4.3 — Modern Microeconomics

ECON 452 • History of Economic Thought • Fall 2020

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/thoughtF20

thoughtF20.classes.ryansafner.com

The Decline of Marshallian Economics

The Decline of Marshallian Economics

Alfred Marshall

1842-1924

Focus on partial equilibrium, applications to policy

Loose and vague definitions & concepts, mathematics in the background

Focus on the art of economics and policy, rather than positive or normative economics, or pure economic theory

Joan Robinson: “Marshall had the ability to recognize hard problems and hide them in plain sight”

The Decline of Marshallian Economics

Alfred Marshall

1842-1924

Up through the 1930s, it was clear that Marshallian economics was the leading version of economics in the English-speaking world

Criticisms from institutionalists

- too much theory, not enough institutional detail

Critics from formalists

- not enough theory, too imprecise, not scientific enough

- partial equilibrium inadequate, need general equilibrium

The Decline of Marshallian Economics

Alfred Marshall

1842-1924

Marshallian economics gets us about 80% of the way to what we teach undergraduates in microeconomics

1920s-1940s culmination of Neoclassical economics:

Tweaks to consumer theory

- John Hicks & Roy Allen on indifference curves, general equilibrium, and demand

Tweaks to producer theory

- Jacob Viner on long-run cost curves

- Rediscovery of Cournot’s marginal revenue curve, MC=MR

- Joan Robinson, Edward Chamberlain on monopolistic competition

- Industrial organization & game theory (1940s-1980s)

The Decline of Marshallian Economics

Alfred Marshall

1842-1924

New welfare economics

- LSE tradition: Hicks, Kaldor, Robbins

- Harvard tradition: Abram Bergson, Paul Samuelson

- Public/social choice: Kenneth Arrow, James Buchanan

More formalist mathematical methods

- Paul Samuelson, Kenneth Arrow

The Decline of Marshallian Economics

Alfred Marshall

1842-1924

Change in methodology and character of economics

Becoming more abstract pure theory, independent of institutions

More advanced mathematics

- calculus & geometry → set theory & real topology

Greater precision in definitions, assumptions, formalizing Marshall:

- Marshall’s “reasonable businessman” → rational maximizer

- Marshall’s “competitive market” → price-taking firms in perfect competition

John Hicks and Revising Consumer Theory

John Hicks

Sir John Hicks

1904-1989

Economics Nobel 1972

Professor of Economics at London School of Economics

Won the 4th Economics Nobel Prize in 1972 with Kenneth Arrow “for their pioneering contributions to general economic equilibrium theory and welfare theory”

1939 Value and Capital

Revision of (Marshallian) consumer theory into its modern form:

- ordinal utility

- indifference curves

- income-compensated demand curve

- differentiates income vs. substitution effects

- general equilibrium

Came up with the “Kaldor-Hicks” criterion for efficiency (in part, with Kaldor)

Also created the IS-LM model to summarize (his view of) Keynesian macroeconomics (and the idea of a liquidity trap)

John Hicks: Indifference Curves

Sir John Hicks

1904-1989

Economics Nobel 1972

Hicks, along with Roy Allen, and Lionel Robbins at LSE, brought Lausanne School ideas (esp. Pareto) to an English audience

Frontal assault against cardinal utility, and measurable “utils”

- Marshallians like Pigou and Edgeworth were still hung up on this utilitarianism

Hicks, John, and Roy Allen, 1934, “A Reconsideration of the Theory of Value”, Economica

John Hicks: Utility and Demand

Sir John Hicks

1904-1989

Economics Nobel 1972

Assumptions about preferences and indifference curves

- Reflexivity

- Completeness

- Transitivity

- Monotonicity

- Convexity

Beginning with ordinal utility, derive demand curves

Indifference curves (from Edgeworth and Fisher)

Individual utility maximization subject to budget constraint

Hicks, John, and Roy Allen, 1934, “A Reconsideration of the Theory of Value”, Economica

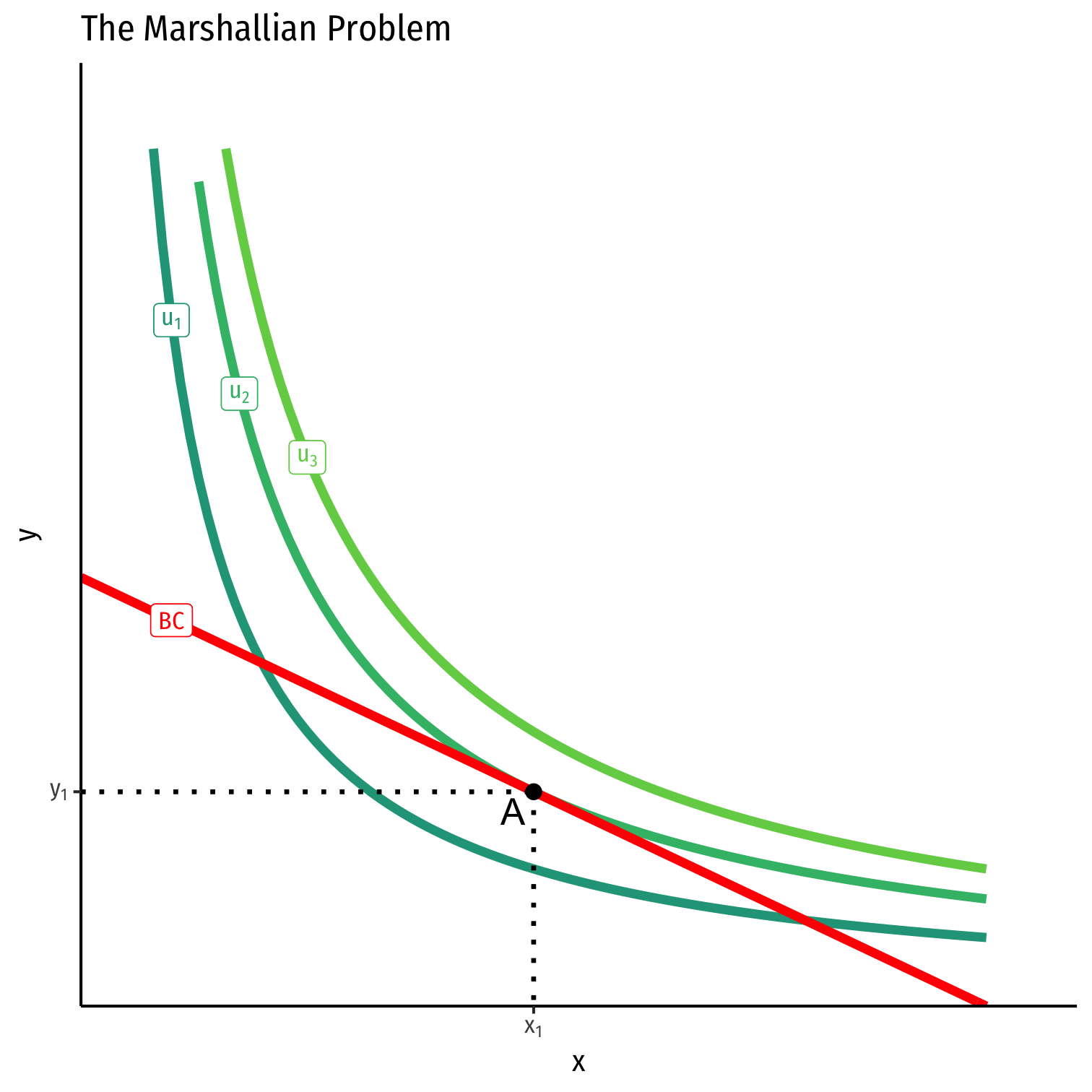

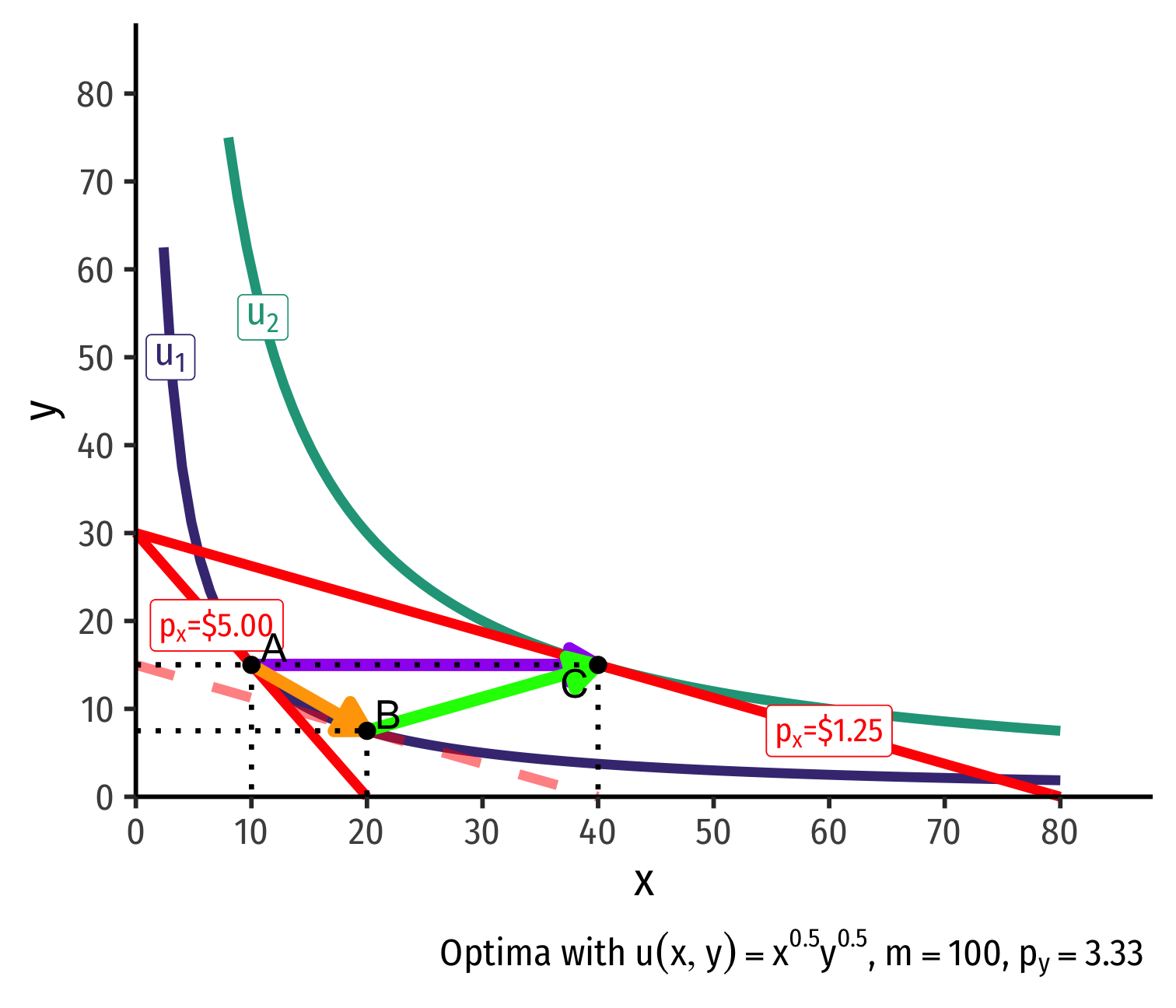

John Hicks: Utility and Demand

maxx,yu(x,y)

- Yields first order condition (Gossen’s second law):

MUxMUy⏟MRSx,y=pxpy

John Hicks: Utility and Demand

Sir John Hicks

1904-1989

Economics Nobel 1972

This is the “Marshallian” or uncompensated” demand function”: conflates income effects with substitution effects

Marshallian demand problem: maximize utility subject to budget (market prices & income)

maxx,yu(x,y)

- Yields a solution M(p,m) as function of prices and income (i.e. demand)

John Hicks: Utility and Demand

Sir John Hicks

1904-1989

Economics Nobel 1972

Define an indirect utility function of prices & income as equal to the utility gained from Marshallian demand function V(p,m)=u(M(p,m))

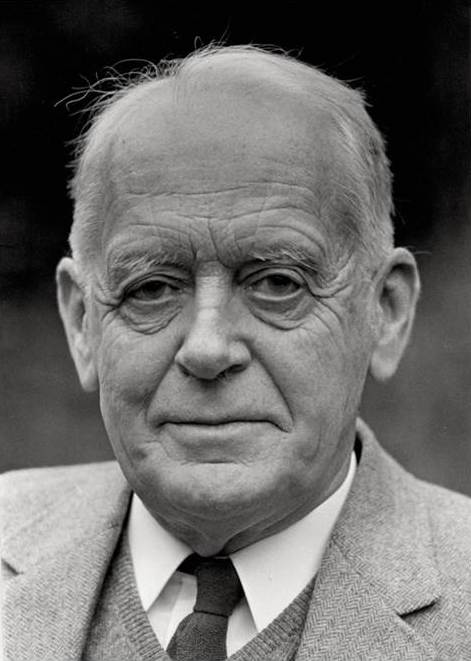

The “Hicksian” demand problem: minimize expenditure subject to fixed amount of utility

minx,ypxx+pyy=m

- Yields a solution H(p,ˉu) as function of prices and fixed amount of utility

John Hicks: Utility and Demand

minx,ypxx+pyy=m

- Yields identical first order condition (Gossen’s second law):

MUxMUy⏟MRSx,y=pxpy

John Hicks: Duality of Problems

Sir John Hicks

1904-1989

Economics Nobel 1972

Duality of consumer’s problem: a Marshallian solution maximizes utility, the Hicksian solution minimizes expenditures for that amount of utility

Similar duality for firms: profit maximization ⟺ cost minimization

Income & Substitution Effects

- Slutsky equation: change in demand for good i in response to a change in the price of good j:

∂xi(p,m)∂pj=∂Hi(p,u)∂pj⏟S.E.−xj(p,m)∂xi(p,m)∂m⏟I.E.

- RHS: change in demand for good i holding utility fixed at u − quantity of good j demanded, multiplied by the change in demand for good i when income changes

- First term is substitution effect, second term is (real) income effect

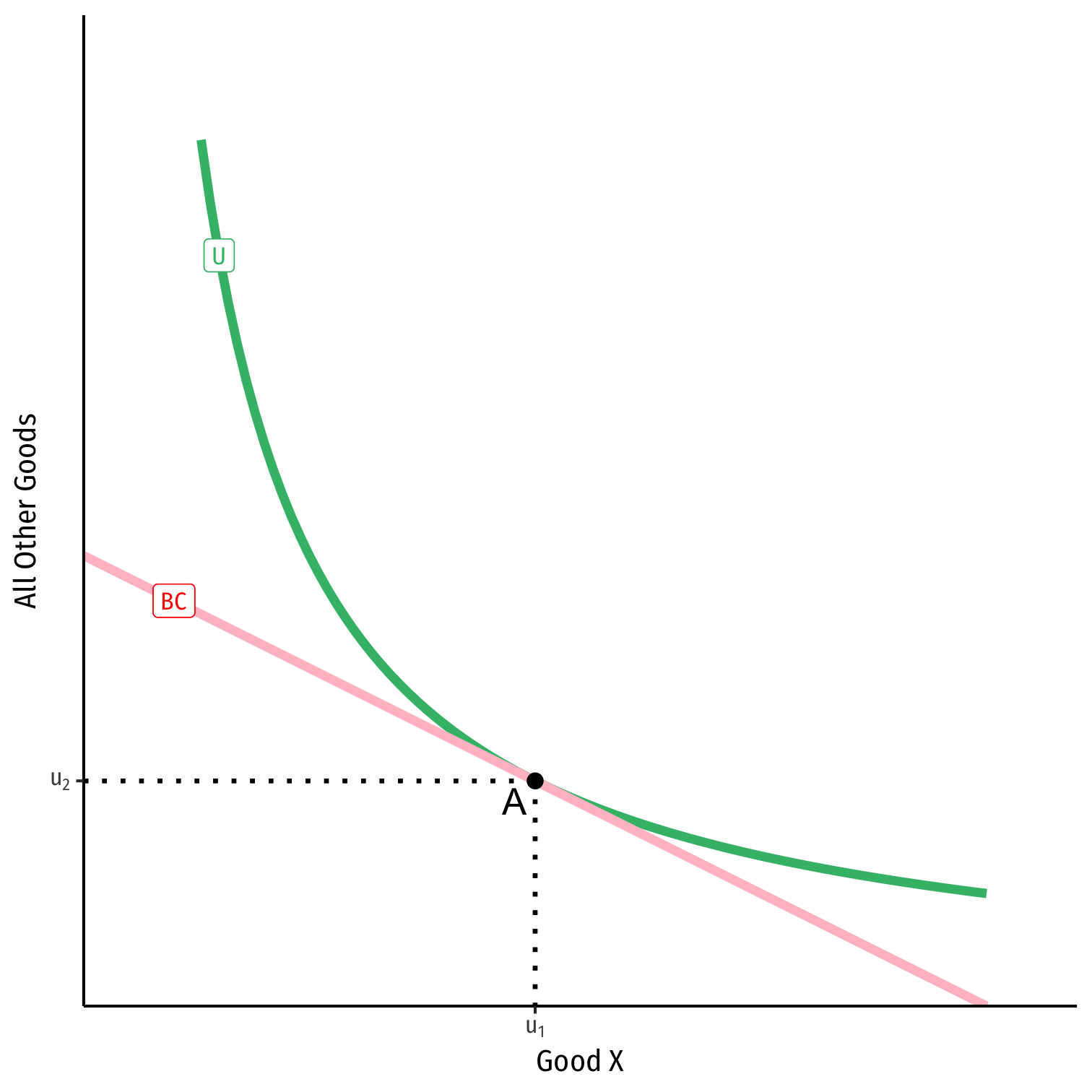

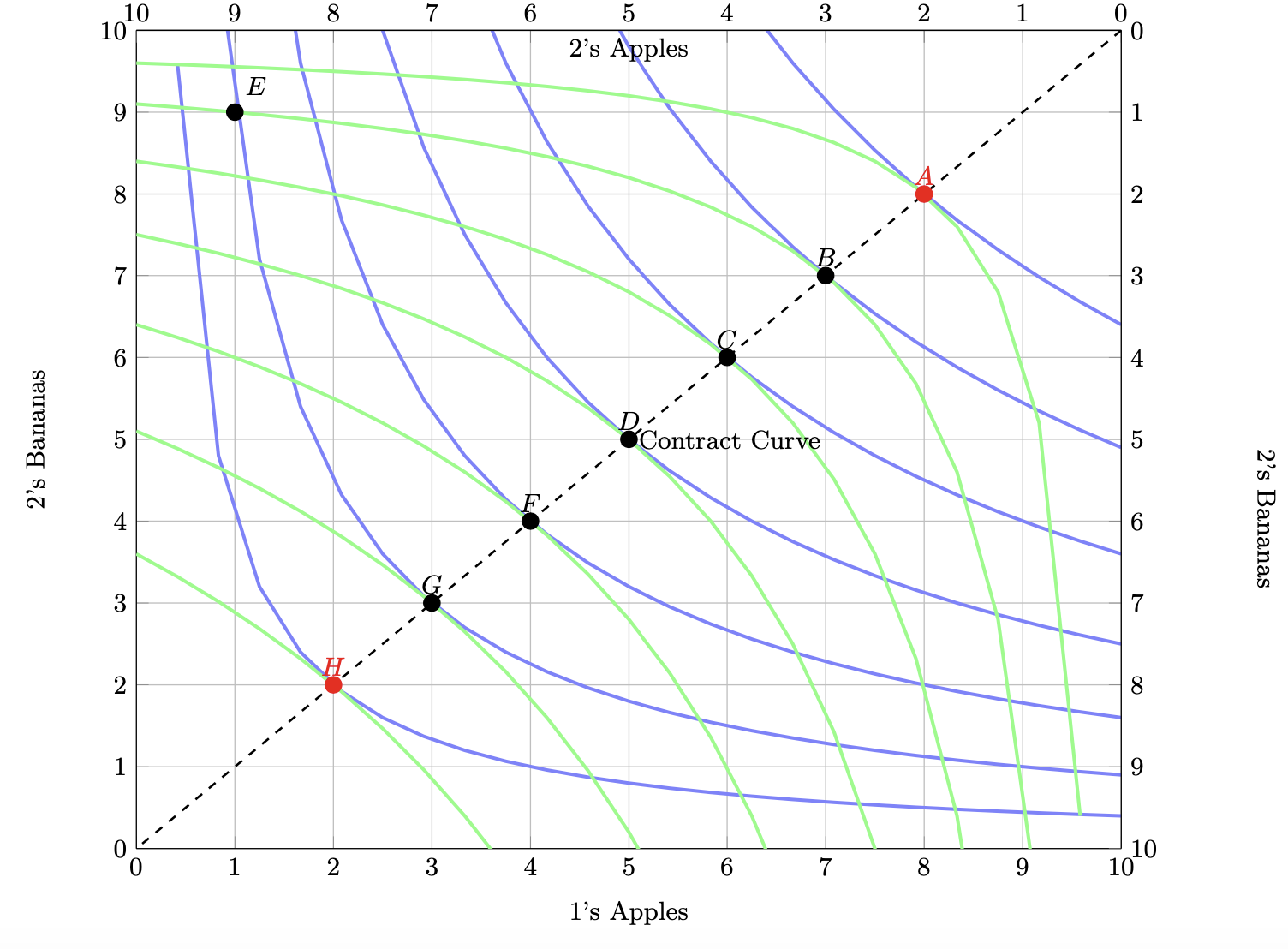

John Hicks: Simple General Equilibrium

Can generalize the 2-good case to the case of one good and a composite of all n−1 other goods

Shows that optimal conditions hold for broader equilibrium across all markets

“New” Welfare Economics & General Equilibrium Theory

Robbins’ Definition of Economic Science

(Lord) Lionel Robbins

1898-1984

“Economics is the science which studies human behaviour as a relationship between ends and scarce means which have alternative uses” (p.15)

“Economics is entirely neutral between ends;...in so far as any end is dependent on scarce means, it is germane to the preoccupations of the economist” (p.24)

“Economics as science is about ‘ascertainable facts’ of the positive as distinct from normative (ethical) judgments on economic policy. It is incapable of deciding as between the desirability of different ends. It is fundamentally distinct from Ethics.” (p.24)

Robbins, Lionel, 1932, Essay on the Nature and Significance of Economic Science

Robbins’ Definition of Economic Science

(Lord) Lionel Robbins

1898-1984

Many saw Robbins’ statements as saying economics cannot recommend policy at all

Pareto had devised his criterion where at least one person is unambiguously better off and nobody unambiguously worse off

- But this is unrealistic in the real world!

The “New” Welfare Economics

Led to the birth of the “New” Welfare Economics in 1930s on Paretian foundations, with two major interpretations/traditions:

Harvard tradition:

- Paul Samuelson, Abram Bergson

LSE tradition:

- Nicholas Kaldor, John Hicks, Tibor Scitovsky

The “New” Welfare Economics

All agree with Pareto that utility is not cardinal, and cannot be compared across people

- proper modification of Pareto’s conditions

Harvard: choice of social optimum is a normative issue, but can be assisted with economic theory

LSE: strictly positive examination of social choice, not a normative issue

- As Robbins might approve: strictly an analysis of means for given ends

- Hicks: the analysis will reach the same conclusions whther “one is a liberal or a socialist, a nationalist or an internationalist, a christian or a pagan”

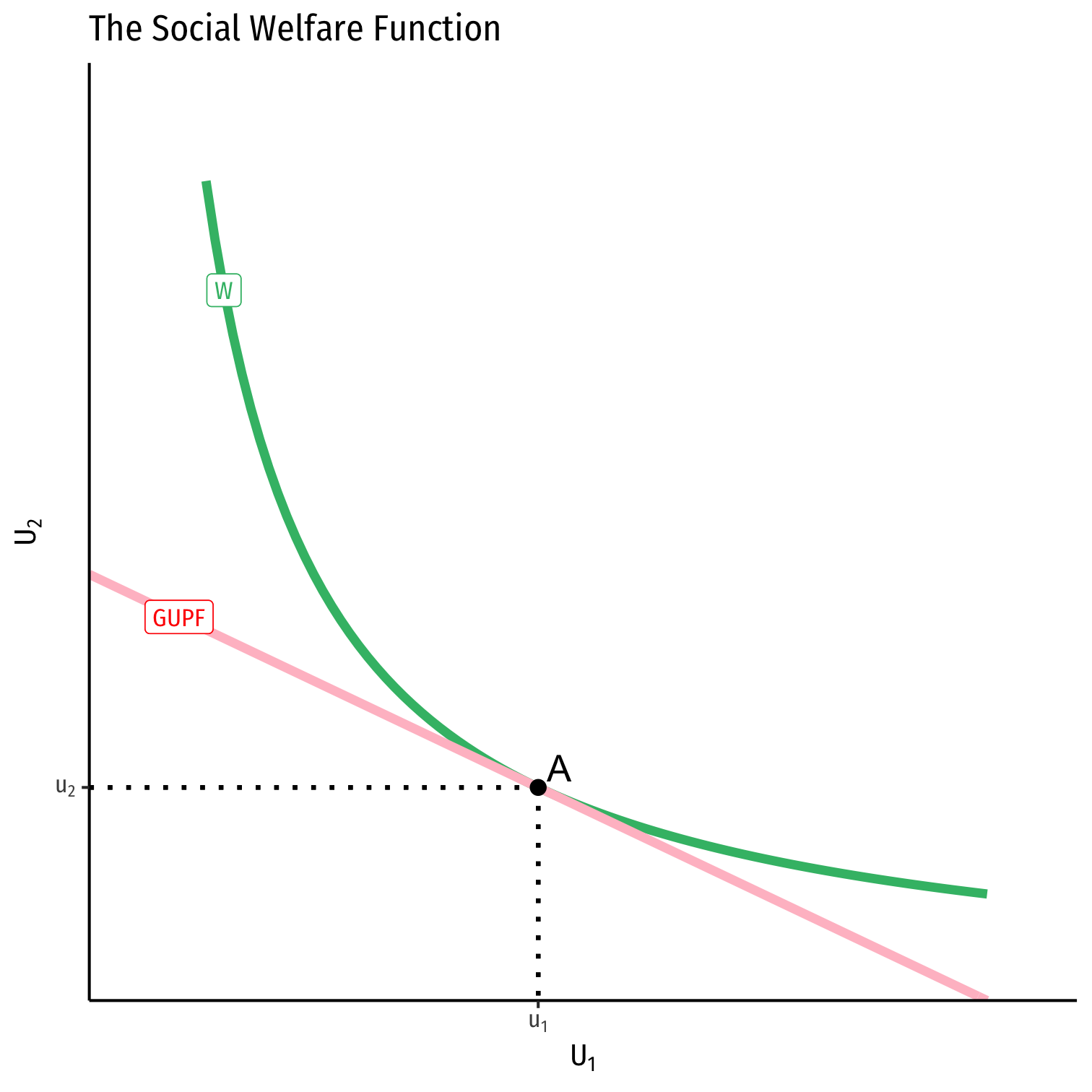

Harvard Tradition: The Social Welfare Function

- Abram Bergson introduces the social welfare function

“to state in precise form the value judgments required for the derivation of the conditions of maximum economic welfare”

- A real valued, continuous, and differentiable utility function to describe the utility of society as a whole

W=W(U1,U2,⋯,UH)

- note it is not additive! (as Benthamite utilitarianism might have it)

- Overtly normative, a maximization problem for a social planner

LSE Tradition: Kaldor-Hicks-Scitovsky

Alternative criteria for judging whether allocations were “preferable” given by Nicholas Kaldor, John Hicks, and Tibor Scitovsky (and based off Barone)

Kaldor criterion: a change is preferable if the winners can in principle, compensate the losers with some of the gains, and still be better off

Hicks criterion: a change is preferable if the losers from the change cannot bribe the winners enough to prevent them from desiring the change

Scitovsky double criterion: both criteria must be true simultaneously

Markets and Kaldor-Hicks Efficiency

Kaldor-Hicks Improvement: an action improves efficiency its generates more social gains than losses

- those made better off could in principle compensate those made worse off

Kaldor-Hicks efficiency: no potential Kaldor-Hicks improvements exist

Keeps intuitive appeal of Pareto but more practical

- Every Pareto improvement is a KH-improvement (but not the other way around!)

Consider policies where winners' maximum WTP > losers' minimum WTA

Policies should maximize social value of resources

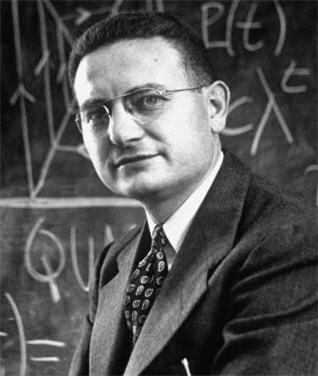

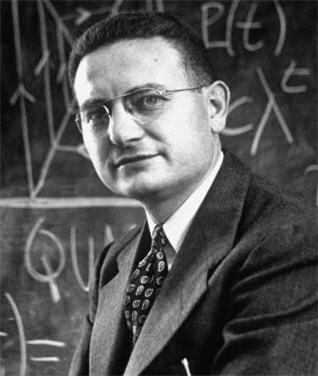

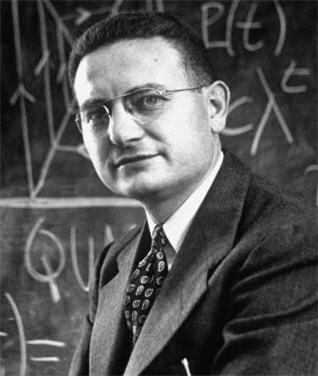

Arrow-Debreu and General Equilibrium

Kenneth Arrow

1921-2017

Economics Nobel 1972

Prove, using the Kakutani fixed-point theorem that (Walrasian) general equilibrium exists

With additional assumptions about preferences, proved that a unique equilibrium exists if utility functions be strongly concave and twice continuously differentiable

Extremely general, works even for contingent-claims markets under uncertainty

- Complete set of prices for all contracts that individuals trade, including contingent-contracts on future delivery of goods based on various conditions, e.g. “1 ton of Winter red wheat, delivered on 3rd of January in Minneapolis, if there is a hurricane in Florida during December”

Prove that “the Invisible Hand works” under specific conditions

Arrow on Social Choice Theory

Kenneth Arrow

1921-2017

Economics Nobel 1972

Arrow is also known for his work in social choice theory

Want a voting systen that meets the following criteria:

- Unanimity/Pareto Criterion: if all individuals prefer X≻Y, then X must be chosen over Y

- Transitivity: the social choice mechanism is transitive such that if X is chosen over Y, and Y over Z, then X must be chosen over Z

- Unrestricted Domain: all individuals are able to rank all alternatives

- Independence of Irrelevant Alternatives: pairwise comparisons between two alternatives are not affected by the rank of other alternatives

- Non-dictatorship: there is no individual that always gets their way regardless of other voters

Arrow on Social Choice Theory

Kenneth Arrow

1921-2017

Economics Nobel 1972

Arrow’s Impossibility Theorem: no social choice mechanism exists that can fulfill all 5 criteria simultaneously

Alternative specification: the only social choice mechanism that can fulfill conditions 1-4 is dictatorship

Learn more in my Public Economics course (Lesson 3.1)

Buchanan on Public Choice Theory

James M. Buchanan

1919-2013

Economics Nobel 1986

Buchanan and Gordon Tullock pioneered public choice theory

Society/government is not a choosing-agent, individuals have different interests as consumers, producers, voters, elected officials, bureaucrats, etc.

- there is no “social welfare function”!

Economic analysis of politics: individuals with separate interests making exchanges with one another

Focus on constitutional rules, rational ignorance, rent-seeking, concentrated benefits and dispersed costs, etc.

Learn more in my Public Economics course

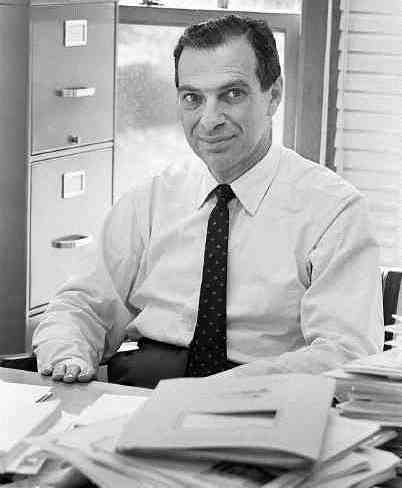

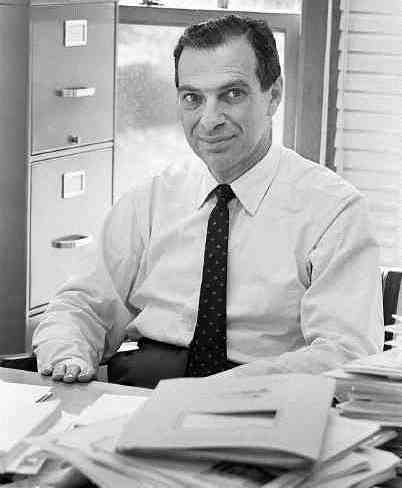

Paul Samuelson and Formalist Economics

Paul Samuelson

Paul A. Samuelson

1915-2009

Economics Nobel 1970

Formalistic methods

Neoclassical synthesis between neoclassical microeconomics and Keynesian macroeconomics

- the leading mainstream

1946 Foundations of Economic Analysis

1948 Economics: An Introductory Analysis

- best-selling economics textbook for decades

- 19 editions, coauthored with William Nordhaus, 4 million sold

Almost single-handedly established MIT as a powerhouse in economics

Paul Samuelson

Paul A. Samuelson

1915-2009

Economics Nobel 1970

- Won the 2nd Economics Nobel Prize (first American to do so):

“More than any other contemporary economist, Samuelson has helped to raise the general analytical and methodological level in economic science. He has simply rewritten considerable parts of economic theory. He has also shown the fundamental unity of both the problems and analytical techniques in economics, partly by a systematic application of the methodology of maximization for a broad set of problems. This means that Samuelson's contributions range over a large number of different fields.” — Nobel Prize Committee

Paul Samuelson: Mathematical Economics

Paul A. Samuelson

1915-2009

Economics Nobel 1970

Foundations of Economic Analysis, his magnum opus based on his doctoral dissertation

Inspired by classical thermodynamics (and friends with William Gibbs)

“[Goal is to] examine underlying analogies between central features in theoretical and applied economics and study how operationally meaningful theorems can be derived with a small number of analogous methods.”

Unifies many branches of economics into a series of repeated models: maximizing agents & stable equilibrium

Comparative statics method of comparing equilibria

“By a meaningful theorem, I mean simply a hypothesis about empirical data which could conceivably be refuted, if only under ideal conditions.”

Paul Samuelson: Mathematical Economics

Paul A. Samuelson

1915-2009

Economics Nobel 1970

- Saw Cournot, Jevons, Edgeworth, Fisher, and Pareto as true founders of modern (mathematical) economics

“I have come to feel that Marshall’s dictum that ‘it seems doubtful whether any one spends his time well in reading lengthy translations of economic doctrines into mathematics...’ should be exactly reversed. The laborious literary working over of essentially simple mathematical concepts such as is characteristic of much of modern economic theory is not only unrewarding from the standpoint of advancing science, but involves as well mental gymnastics of a peculiarly depraved type,” (p.6).

Samuelson, Paul A, 1946, Foundations of Economic Analysis

Alternatives to Formalist Economics

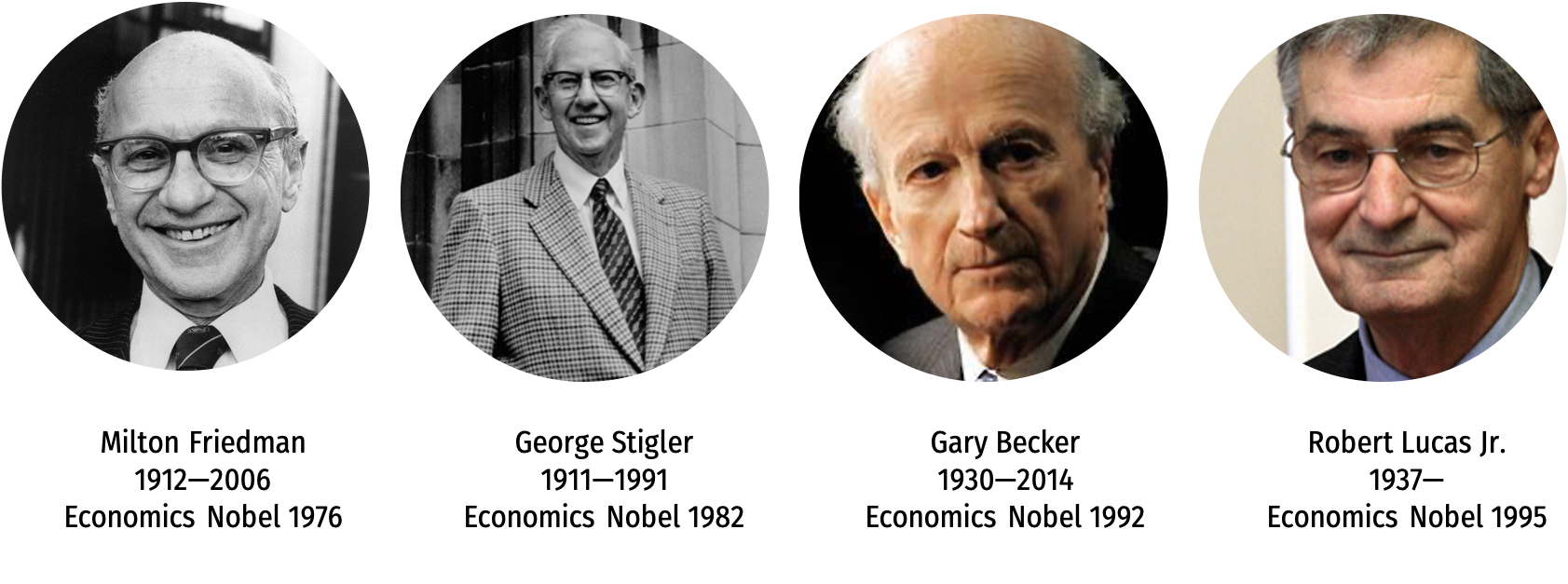

Milton Friedman

Milton Friedman

1912-2006

Economics Nobel 1976

Counterweight to Paul Samuelson’s formalism and counterweight to Keynesian macroeconomics

Methodology: positivism & “as-if” modeling (see Class 1.2)

Work on consumption, demand, monetary theory and history

Free-market classical liberalism

1976 Nobel Prize in Economics “for his achievements in the fields of consumption analysis, monetary history and theory and for his demonstration of the complexity of stabilization policy”

Friedman, Milton, 1953, Essays in Positive Economics

Friedman, Milton, 1957, A Theory of the Consumption Function

Friedman, Milton, 1962, Capitalism and Freedom

Friedman, Milton and Anna Schwartz, 1963, A Monetary History of the United States, 1867-1960

The Chicago School of Economics

Milton Friedman

1912-2006

Economics Nobel 1976

“In discussions of economic policy, “Chicago” stands for belief in the efficiency of the free market as a means of organizing resources, for skepticism about government affairs, and for emphasis on the quantity of money as a key factor in producing inflation.” “In discissusion of economic science, “Chicago” stands for an approach that takes seriously the use of economic theory as a tool for analyzing a statingly wide range of concrete problems, rather than as an abstract mathematical structure of great beauty but little power; for an approach that insists on the empirical testing of theoretical generalizations and that rejects alike facts without theory and theory without facts,” (quoted in Landreth & Colander, p. 400)

The Chicago School of Economics

Milton Friedman

1912-2006

Economics Nobel 1976

Marshallian-style application of price theory and partial equilibrium to all social problems

- maximizing individuals, stable preferences, equilibrium

Not overly mathematical or formalist, more intuitive and logical application of price theory

Gary Becker: economic analysis of the family, discrimination, addiction, “irrational” behavior

- “economic imperialism” into other social sciences

The Chicago School

- 13 Nobel Prizes to Chicago-based economists

Coase and the Return to Institutions

Ronald H. Coase

(1910-2013)

Economics Nobel 1991

“The traditional [Pigouvian] approach [to externalities] has tended to obscure the nature of the choice that has to be made. The question is commonly thought of as one in which A inflicts harm on B and what has to be decided is: how should we restrain A? But this is wrong. We are dealing with a problem of a reciprocal nature. To avoid the harm to B would inflict harm on A. The real question that has to be decided is: should A be allowed to harm B or should B be allowed to harm A?” (p.2)

Coase, Ronald H, 1960, "The Problem of Social Cost," Journal of Law and Economics 3:1-44

Externalities as a Property Rights Problem

Ronald H. Coase

(1910-2013)

Economics Nobel 1991

Harm is often bilateral, not unilateral

Takes two parties to have a dispute

A ⟺ B

Origin of the problem is rights are not clear (undefined or unenforced)!

Who has right/responsibility over activity creating the external harm?

Coase, Ronald H, 1960, "The Problem of Social Cost," Journal of Law and Economics 3:1-44

Property Rights and Externalities

Court must must imposing a cost on either the defendant or plaintiff

Real issue is the social balance of efficiency

At what rate is society willing to give up confections for medical services, and vice versa?

The "Coase Theorem"

Coase Theorem: if transactions costs are low, clearly defined property rights allow parties to bargain to the efficient social outcome regardless of who has the property right

Wealth and distribution effects will change (who pays who)

If there are mutual gains from exchange to be had, parties will find a way to capture them

- Resources will flow towards highest-valued uses

- Coase: there's nothing new here if you understand Adam Smith!

The "Coase Theorem" in the Real World

In real world of transactions costs, the assignment of property rights matters!

Property rights and resources are sticky!

Means some allocations are more efficient than others!

The "Coase Theorem" in the Real World

Coase: forget "Blackboard economics" and go study the real world of institutions

Launches "Law & Economics" field, and “property rights” economics

- Armen Alchian, Harold Demsetz, Richard Posner, etc.

How should property rights be assigned to minimize the total cost of externalities and to maximize efficiency?

New Institutional Economics

- Focus on role of institutions (and transaction costs) in structuring incentives of individuals, firms, and governments

How Much of Modern Microeconomics is Neoclassical?

- Neoclassical economics assumes strict rationality

- Behavioral economics

- Bounded rationality & “satisficing”

- Ecological rationality

How Much of Modern Microeconomics is Neoclassical?

- Neoclassical economics focuses almost exclusively on marginal conditions at the optimum among price—takers

- Game theory — strategic interactions

- Austrians — entrepreneurship, uncertainty, market process

- Evolutionary economics — adaptation

- Industrial organization — theory of the firm, market power

- New Institutional economics — economics of organization

How Much of Modern Microeconomics is Neoclassical?

- Neoclassical economics focuses only on individuals

- Complexity science

- Agent-based modeling

- New Institutional economics — economics of organization

How Much of Modern Microeconomics is Neoclassical?

- Neoclassical economics assumes away institutions

- New Institutional Economics

- Public Choice & Social choice economics

- Property rights economics

- Law & Economics

How Much of Modern Microeconomics is Neoclassical?

Go back to lessons

- 1.2 — What Exactly Is Economics?

and reconsider:

- orthodox vs. heterodox economics

- proper scope and methodology of economics

- what is economics?