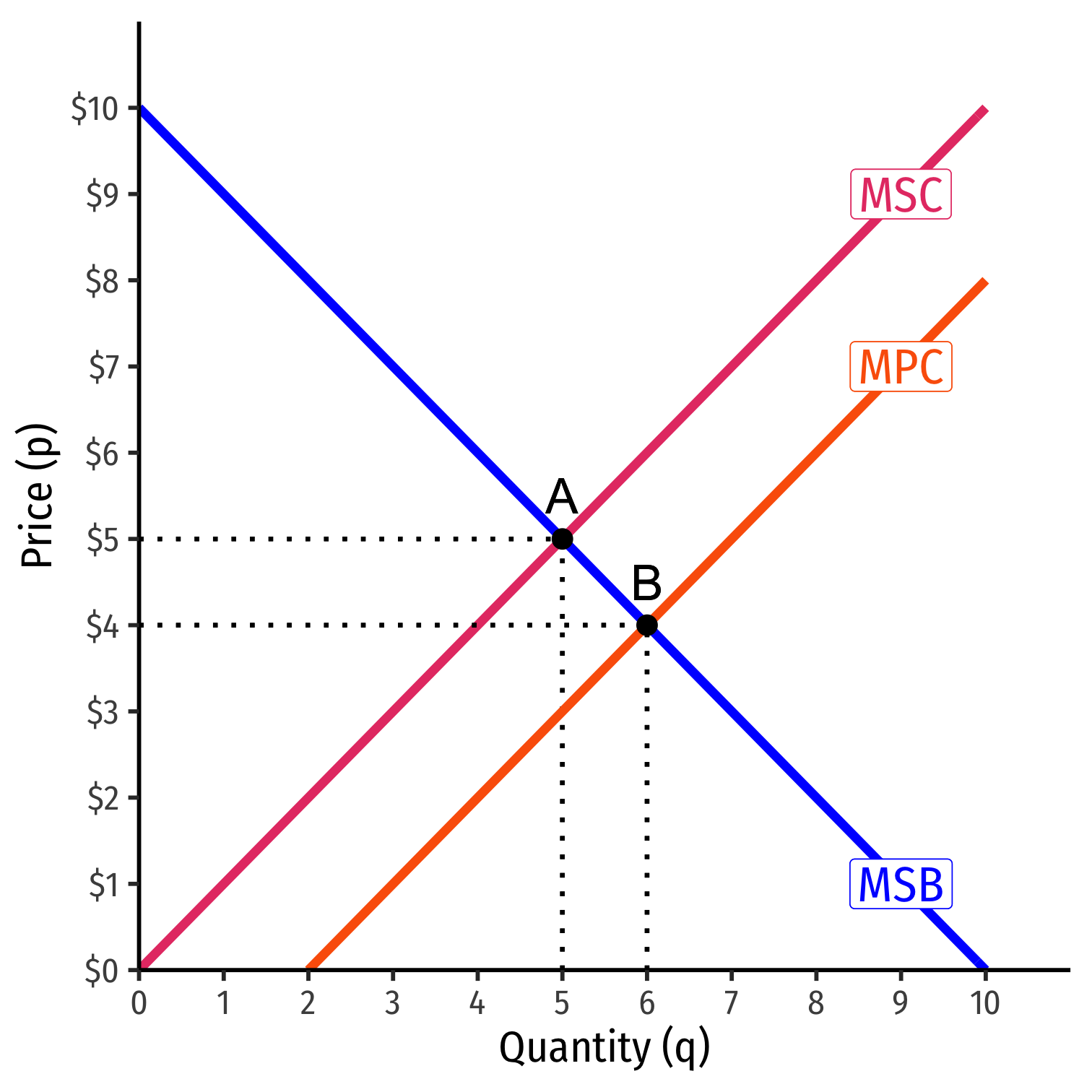

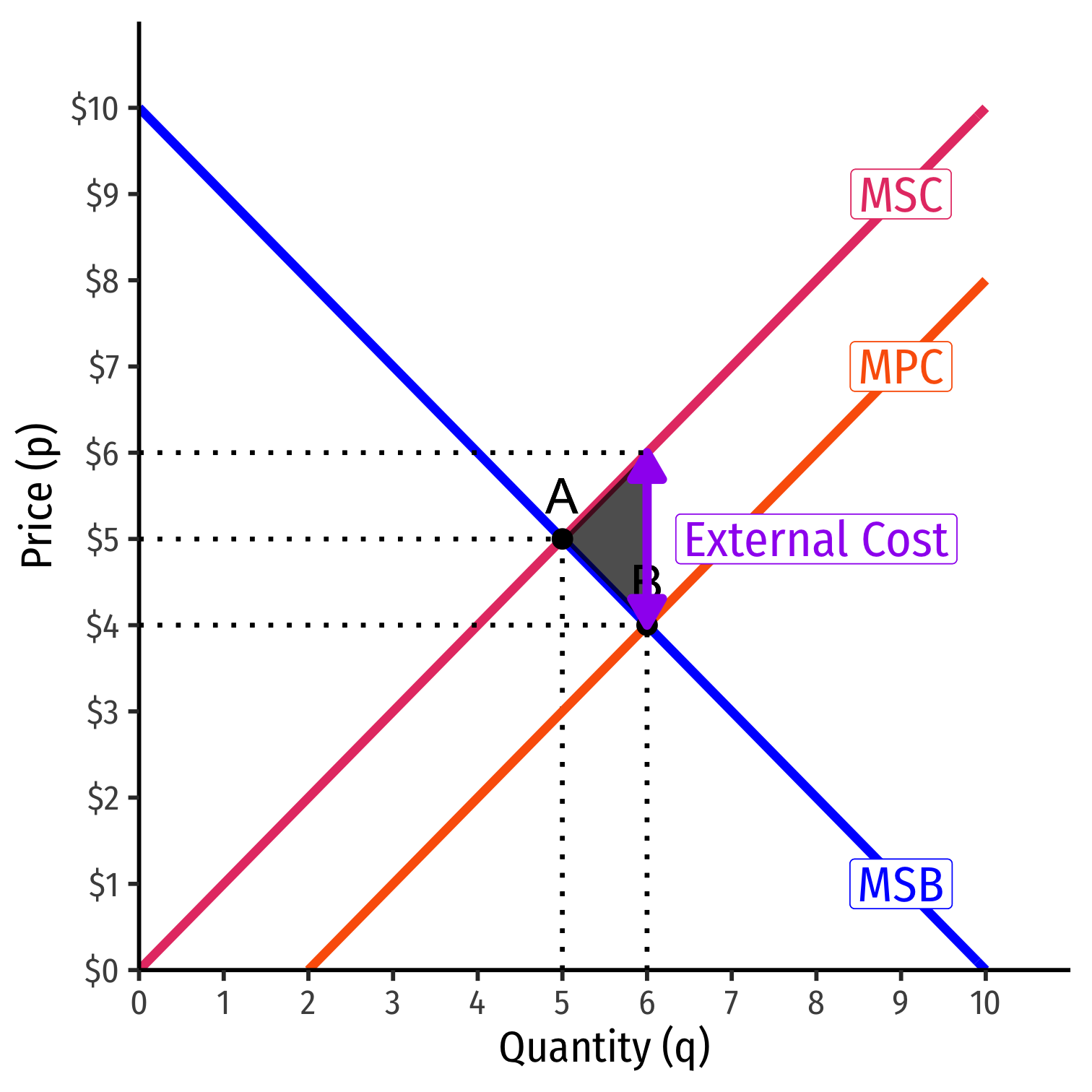

Negative Externality

Marginal Private Cost to producer is less than Marginal Social Cost to society

Market Equilibrium (B) too much \(q\) at too low \(p\) compared to Social Optimum (A)

Negative Externality

Marginal Private Cost to producer is less than Marginal Social Cost to society

Market Equilibrium (B) too much \(q\) at too low \(p\) compared to Social Optimum (A)

- Overproduction due to external cost

Negative Externality

Marginal Private Cost to producer is less than Marginal Social Cost to society

Market Equilibrium (B) too much \(q\) at too low \(p\) compared to Social Optimum (A)

Overproduction due to external cost

A deadweight loss from overproduction

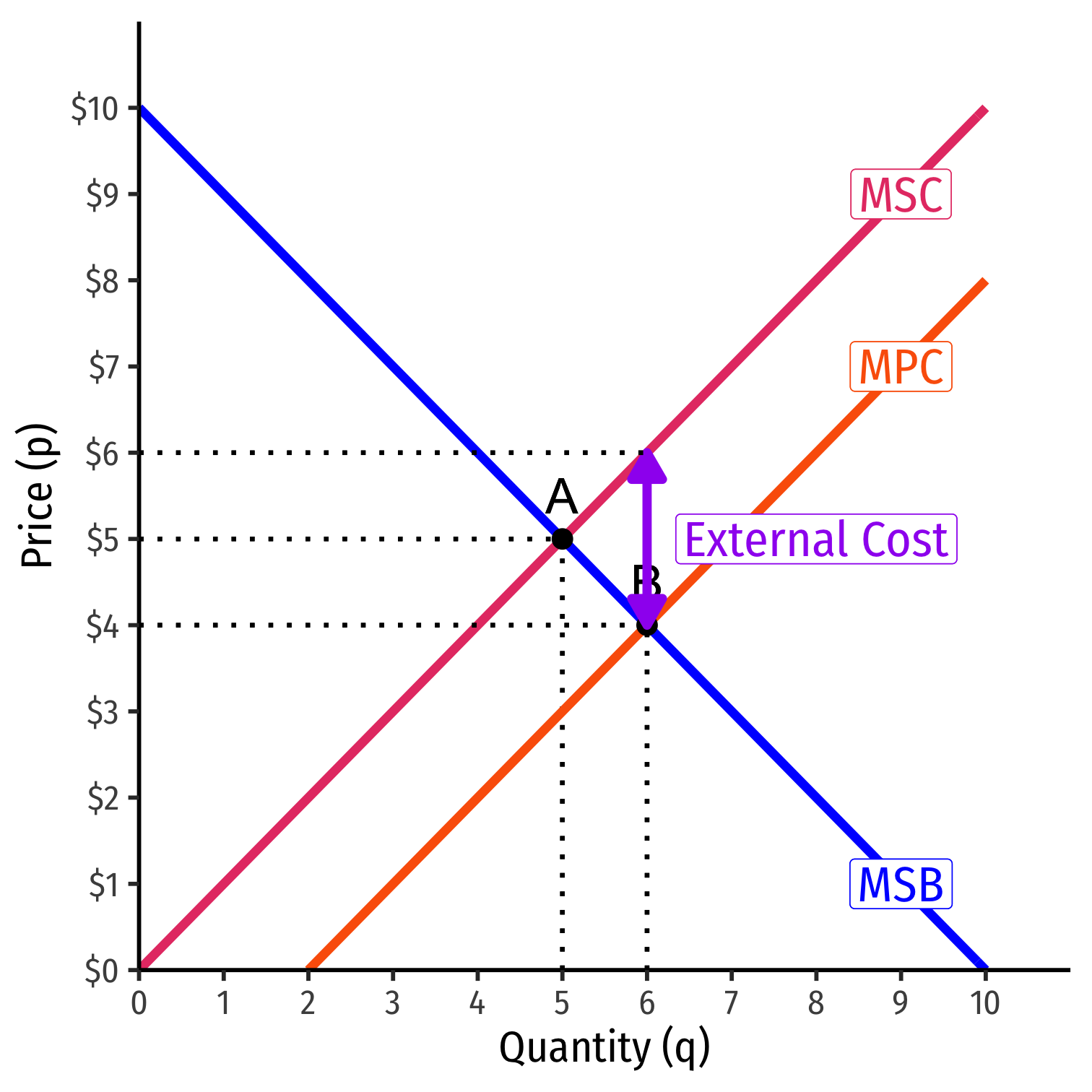

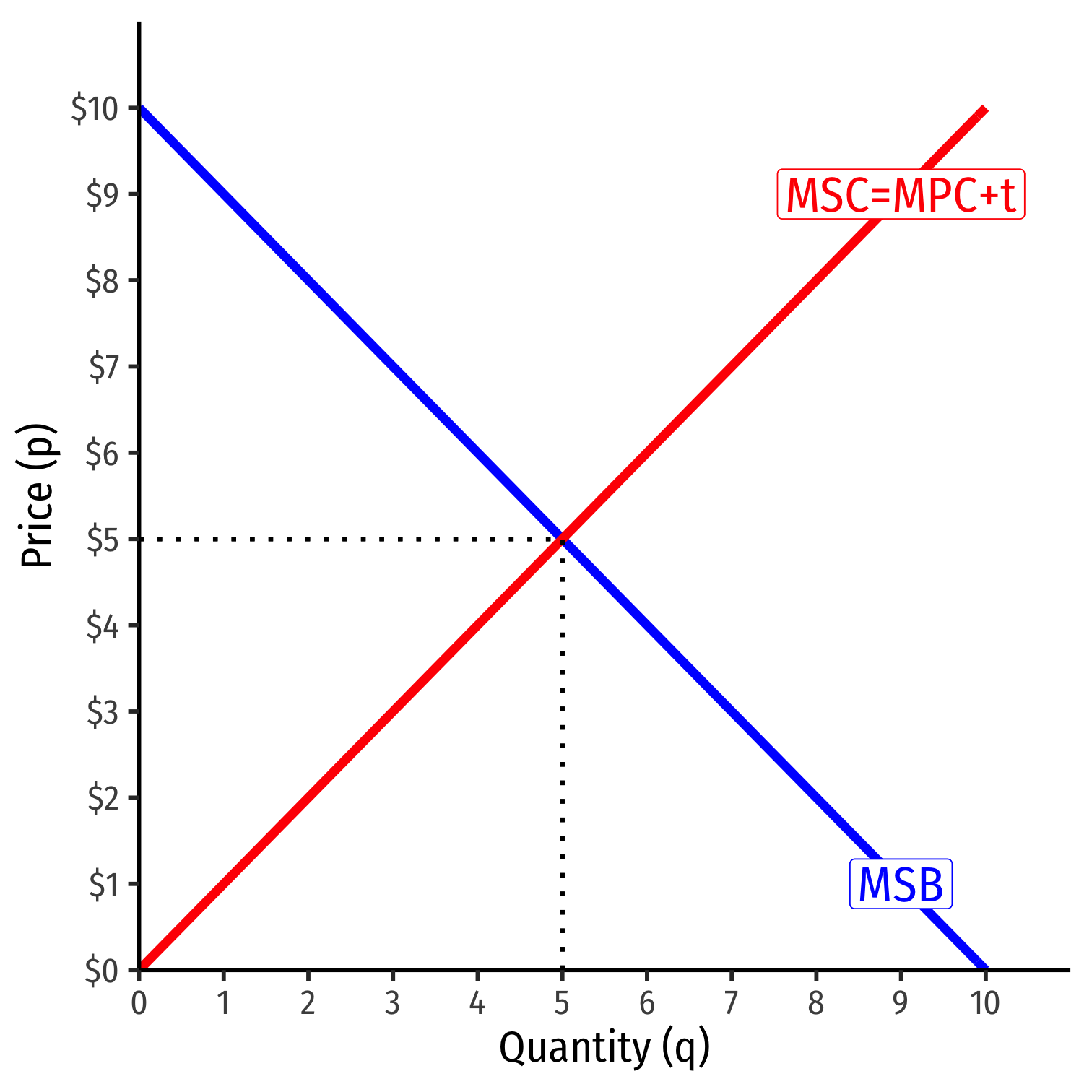

Negative Externality: Pigouvian Solution

A.C. Pigou

1877-1959

Policy solutions to externalities should focus on the missing price

- Narrowly tailor policy to create or modify price

"Pigouvian" tax or subsidy

Negative Externality: Pigouvian Solution

Set a specific tax $$t = MSC-MPC$$

Eliminates the DWL

Internalizes the externality into the price system

Producers (and consumers) now consider the true cost to society

- \(MPC\) (with tax) \(=MSC\)