4.5 — Modern Macroeconomics

ECON 452 • History of Economic Thought • Fall 2020

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/thoughtF20

thoughtF20.classes.ryansafner.com

Hayek and Austrian Business Cycle Theory

Hayek and Austrian Business Cycle Theory

Friedrich August von Hayek

1899-1992

Economics Nobel 1974

Hayek came to LSE during this time, hired by Lionel Robbins

Became the major competing theory of the business cycle and macroeconomics to Keynes in 1930s

Focus on capital theory, building off of Mises’ theory of money and credit & Wicksell’s theory of the natural rate of interest

Revival of Austrian Business Cycle Theory (and Keynesian theory) as possible explanation of 2008-2009 financial crisis

1931 Prices and Production

1941 The Pure Theory of Capital

Hayek and Austrian Business Cycle Theory

Friedrich August von Hayek

1899-1992

Economics Nobel 1974

“Mr. Keynes’ aggregates conceal the most fundamental mechanisms of change.”

“Mr. Keynes’ assertion that there is no automatic mechanism in the economic system to keep the rate of saving and the rate of investing equal might with equal justification be extended to the more general contention that there is no automatic mechanism in the economic system to adapt production to any shift in demand. I begin to wonder whether Mr. Keynes has ever reflected upon the function of the rate of interest...”

Hayek, F. A., 1931, Prices and Production

Hayek and Austrian Business Cycle Theory

Friedrich August von Hayek

1899-1992

Economics Nobel 1974

Focuses on the role of interest rates as prices that coordinate capital investment over time

- Higher interest rates discourage longer term, riskier projects

- Lower interest rates encourage longer term, riskier projects

Recall, interest rates are determined by the supply (time preference of savers) and demand of loanable funds

Hayek’s work is a little abstract and difficult to follow, better interpretted by some modern Austrians

- Garrison, Roger, 2000, Capital-Based Macroeconomics

Hayek and Austrian Business Cycle Theory

Friedrich August von Hayek

1899-1992

Economics Nobel 1974

“Before we can even ask how things might go wrong, we must first explain how they could ever go right.”

Hayek, F.A., 1948, “Economics and Knowledge” in Individualism and Economic Order

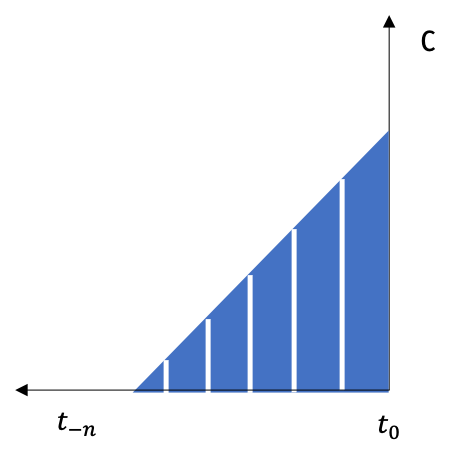

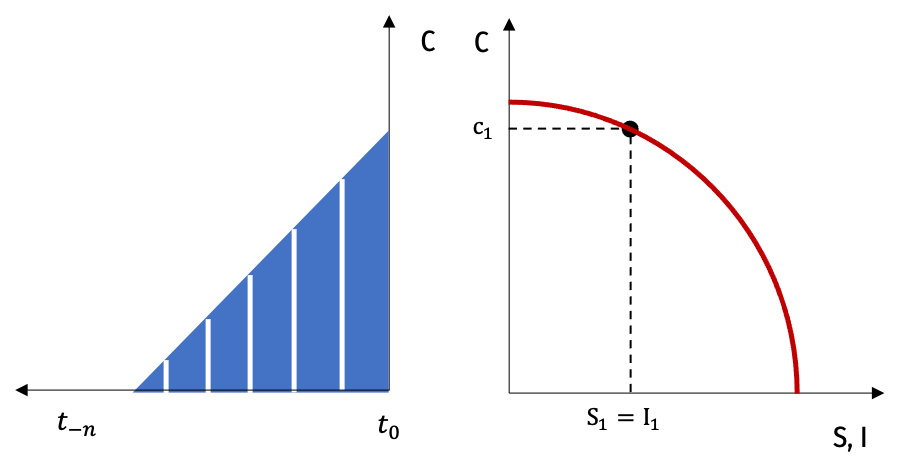

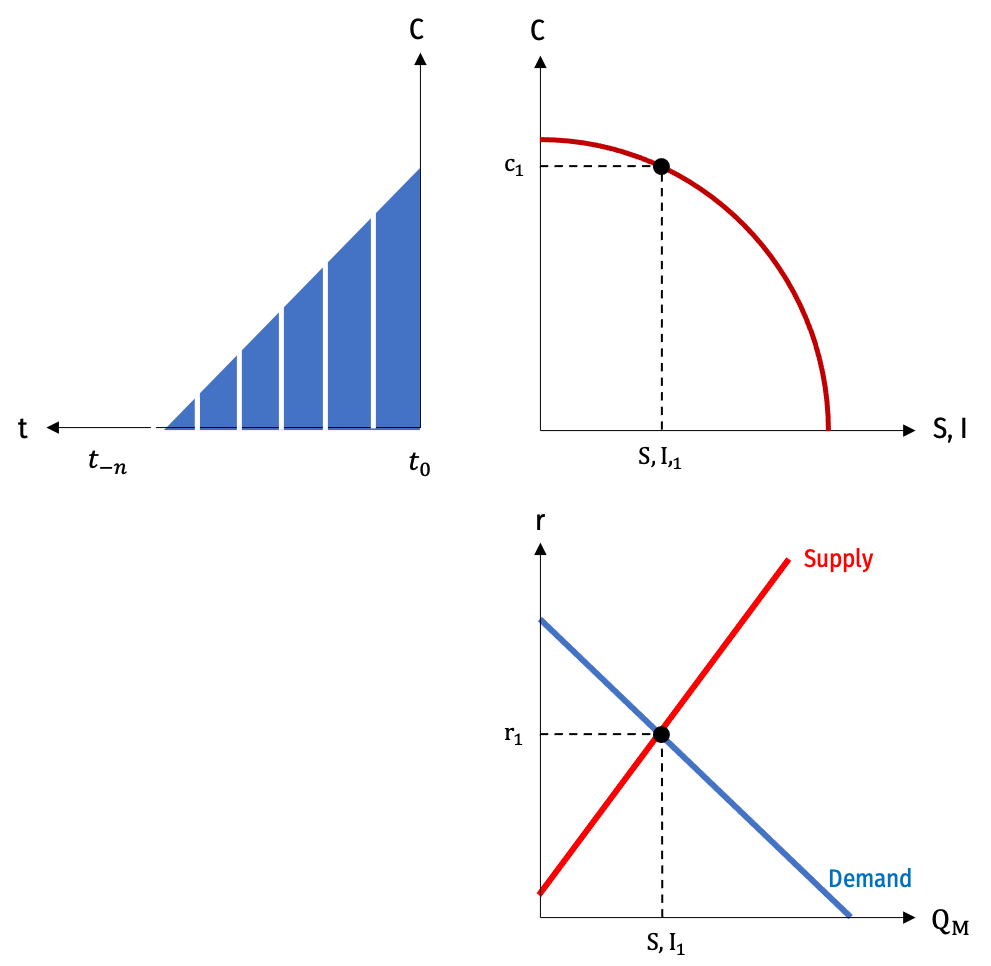

Structure of Production

- Take Menger’s idea of higher-order goods and arrange an analytical “structure of production” through time

Theory of Capital

Capital is heterogeneous — not one identical aggregate “blob” K, but a variety of goods

- e.g. beer barrels, blast furnaces, computers, trucks, hammers, etc

Capital is specific to particular uses and not others, with a cost of switching uses

- e.g. can’t turn a pencil factory into a tank factory

Capital is complementary to other goods that must be fit together into a single plan

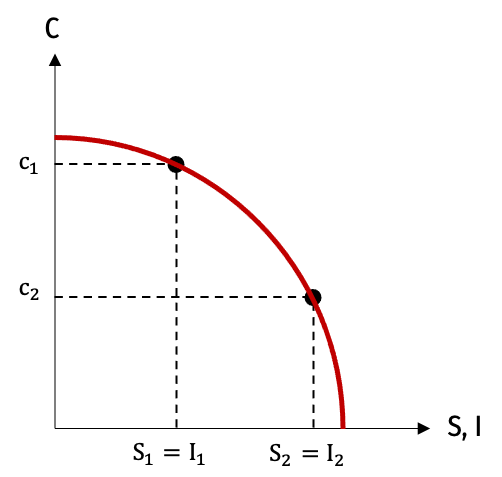

Time Preferences

- Time-preference: make tradeoff between present consumption and saving/investment (in hopes of higher future consumption)

- Decrease in time preference: (I,S1,c1)→(I,S2,c2)

- Increase in time preference: (I,S1,c1)←(I,S2,c2)

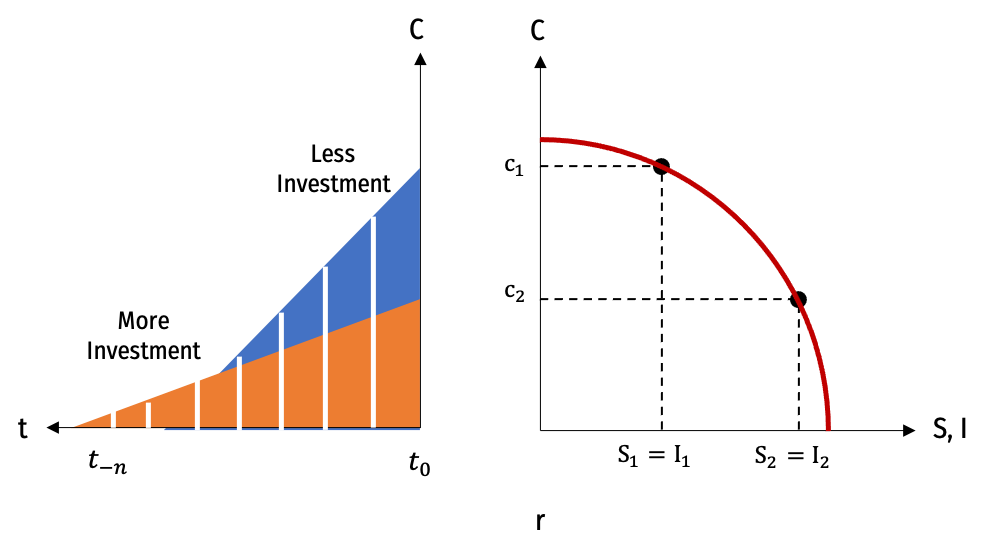

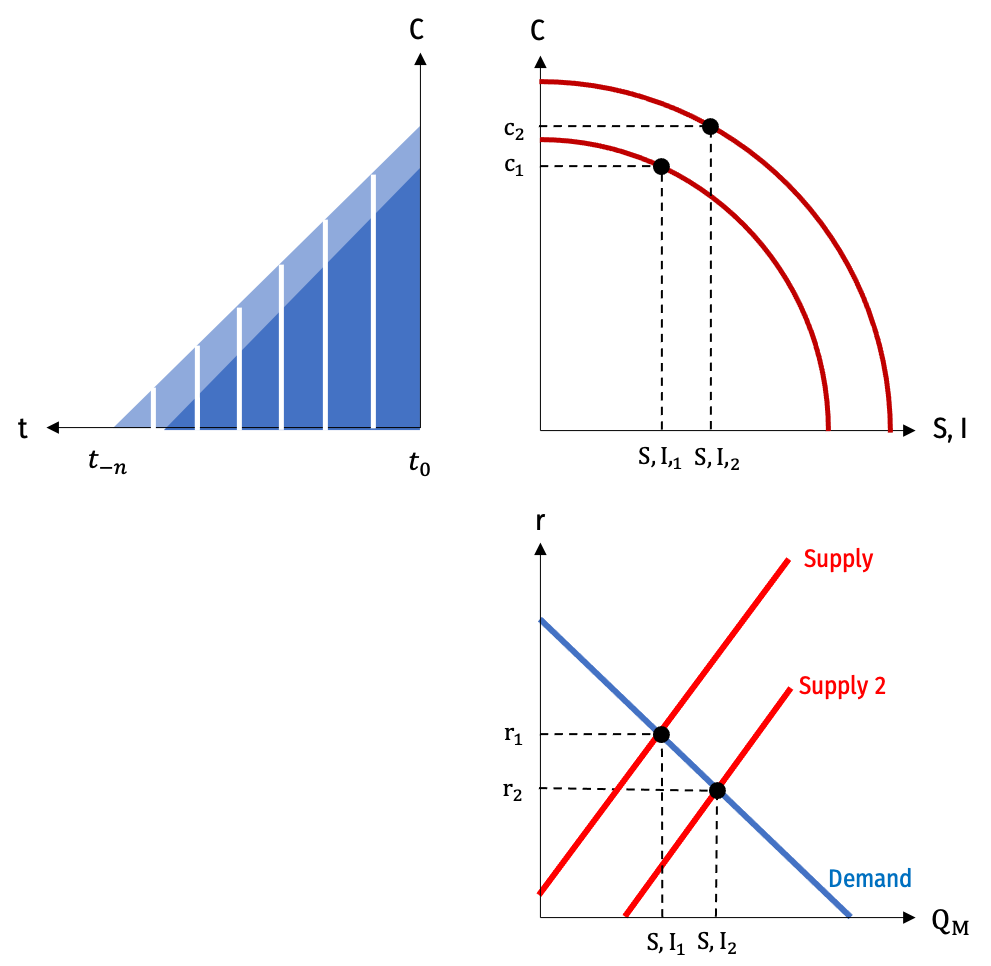

Time Preferences and the Structure of Production

- Structure of production determined by time preferences

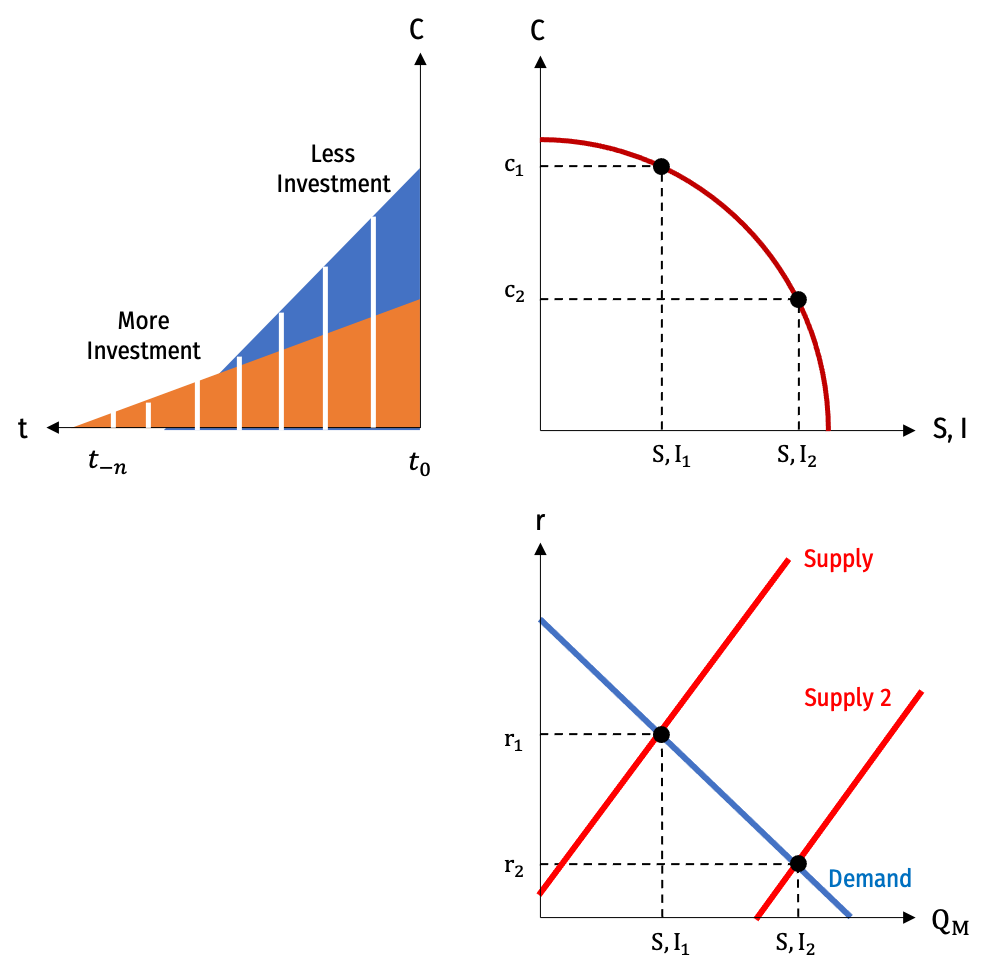

Time Preferences and the Structure of Production

Structure of production determined by time preferences

Decrease in time preferences (more investment, less consumption)

- Decreases investment in 1st-order consumption goods

- Increases investment in earlier, higher-order goods

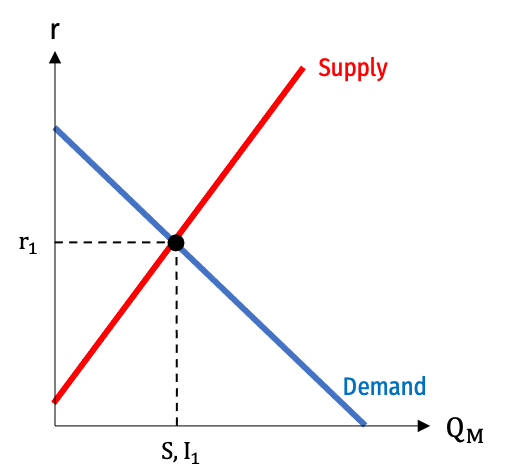

Market for Loanable Funds

- Market for loanable funds

- Supply of savings

- Demand to borrow

- determines market interest rate r

Decrease in Time Preferences

Decrease in time preference

Increases supply of savings

Lowers interest rates

Increases investment in long-term projects, decreases investment in late-stage projects

Economic Growth

- Economic growth

Economic Growth

- Economic growth

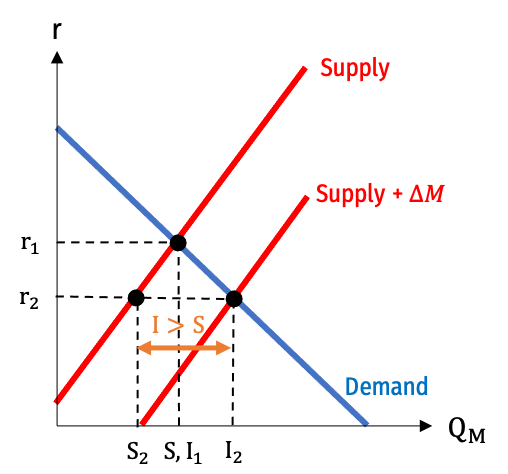

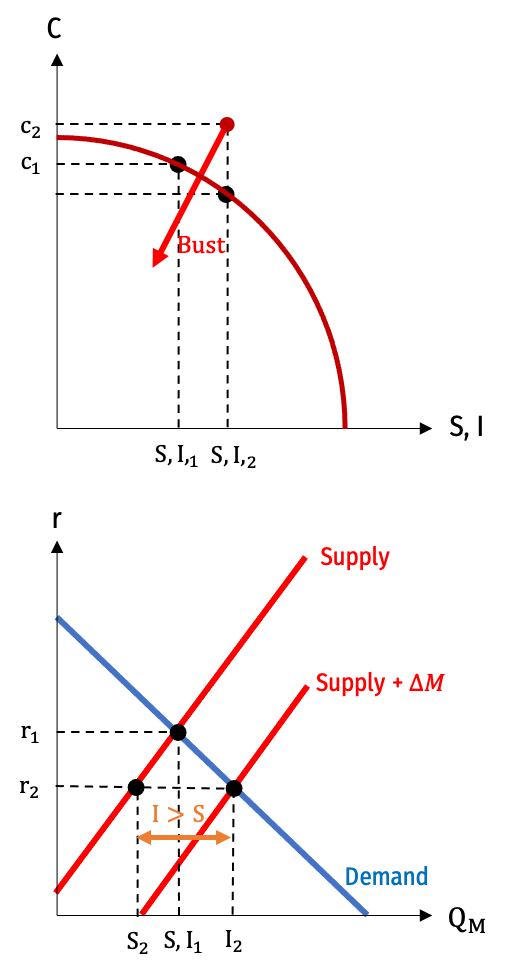

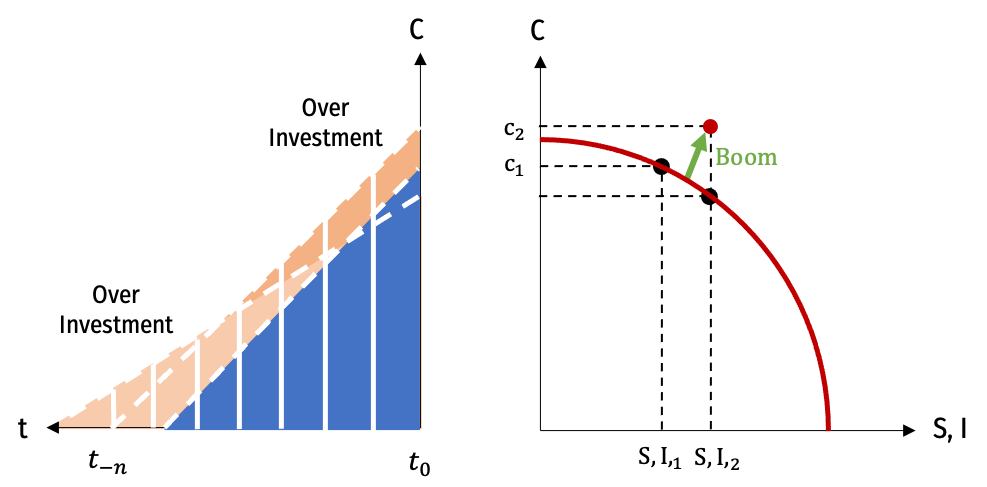

Bad Monetary Policy Creates Boom-Bust Cycle

Suppose through credit expansion (Central bank monetary policy), interest rates are artificially lowered tor r2

- below the “natural rate” determined by real savings & demand, r1

At r2, investment I2>S2 savings

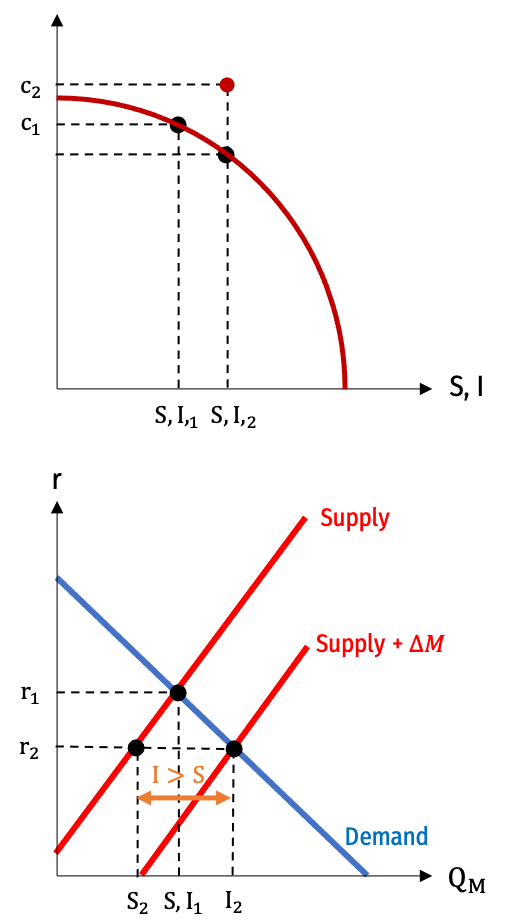

Bad Monetary Policy Creates Boom-Bust Cycle

Creates an artificial economic boom

- beyond the PPF!

- more consumption and more investment than is possible

Unsustainable, cannot last

- Some investments are not backed by sufficient real resources!

Bad Monetary Policy Creates Boom-Bust Cycle

Boom will burst, requiring liquidation of bad investments, fall in consumption

Economy will retreat inside of PPF

Capital has been misallocated to wrong sectors of the economy, costly to reallocate capital to different uses

Bad Monetary Policy Creates Boom-Bust Cycle

Boom will burst, requiring liquidation of bad investments, fall in consumption

Economy will retreat inside of PPF

Capital has been misallocated to wrong sectors of the economy, costly to reallocate capital to different uses

Neo-Keynesianism

Simon Kuznets and National Income Accounts

Simon Kuznets

1901-1985

Economics Nobel 1971

Student of Wesley Clair Mitchell (a famous American institutionalist) - Worked at NBER (founded by Mitchell), empirically studying business cycles - 15-25 year “Kuznets cycles”

National Income Accounts, first at NBER, later at U.S. Department of Commerce - GDP and GNP - Disapproved of it as a measure of welfare:

“the welfare of a nation can scarcely be inferred from a measure of national income.”

Simon Kuznets and National Income Accounts

Simon Kuznets

1901-1985

Economics Nobel 1971

Work in empirical macroeconomics, compiling data on income, output, consumption, and savings - helped fuel the Keynesian Revolution by testing Keynesian hypotheses

Also known for the “Kuznets curve”: an upside-down U-shaped relationship between economic growth and income inequality

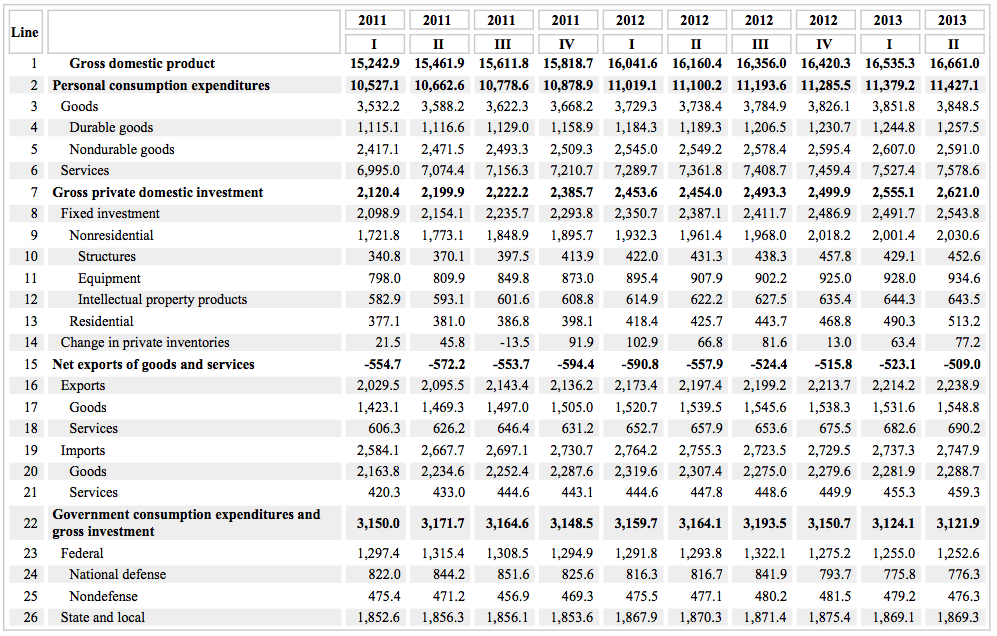

GDP

- Gross Domestic Product (GDP): the market value of all final goods and services produced within a country in a year

Y=C+I+G+(X−M)

- Y: national income

- C: consumption

- I: investment

- G: government spending

- X: exports

M: imports

Gross National Product: GDP + production by citizens living abroad

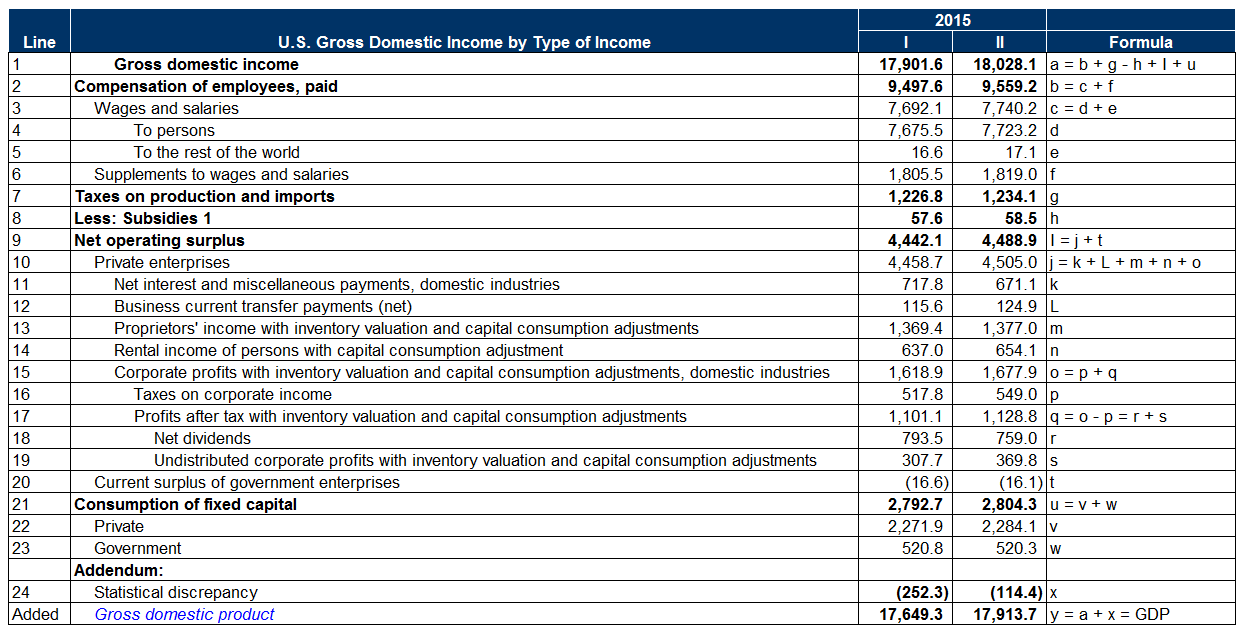

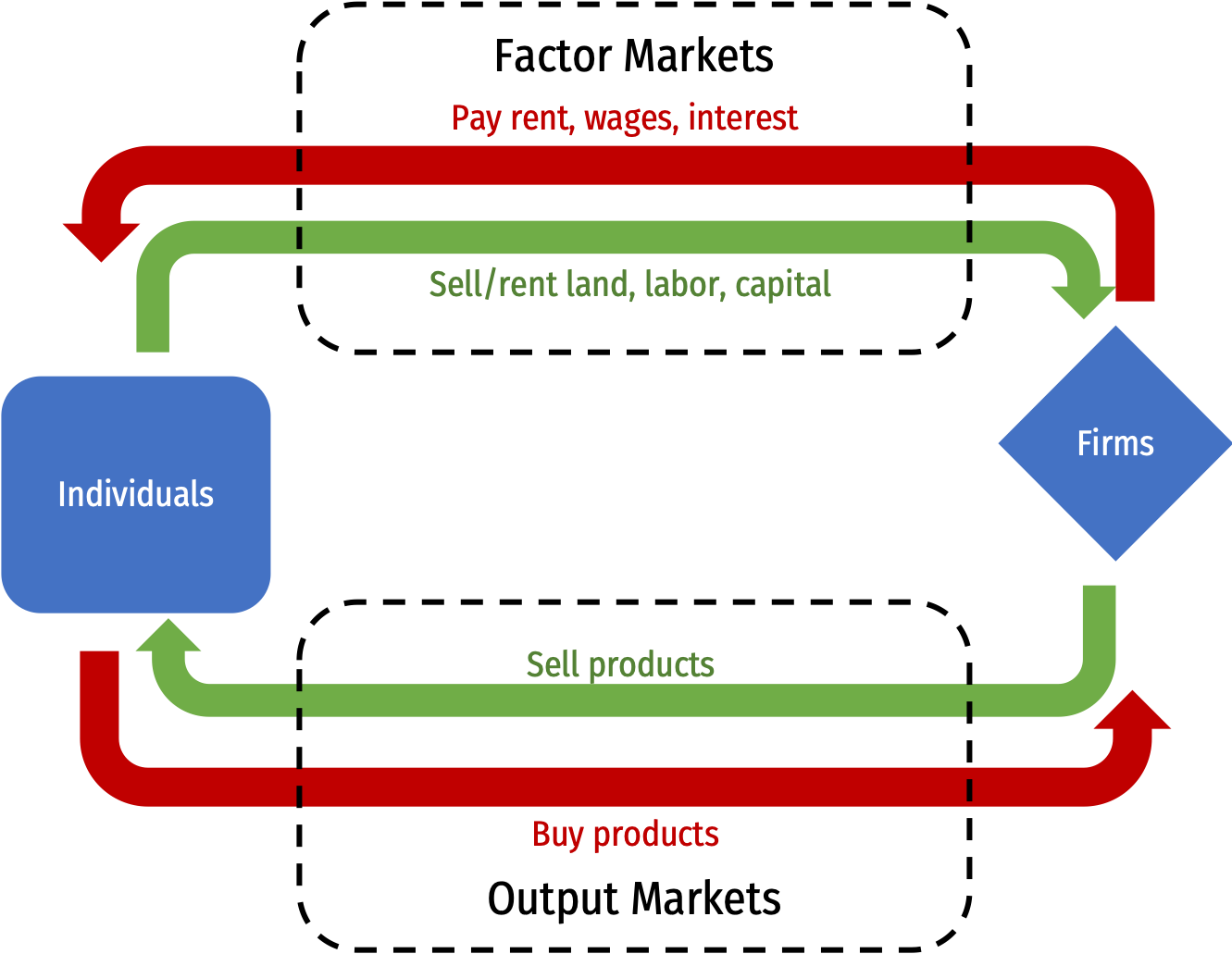

Income, Expenditures, and the Circular Flow

Can calculate GDP or GNI as expenditures or as income

As expenditures:

- consumption + investment + government spending + net exports

As income:

- wages + rent + capital income

For a country: ∑ expenditures = ∑ income

GDP as Expenditures

GDP as Income

The Circular Flow

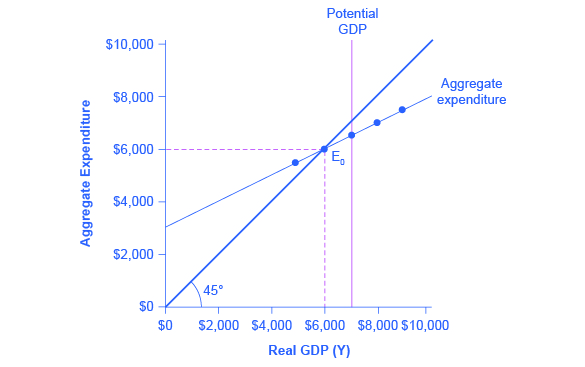

Samuelson and Keynesian Cross

Paul A. Samuelson

1915-2009

Economics Nobel 1970

- Samuelson’s 1948 textbook, Economics incorporated Keynes’ insights into neoclassical models

- “Keynesian Cross”

- “Liquidity trap”

- Aggregate demand aggregate supply analysis

- Fiscal policy & multipliers

Samuelson and Keynesian Cross

Aggregate income (real GDP) as independent variable

Aggregate planned expenditures (aggregate demand) as dependent variable

45* line: “aggregate supply” — if at less than full employment, anything demanded will be supplied

Not all expenditures are planned (some inventories unsold)

Equilibrium: where AE intersects 45* line

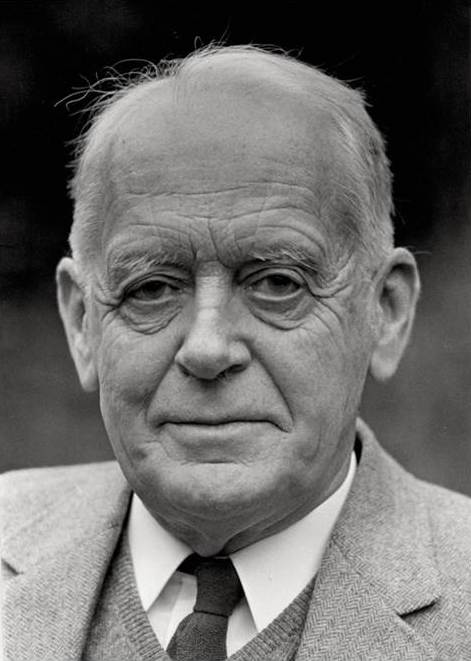

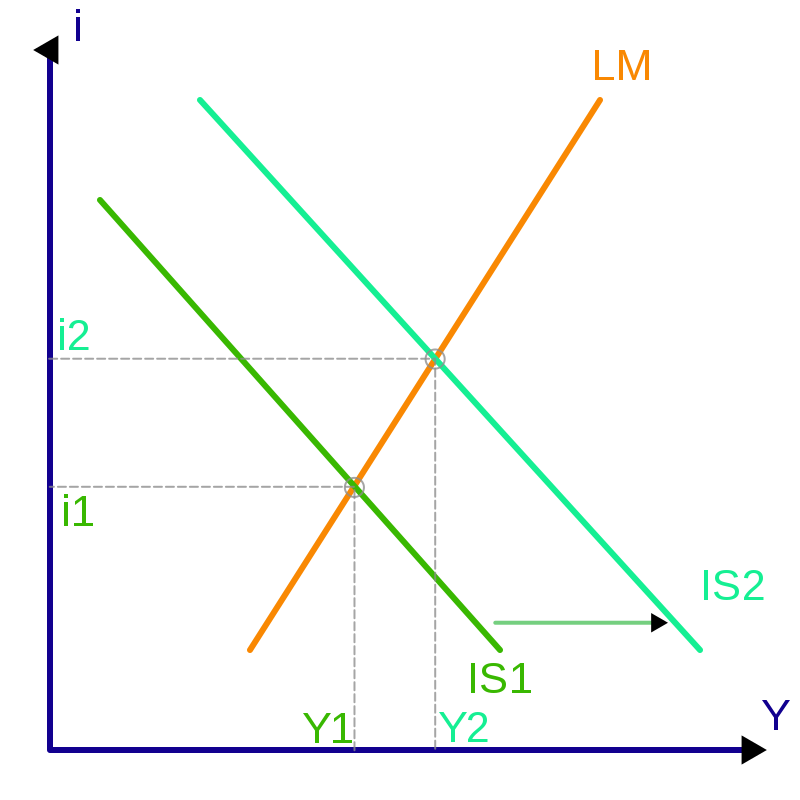

Hicks and IS-LM

Sir John Hicks

1904-1989

Economics Nobel 1972

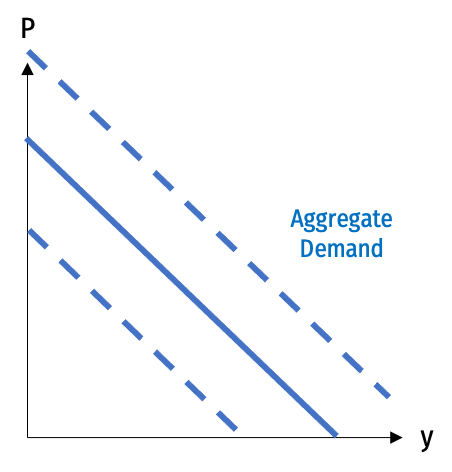

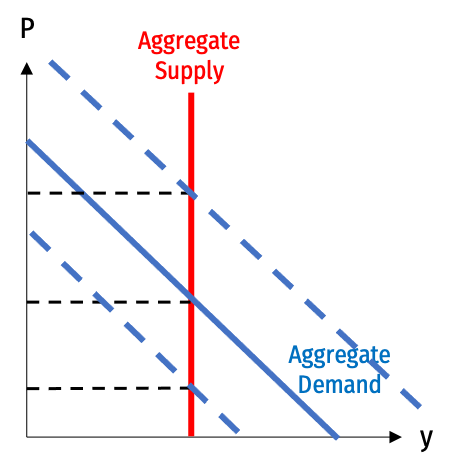

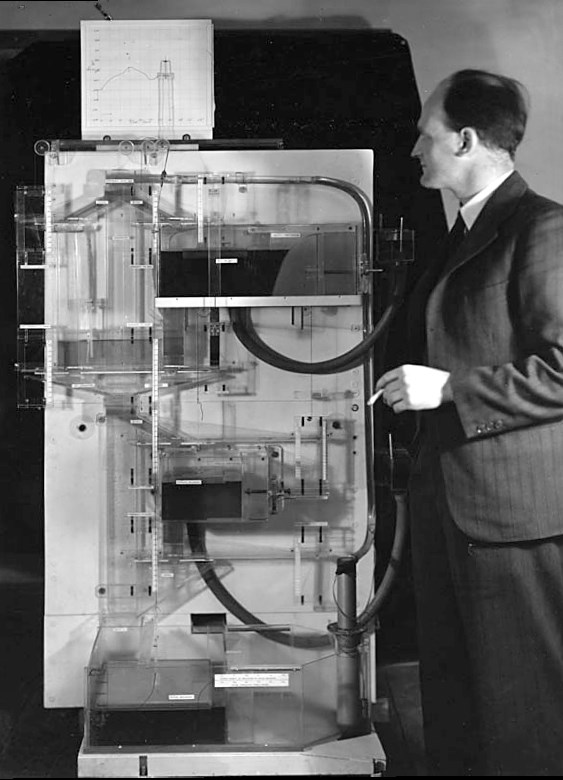

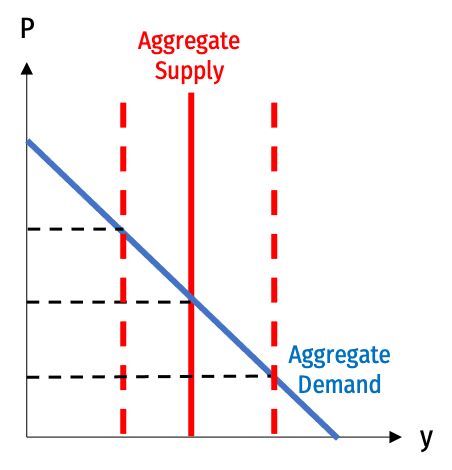

Aggregate Demand & Aggregate Supply

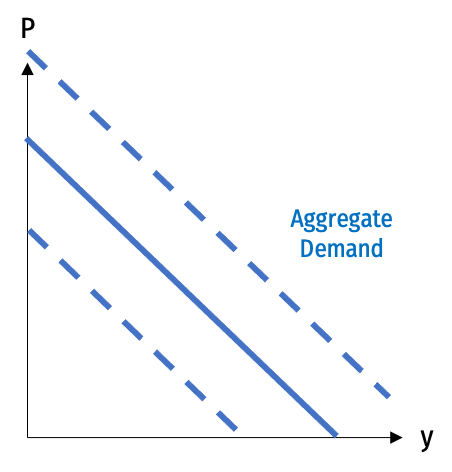

Take the quantity theory of money MV⏟nominal spending=Py⏟nominal income

Aggregate demand: all combinations of M and y consistent with same MV (nominal spending)

Downward-sloping

- if ↑M, ↓y to maintain MV

Aggregate Demand & Aggregate Supply

Take the quantity theory of money MV⏟nominal spending=Py⏟nominal income

Aggregate demand: all combinations of M and y consistent with same MV (nominal spending)

Downward-sloping

- if ↑M, ↓y to maintain MV

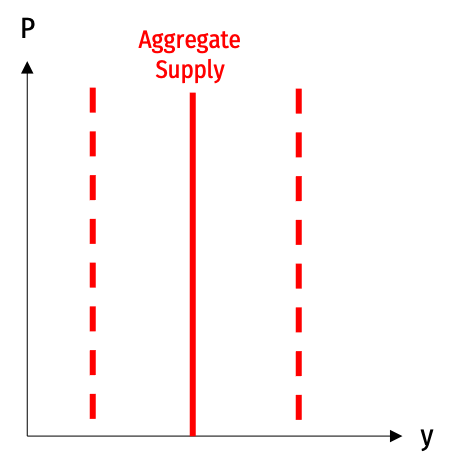

Aggregate Demand & Aggregate Supply

Aggregate supply: economy has potential output determined by production function Y=f(A,L,K)

In long run: vertical, determined by these real factors

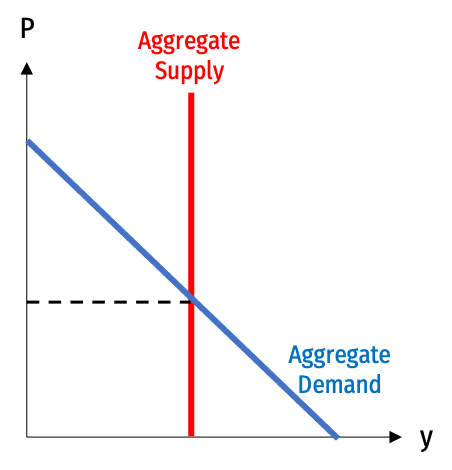

Aggregate Demand & Aggregate Supply

Equilibrium level of M and y

Can talk about how major changes to the economy (“shocks”) can cause changes in M (inflation) and y (real GDP growth)

Two major sources of shocks:

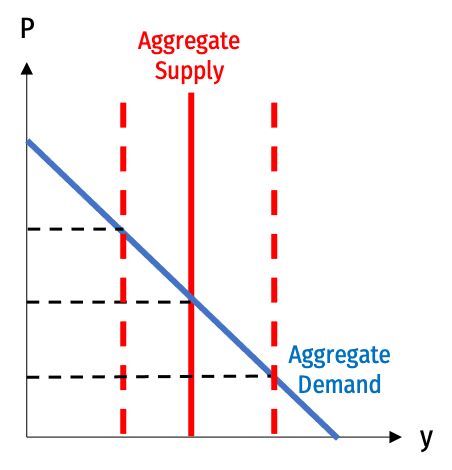

Aggregate Demand & Aggregate Supply

Equilibrium level of M and y

Can talk about how major changes to the economy (“shocks”) can cause changes in M (inflation) and y (real GDP growth)

Two major sources of shocks:

- Aggregate Supply shocks

Aggregate Demand & Aggregate Supply

Equilibrium level of M and y

Can talk about how major changes to the economy (“shocks”) can cause changes in M (inflation) and y (real GDP growth)

Two major sources of shocks:

- Aggregate Supply shocks

- Aggregate Demand shocks

Keynesian Aggregate Demand Management

(Neo)-Keynesians emphasize insufficient aggregate demand

- Consumption affected by MPC

- Investment driven by “animal spirits”

Government spending can makeup shortfalls in C, I, to achieve high nominal spending (MV)

- public works programs

- fiscal policy

- “priming the pump” and “steering the economy”

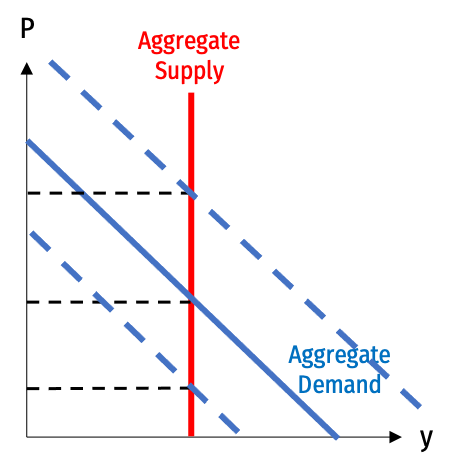

Keynesian Models of the Macroeconomy

Neo-Keynesian economists focused on making macroeconometric models of the macroeconomy

Deriving optimal fiscal policies

The New Classical (Counter) Revolution

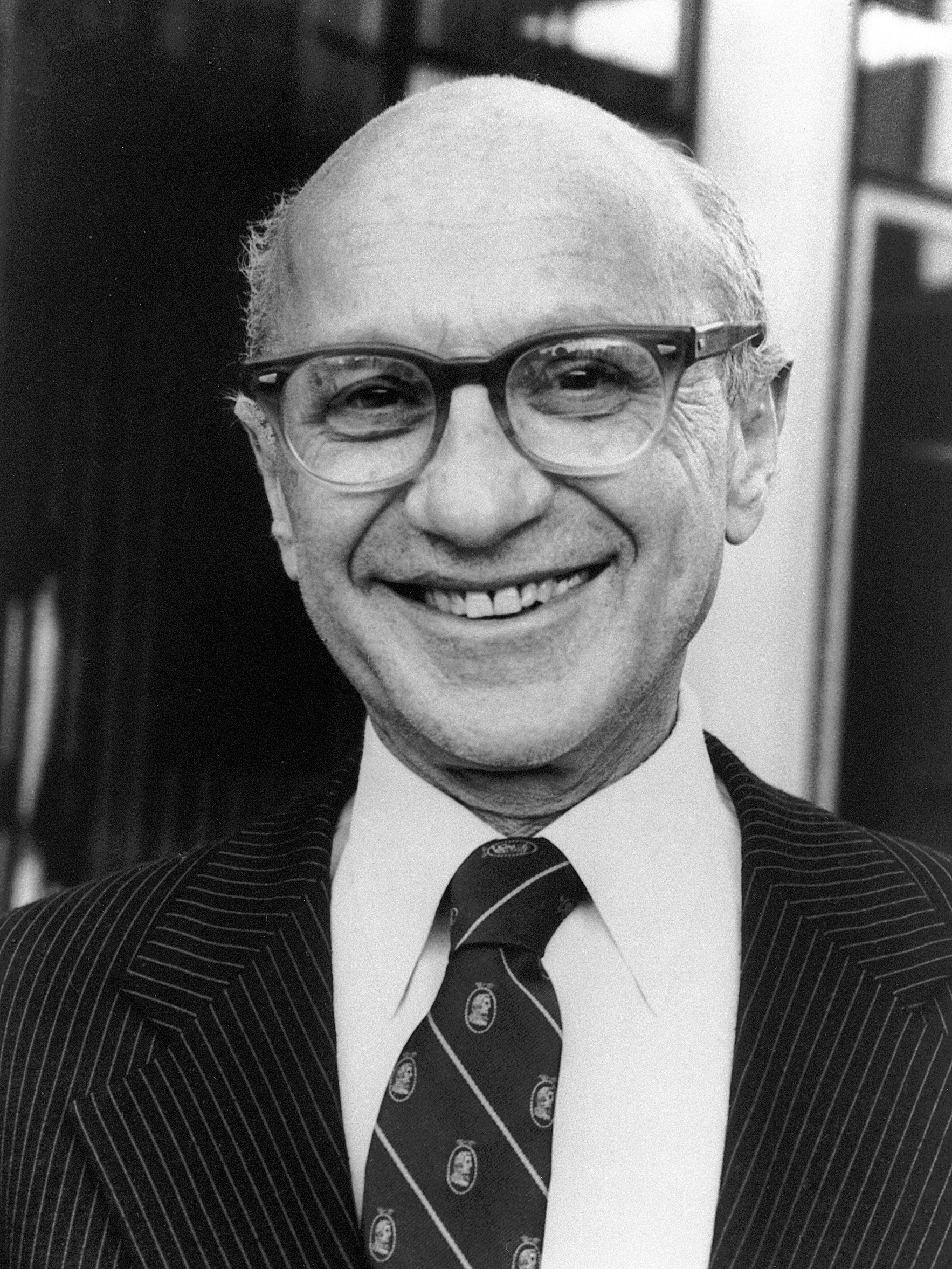

Friedman and Monetarism

Milton Friedman

1912-2006

Economics Nobel 1976

Work on consumption function: permanent income hypothesis, consumption smoothing

Many macroeconomic problems are caused by bad monetary policy

- Great Depression prolonged by bad Federal Reserve policy

“Inflation is always and everywhere a monetary phenomenon”

Importance of rules vs. discretion

New Classical Macroeconomics

Robert Lucas Jr.

1937—

Economics Nobel 1995

“Lucas Critique”: relationships that appear to hold in a model cannot be exploited by policymakers, because changing policy changes the relationships in the real world

- Macroeconomic relationships are endogenous to policy

- Example: “the Phillips curve” apparent negative relationship between inflation & unemployment

Cannot derive an econometric model of the macroeconomy and then use it to make policy

Begins the call for microfoundations of macroeconomics

New Classical Macroeconomics

L: Edward Prescott

R: Finn Kydland

“New Classical” Macroeconomics

- rejection of Keynesian aggregate demand theory and macroeconometric modeling

- focus on real determinants of economic growth and fluctuations

- microfoundations of macroeconomics

Rational expectations

Real business cycle theory

Representative agents

New Classical Macroeconomics

“Real Business Cycle” Theory

- most recessions in history (even pre-capitalism) came from negative supply shocks

- war, famine, bad weather, pandemics, bad harvest, oil shocks, etc.

Only changes in real productivity (short run and long run) determine outcomes

What Are We Missing (For Time)?

Cambridge capital controversy

- can’t aggregate capital

- Robinson, Sraffa vs. Samuelson, Solow

Growth theory

- Exogenous growth model (Harrod-Domar, Solow)

- Endogenous growth model (Romer)

Post-Keynesianism

- coordination failures, disequilibrium expectations

- Robinson, Leijonhufvud, Davidson

New Keynesianism

- “macrofoundations of microeconomics”

- microeconomics origins of wage and price rigidities, menu costs

- Mankiw, Krugman, Stiglitz,

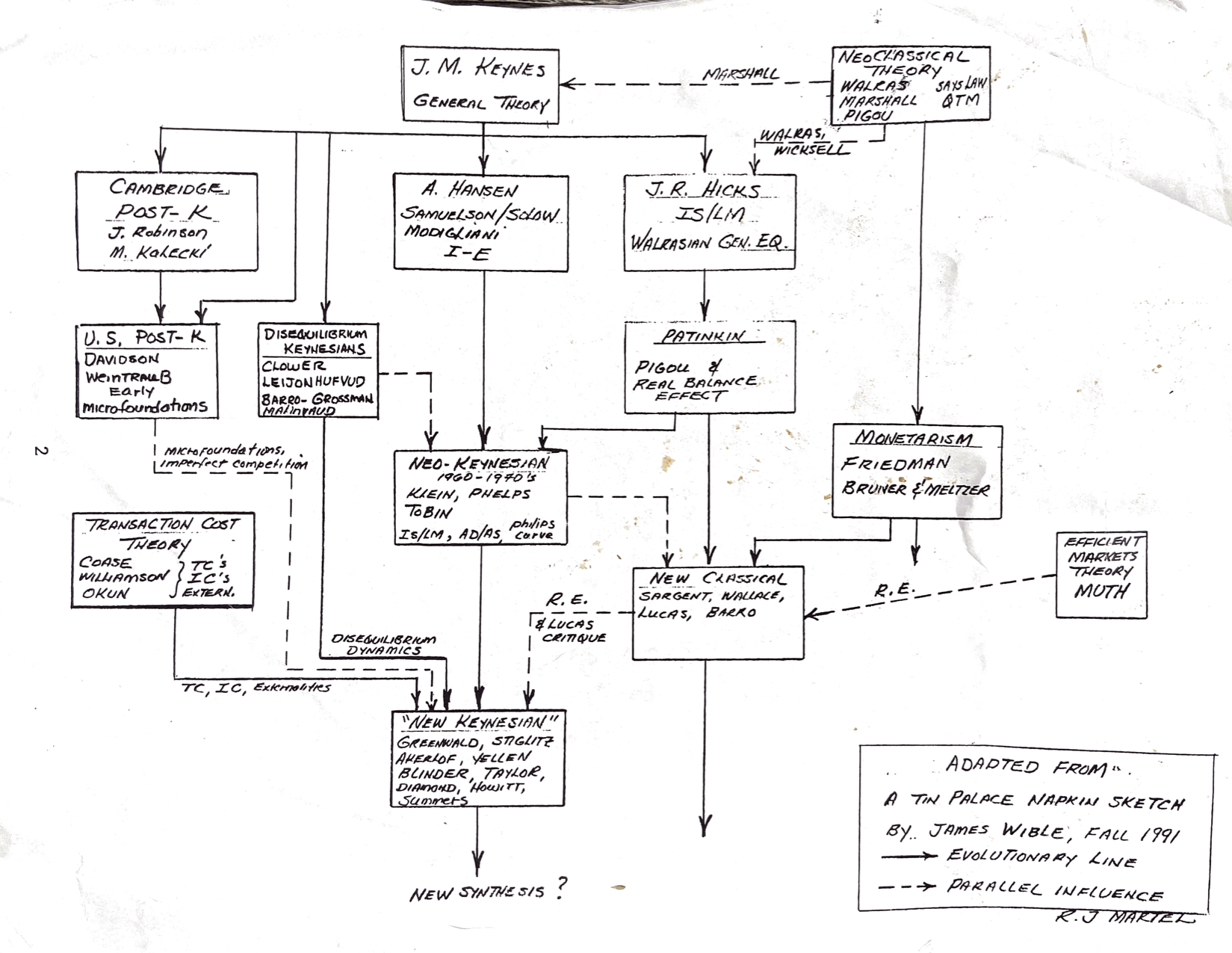

A Good Summary